DeFi Update – Total Value Locked (ETH) in DeFi Products Reaches All-Time High at 3.5 Million ETH

If 2017 was the year of “general crypto” growth and 2018 the year of “stable coins” growth, then 2019 will be regarded as the year we saw an exponential growth in “decentralized finance”, referred to as DeFi. Over the past year, the total value locked in DeFi products grew as the field witnessed a rapid growth due to the increased number of new applications and protocols.

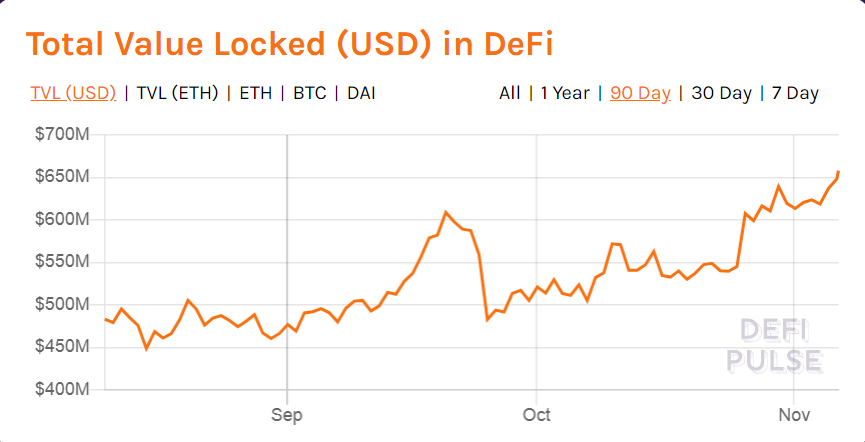

Total USD value locked in De-Fi grows to 4-month high

According to crypto data analytics firm, Defipulse, the total value in USD locked on DeFi products touched $666 million on Nov. 6, recording a four month high. DeFi system presents an accessible-to-all, decentralized and secure platform providing loans, leverage and derivatives trading and transfer of traditional financial assets on digital platforms.

The total USD value locked (TVL) in DeFi products has seen an impressive 37% growth since August currently at $663 million USD, as at time of writing. The sharp rise in TVL (measured in dollars) however falls short of the all-time high value of $700 million USD recorded in the summer.

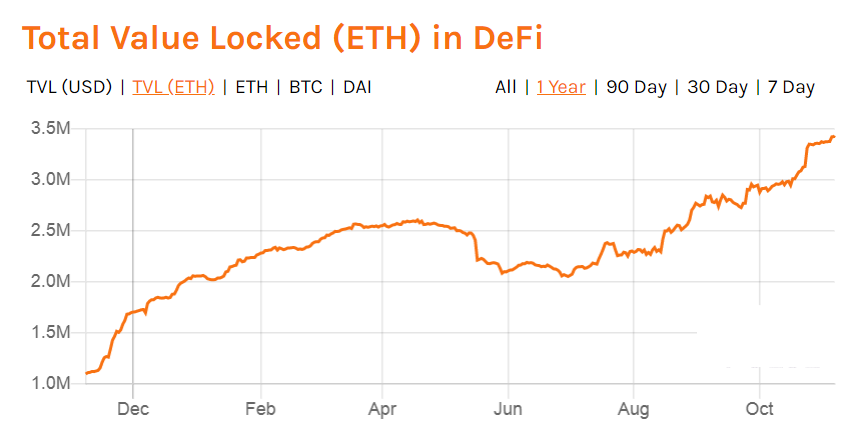

Total value locked in Ether at all-time high

While the price of ETH is struggling to break the $200 mark barrier, the total value locked in ETH on DeFi products is at an all-time high with the ETH denominated value at 3.437 million ETH. The TVL (in Ether) crossed the 3 million ETH mark on Oct. 17 causing the market to take notice of the rising sub-industry in blockchain.

Ethereum based applications dominate the top 20 slots of value stored in DeFi products, holding 19 of the slots – the sole loner being the Lightning Network. Maker, a portal that offers DAI-collateralized loans, tops the charts with a dominance of 52.50%, after a slight 1.4% rise in the past 24 hours. Compound, InstaDapp, dYdX and Synthetix – all lending apps except for the last one – make the top five DeFi platforms with highest value of ETH locked.

TVL in DAI also hit an all-time high on Nov. 5 – a few tokens short of 30 million DAI locked in DeFi. A recent tweet by Defipulse, shows the extent of growth in DeFi products,

In case you need a reminder of how fast #DeFi is growing: the total $DAI locked in DeFi has increased…

~81% since Aug 4, 2019

~275% since May 4, 2019

~9133% since Nov 4, 2018

? ? ? ? ? ? ? ?— DeFi Pulse ? (@defipulse) November 4, 2019

- Trump-Linked World Liberty Targets $9T Forex Market With “World Swap” Launch

- Analysts Warn BTC Price Crash to $10K as Glassnode Flags Structural Weakness

- $1B Binance SAFU Fund Enters Top 10 Bitcoin Treasuries, Overtakes Coinbase

- Breaking: ABA Tells OCC to Delay Charter Review for Ripple, Coinbase, Circle

- Brian Armstrong Offloads $101M in Coinbase Stock Amid COIN’s Steep Decline

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter

- Ethereum Price Prediction Ahead of Roadmap Upgrades and Hegota Launch

- BTC Price Prediction Ahead of US Jobs Report, CPI Data and U.S. Government Shutdown

- Ripple Price Prediction As Goldman Sachs Discloses Crypto Exposure Including XRP

- Bitcoin Price Analysis Ahead of US NFP Data, Inflation Report, White House Crypto Summit