Top Whales Accumulating Stablecoins, Is A Major Correction In Bitcoin Price Ahead?

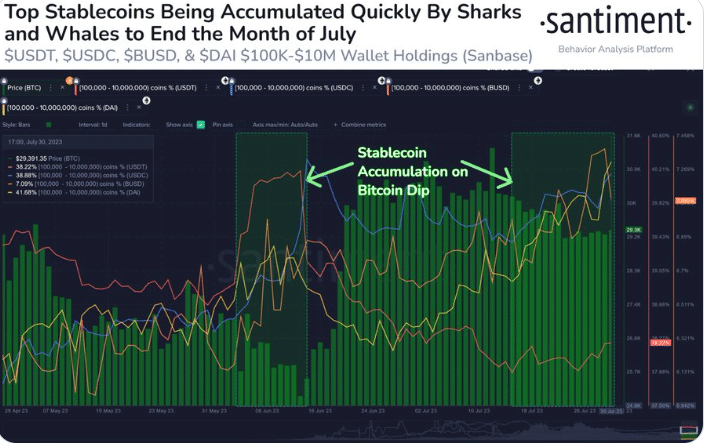

According to Santiment data, in a significant move, high-value stablecoin wallet holders, famously known as “whales” have been strategically capitalizing on Bitcoin’s recent dip below the $30k mark. Key stablecoins such as Tether, USDCoin, BinanceUSD, and Dai have all seen a shift in supply towards these major wallets.

Whales Adding Up Stablecoins

The sharp increase in stablecoin holdings among these key players coincides with Bitcoin’s price dip, suggesting that whales and sharks may be buying Bitcoin at lower prices in anticipation of a potential rebound. Stablecoins, valued for their price stability relative to other more volatile cryptocurrencies, are often used as a medium of exchange and a haven during periods of volatility in the crypto market.

Another set of Santiment data from this month revealed a large increase in DAI and paxos standard (USDP) addresses holding between $100,000 and $10 million in stablecoins since June 27. Additionally, the market intelligence site reports that since June 27 investors have already added 2% of the entire supply of DAI.

How does this translate to Bitcoin’s future pricing? The accumulation of Bitcoin by whales often signals a bullish trend for the leading cryptocurrency. Major players, due to their significant holdings, can wield considerable influence over the market direction. If these whales decide to shift their large stablecoin holdings back into Bitcoin, the increased demand could provide a substantial boost to Bitcoin’s price.

On the other hand, the market cap of these stablecoins is down. The global market cap of Tether is down by 0.03% in 24 hours. The market cap of USDC is down by 0.05%, and the same of BUSD is down by 0.02% in a day.

Also Read: BNB Price Trade Idea As Binance Bags Dubai’s Major Exchange License

Is A Bitcoin Correction Ahead, Before The Bull Run?

However, the market must tread cautiously. A sudden sale of Bitcoin by these large holders could result in a price drop, demonstrating the power these entities hold in the cryptocurrency market. At the time of writing, Bitcoin is trading around $29,388, down by 1.2% from last week.

Also Read: XRP Lawyers, Coinbase CLO Share Significance Of Judge Torres’ Ripple Ruling

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- Ripple Prime Adds Support For Bitcoin, Ethereum, XRP, Solana Derivatives on Coinbase

- Bitcoin Price Still Risks Decline If Iran War Mirrors Ukraine War Market Reaction, JPMorgan Warns

- Bitget Unveils Upgrade For Stock, Gold Trading Alongside Crypto As Part Of Universal Exchange Push

- ChangeNOW Is Settling Crypto Swaps in Under a Minute.

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

Buy $GGs

Buy $GGs