Traders Brace for Hot US PPI amid Sticky Inflation, Risks BTC, ETH, XRP Liquidations

Highlights

- August US PPI inflation to rise 0.3%, but crypto traders brace for hot inflation.

- BTC, ETH, and XRP may witness liquidations if inflation comes in higher-than-expected.

- JPMorgan CEO Jamie Dimon said the focus shifted to the U.S. economic health after weaker jobs report.

Crypto traders are bracing for another higher-than-expected August US PPI print, after a hot 0.9% July PPI reading amid sticky inflation. While economists expect the producer price index (PPI) to rise 0.3% month-on-month (MoM), tariffs and renewed geopolitical tensions could raise inflation.

Wall Street experts stated that the Fed rate cuts would resume in September despite rising inflation. The weaker labor market will likely push the FOMC to at least cut interest rates by 25 bps next week.

US PPI Inflation Expectations

The U.S. Bureau of Labor Statistics (BLS) will release the PPI inflation data for August today. The PPI MoM is expected to come in at 0.3%, significantly slowing from the 0.9% PPI inflation in July. However, the annual PPI is forecasted to remain at 3.3%.

Besides, the core PPI is projected to advance 0.3%, slowing from a 0.9% surge in the prior month. Economists expect the annual core PPI to cool from 3.7% and 3.5%. Investors are bracing for an impact on the US Treasuries, Bitcoin, and other assets amid intense uncertainty and volatility.

JPMorgan CEO Jamie Dimon said the focus shifted to the U.S. economic health. He warned that the US economy is losing steam after weak July and August nonfarm payrolls data, indicating rising recession risks.

At the time of writing, the U.S. Dollar Index (DXY) was 97.86, holding firm ahead of the inflation data. The U.S. 10-year Treasury yield holds above 4.082%, after falling to a 5-month low due to weak jobs data.

Bitcoin (BTC), Ethereum (ETH) and XRP Crypto Liquidations

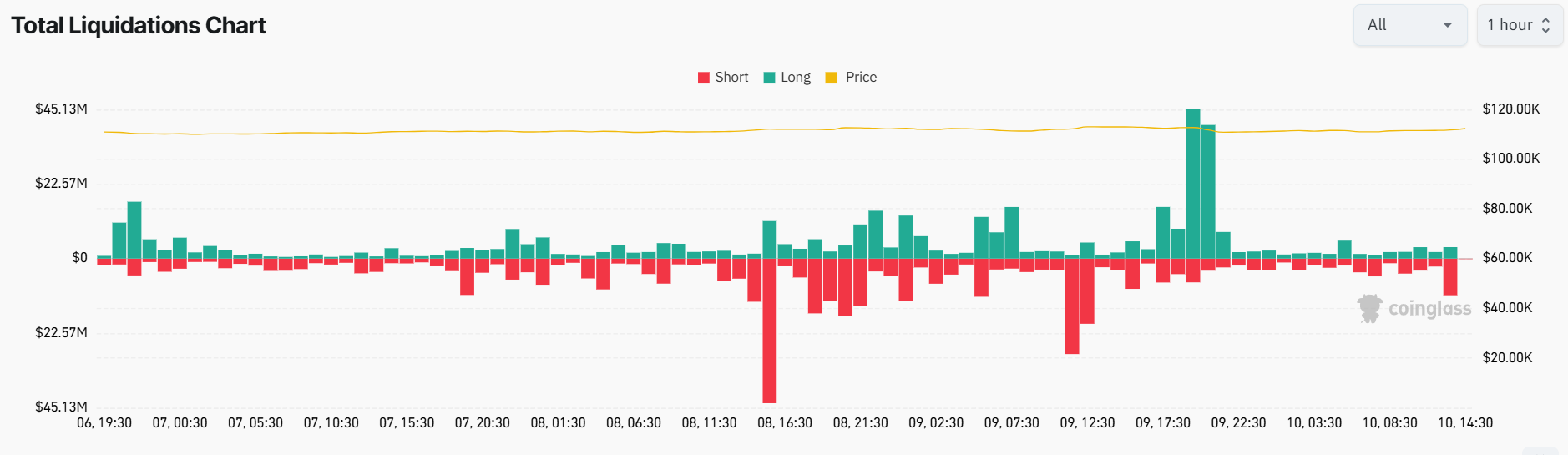

The crypto market saw over $270 million in liquidations in the last 24 hours, with nearly $170 million in longs and $100 million in shorts liquidated over the last 24 hours. Over 133K traders were liquidated in the last 24 hours, with the largest single liquidation order of BTC-USDT Swap worth $4.45 million on crypto exchange OKX.

BTC, ETH, and XRP saw $39 million, $36 million, and over $4 million in liquidations. US PPI and CPI inflation data this week will set the crypto market direction for the coming weeks.

Bitcoin price turned volatile, with the price currently trading at $$112,164. The 24-hour low and high are $110,776 and $113,020, respectively. Furthermore, the trading volume has slightly increased by 8% in the last 24 hours, indicating interest among traders.

In contrast, BTC futures open interest fell 0.58% to $81.77 billion in the last 24 hours. The 4-hour BTC futures OI on CME jumped 1.80% and declined 1.35% on Binance, indicating uncertainty among derivatives traders.

Meanwhile, ETH price dropped 1% to $4,319 and XRP price fell over 1.60% to $2.96 amid concerns over hot PPI inflation data.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

Buy $GGs

Buy $GGs