Top Crypto Losers Today: Terra Classic, Chainlink , And Toncoin Prices See Drastic Fall

Cryptocurrency Prices Today: The cryptocurrency prices today traded slightly higher as the global crypto market cap was up 0.08% at $810.38 Billion. The total crypto market volume over the last 24 hours is $38.00B, which makes a 62.01% increase. The world’s two largest cryptocurrencies, Bitcoin and Ethereum, also traded positively as Bitcoin price was up 0.15% at USD$16,791.27 while Ethereum price was up 1.84% at USD$1,208.39.

The top crypto losers on Tuesday were Terra Classic (LUNC), Chian (XCN), and Toncoin (TON).

Top Crypto Losers today, December 20:

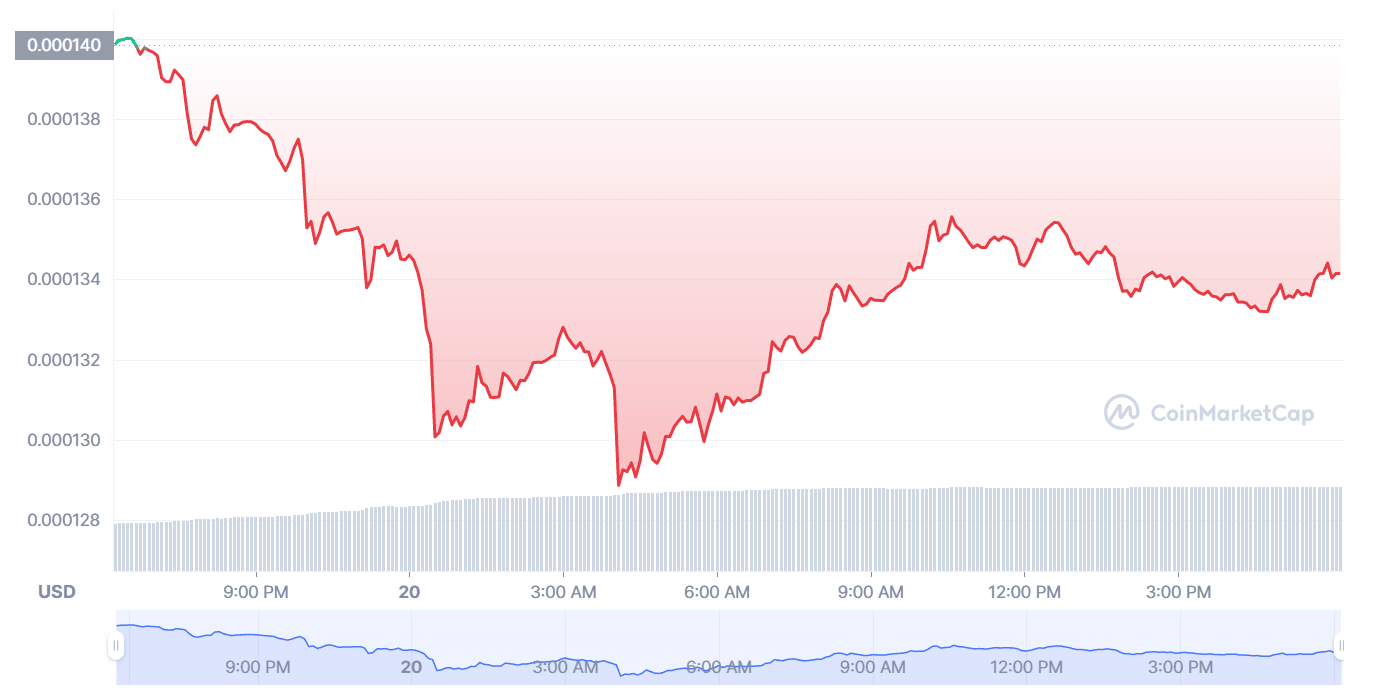

Terra Classic (LUNC):

Today, the Terra Classic price was down 4.94% at USD$0.000134 with a 24-hour trading volume of USD$84,110,585. With a live market cap of USD$799,046,022, the current CoinMarketCap ranking of LUNC is 44.

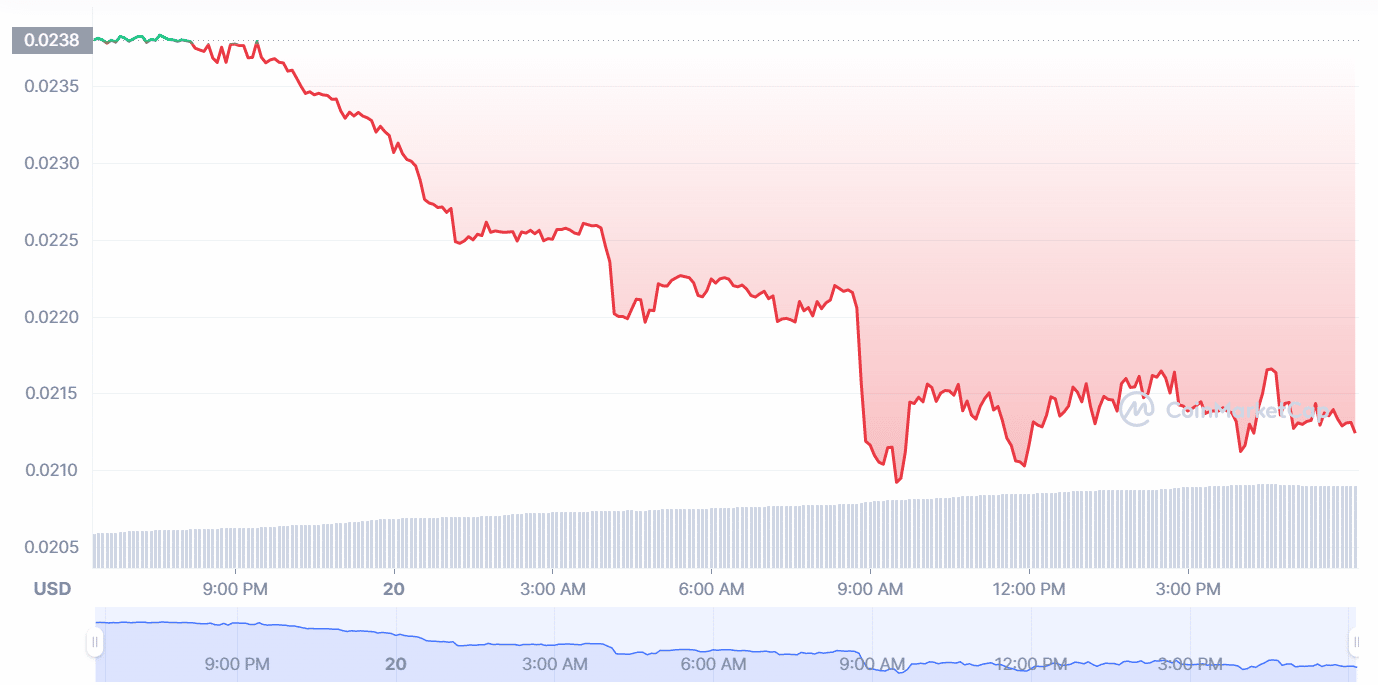

Chain (XCN):

Chain price today was down 9.39% at USD$0.021502 with a 24-hour trading volume of USD$7,508,359. With a live market cap of USD$461,703,685, the current CoinMarketCap ranking of Chain is 68. The altcoin has a maximum supply of 53,474,611,831 XCN coins.

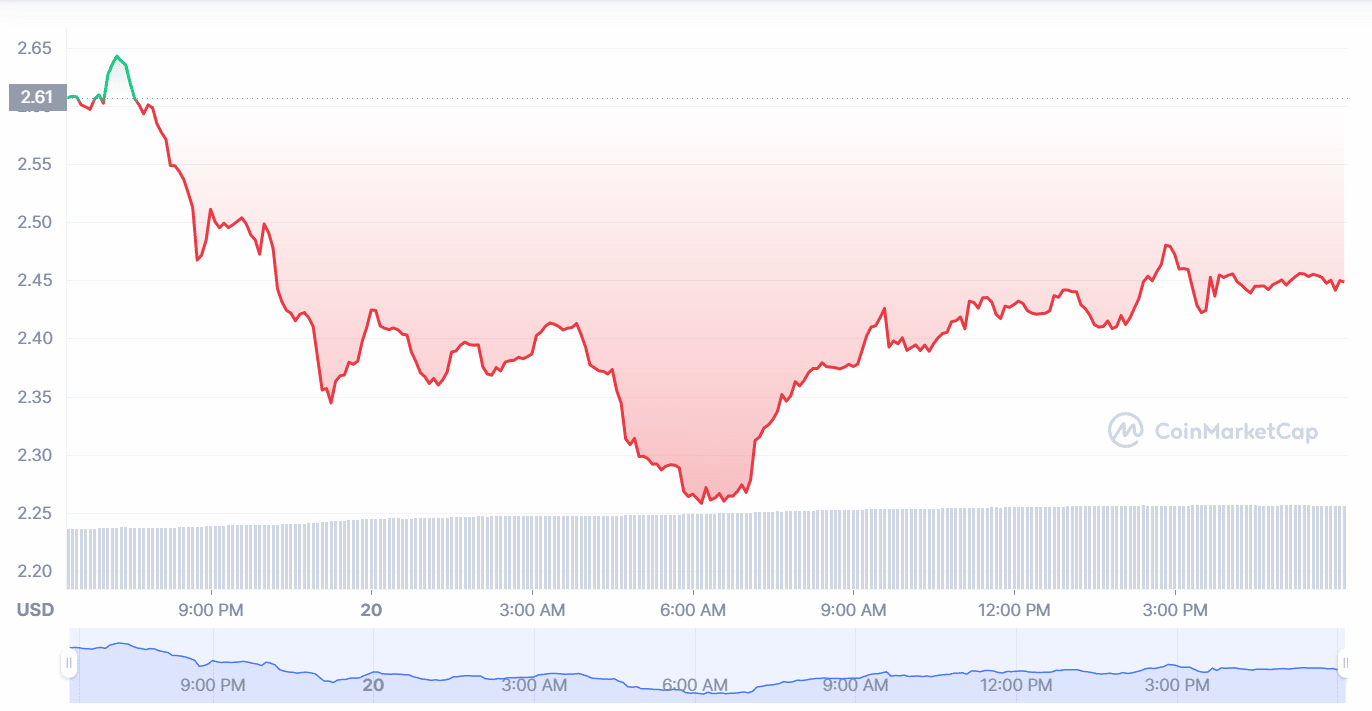

Toncoin (TON):

Toncoin price was spotted trading 8.09% lower at USD$2.45 USD with a 24-hour trading volume of USD$69,733,768. According to coinmarketcap data, Toncoin ranks at 22nd position, with a live market cap of USD$2,992,515,265. Toncoin has a maximum supply of 5,000,000,000 TON coins.

Popular meme coins:

Dogecoin and Shiba Inu price:

Dogecoin (DOGE) fell 4.03% at USD$0.074332. Its 24-hour trading volume was up almost 132% at $671,395,814. Shiba Inu (SHIB) was down 3.42% to USD$0.000008. At the time of writing, the current CoinMarketCap ranking of Shiba Inu is 15, at a live market cap of USD$4,612,555,936.

Short-term relief in Bitcoin (BTC) prices:

The slight recovery in Bitcoin’s price today from an overnight dip on December 20 was seen as the U.S. dollar weakened following a sudden policy twist from the Bank of Japan (BoJ).

As soon as the Japanese policymakers lifted the cap on bond yields, the yen instantly gained against the U.S. dollar. As of 6:59 a.m. EST, the U.S. dollar index (DXY) was down 0.74%, retreating to lows under 104 and abandoning its attempt at a sustained rally on intraday timeframes.

The short-term benefits from today’s fall in DXY figures have brought relief to Bitcoin enthusiasts today.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

Buy $GGs

Buy $GGs