Top Analyst Warns Bitcoin Price Crash To $38130, Massive Selloff Ahead?

Bitcoin (BTC), the world’s largest and oldest cryptocurrency, has been grappling with a significant pullback lately. The Bitcoin price recently extended lower than the $40,000 level before bouncing back. However, the rebound isn’t significant as BTC is still trading 19% below the high attained after the Spot Bitcoin ETF approval. Amidst the crash frenzy, a crypto analyst even warned against a BTC price dip to $38,130

Analyst Insight On Bitcoin Price Crash To $38,130

A popular crypto insights provider on X, Ali Martinez, suggested that the recent Bitcoin price dip could extended below $38,130. In a recent post on X, he also stated that it would trigger panic selling mode among short investors. The analyst noted that the price crash below the above-mentioned threshold would indicate losses for short-term BTC holders.

Hence, he anticipates a “new wave of panic selling” to occur as these short traders would seek ways to minimize their losses. However, the bearish turn is momentarily as Martinez expects the Bitcoin bull cycle to top in late 2025.

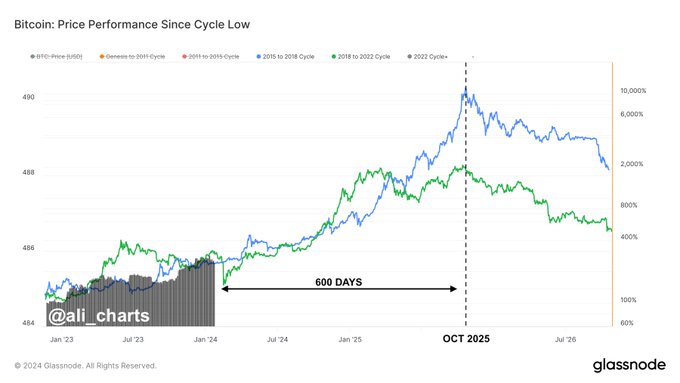

In another post, he mentioned that Bitcoin is currently mirroring historical bull runs stretching from 2015-2018 and 2018-2022. Thereafter, he noted that market projections indicate a potential peak in October 2025. He went on to conclude, “This implies $BTC still has 600 days of bullish momentum ahead!” Therefore, long-term Bitcoin HODLers can relax and enjoy humongous gains when this bull cycle tops.

In addition, Martinez also mentioned that all Bitcoin price corrections during a bull run are followed by an upswing, according to historical patterns. He advised that traders who want to capitalize on Bitcoin’s potential growth could leverage the “buy the dip” opportunity.

Also Read: Bitcoin Eyes $42K Surge as BlackRock’s Head Sees ETF Impact

BTC Price Struggles To Rebound

The Bitcoin price is struggling to sustain over the $40,000 mark as it’s hit by a pullback after every attempt to rebound. BTC was trading at $40,111.13 at press time on Thursday, January 25, indicating a 0.25% increase. Whilst, the crypto boasted a market cap of $786.18 billion.

On the other hand, the 24-hour trade volume for Bitcoin plummeted 34.75% to $20.09 billion. Also, it plunged as low as $39,508.80 before rebounding. Furthermore, the Bitcoin price is considerably lower than its 10-day and 50-day EMAs of 41038 and 41749, respectively, according to data from TradingView.

Earlier, Martinez underscored the significance of the $38,000 threshold on the weekly chart. The analyst cautioned that a close below this crucial level may serve as a signal for a potential downturn in Bitcoin’s value, which could target the strong support cluster around $33,000.

This critical zone is based on a host of key technical indicators, including the lower boundary of a parallel channel, the 0.5 Fibonacci retracement level, and the 50-week simple SMA. However, the analyst noted that these “factors together form a significant line of defense that could potentially halt further #BTC price declines.” This implies that a BTC price drop below $32,000 is not on the cards as of now.

Also Read: Bitcoin Whales Have Been Buying Every Dip, BTC Price Recovers to $40,000

- Robert Kiyosaki Reveals Why He Bought Bitcoin at $67K?

- XRP News: Ripple Partner SBI Reveals On-Chain Bonds That Pay Investors in XRP

- BitMine Ethereum Purchase: Tom Lee Doubles Down on ETH With $34.7M Fresh Buy

- BlackRock Buys $65M in Bitcoin as U.S. Crypto Bill Odds Passage Surge

- Bitcoin Sell-Off Ahead? Garett Jin Moves $760M BTC to Binance Amid Trump’s New Tariffs

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?