Total Inflow of Bitcoin On Bitfinex Rises to 21,250 BTC; Are Institutions Moving From Bitcoin to ETH

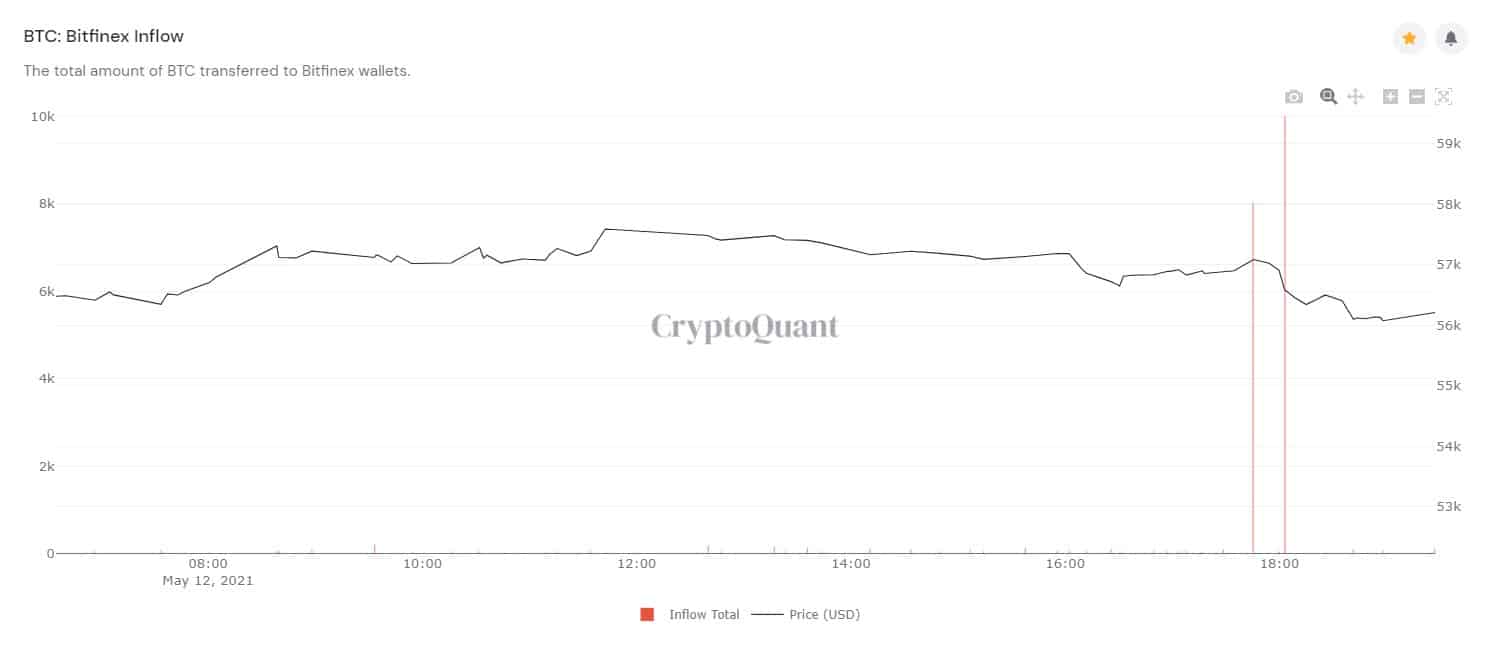

Bitcoin price is nearing a month of consolidation since its all-time-high of $64,863 last month, while it has historically seen an uptrend after 3-4 weeks of consolidation this bull season, the sudden surge on exchange inflows hint otherwise. A total of 21,250 Bitcoins inflowed into Bitfinex today, which is significantly higher given the net inflow throughout the past week, is 28,379.

A significant inflow of Bitcoin on exchanges is seen as a bearish signal since the traders usually shift their holdings to sell. With every new ATH, many have called it a short-term price top for the top cryptocurrency, however, bitcoin has defied them on all occasions in the past. Despite longer consolidation phases with each new ATH, the confidence of institutions didn’t seem to deter and exchange outflows continued even during the significant corrections up to 30%.

The falling market dominance of Bitcoin is also being seen as a key reason behind the continuous slump as other altcoins led by Ethereum continue to surge to new ATHs. The current Bitcoin dominance has fallen to a three-year low of 42% and if the top cryptocurrency doesn’t recover soon, it would fall to the levels of post-2017 Bitcoin high indicating a potential price top.

Are Institutions Moving into Ether?

Ether (ETH), the second-largest cryptocurrency has had quite a run over the past couple of months after a late February scare. ETH has more than tripled its 2017 high just above $1,200 and currently registering a new ATH every other day. The last ATH came just a few hours earlier as ETH reached $4,360. The recent bullish burst in ETH price is being attributed to the diminishing market supply amid growing institutional demand.

The ETH balance on centralized exchanges has reached a 2-year low as the majority of the tokens are either being staked in ETH 2.0 staking contracts or into cold wallets. The supply crunch added with the growing demand along with upcoming EIP-1559 integration next month have helped Ether to continue its surge and many believe now institutions are moving from Bitcoin to ETH as many analysts have predicted a price target of $10,000.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs