Top Analyst Predicts Bitcoin Price To Jump $49K, Here’s Why

Bitcoin (BTC), the world’s largest crypto, has made a strong comeback after major price declines lately. Bitcoin’s value is nearing the $42,000 mark again after it dropped below $39,000 earlier in the week. Moreover, a renowned crypto analyst has made an optimistic prediction for the Bitcoin price in the short term.

Will Bitcoin Touch $49,000 Soon?

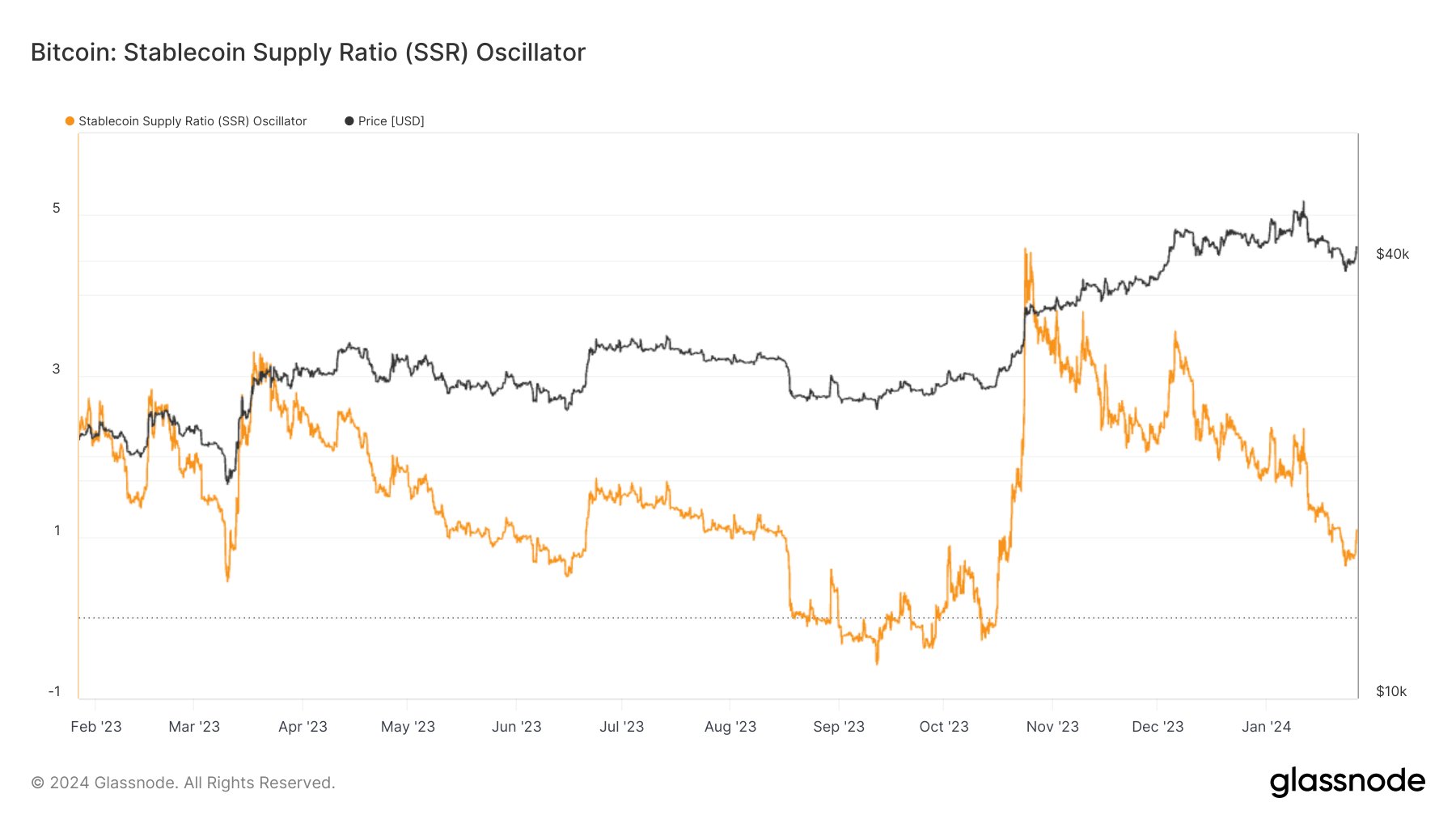

The crypto analyst, James Van Straten, suggested that Bitcoin price could touch the high of $49,000 for the second time after ETF approval. He noted that stablecoin rotation could propel this bullish rally. In addition, Straten stated that a slight rotation from stablecoins sent Bitcoin to $42,000 on Friday, January 26.

Therefore, he believes that stablecoin rotation could alone push the BTC price over $49,000 in the coming days. Furthermore, he mentioned that inflows from Spot Bitcoin ETFs would also play a prominent role in Bitcoin’s recent rebound. According to Crypto Quant data, the Bitcoin Stablecoin Supply Ratio (SSR) fell to 11.22 on Thursday from 11.28 a day ago, which could have spurred a bullish sentiment due to potential purchase pressure.

However, the Bitcoin SSR jumped to 11.70 on Friday, which indicates that a selling pressure could lead to a possible correction in the short term. On the other hand, the Bitcoin price gains haven’t been affected by a bearish turn as of now.

Also Read: Bitcoin Price Zooms Past $41k On Friday, Can BTC Rally To $43k This Weekend?

Bitcoin Price Today

Bitcoin touched the $42,000 mark on Friday but couldn’t sustain it. In addition, the BTC price distanced further from the level as the daily gains slumped from over 5% to a little more than 2%. At the time of writing, the BTC price was up by 2.41% and traded at $41,747.53 on Saturday, January 27.

Moreover, the crypto boasts an unmatched market capitalization of $818.73 billion, up by 2.39%. Furthermore, the 24-hour trade volume for Bitcoin displayed an increase of 14.74% to $23 billion. However, the largest crypto’s value is still fairly below the day’s high of $42,209.39.

On the other hand, the TradingView moving averages meter suggests a ‘buy’ signal for Bitcoin. According to the TradingView stats, the Bitcoin price is trading higher than its 10-day and 50-day EMAs of 41745 and 41262, indicating a bullish sentiment.

Also Read: Bitcoin Revealed a Cautious Pre-Halving Tale With Dips And Recovery

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Gold ETF vs Tokenized Gold: Who Could Outperform in 2026?

- Crypto Weekly Wrap: Jane Street Targeted After Terra Suit, Vitalik’s ETH Selloffs, Regulatory Progress Feb 23-27

- Meme Coin Market Dead? Top 5 Reasons Dogecoin, Shiba Inu, and Pepe Are Crashing

- Crypto Market Crashes as U.S.-Iran Tensions Escalate With Airstrikes

- Breaking: Ethereum Price Drops Amid Israel-Iran Tensions; Machi Big Brother Liquidated Again

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs