Traders Eye Grayscale Vs US SEC Ruling As Bitcoin Crash Takes Down Crypto Market

The crypto market witnessed over $1 billion in liquidation. Traders and whales cite weak market structure and liquidations as reasons for the selloff, not SpaceX’s bitcoin sales or China’s real estate giant Evergrande’s bankruptcy filing.

CoinGape Media first reported a likelihood of a massive selloff after the FOMC Minutes release. US stock market indices continued to fall this week amid banking concerns and weakening China’s economy. US Federal Reserve looking for further rate hikes and crypto longs liquidations amid weak market structure on Wednesday already triggered a correction.

Traders now await the likely decision in the Grayscale vs SEC lawsuit on Friday, which will give a clear direction to the market. Approval of a Bitcoin ETF this year majorly depends upon Grayscale’s win against the SEC. In fact, GBTC is looking strong despite a fall in BTC price, as per data by Coinglass. Grayscale Investments has also put out an advert to employ a Senior ETF Associate as it nears the tail end of its lawsuit with the SEC.

Also Read: XRP Price Plunges 20% to Pre-Court Ruling Levels, More Correction Likely?

Indicators That Signaled A Crypto Market Selloff

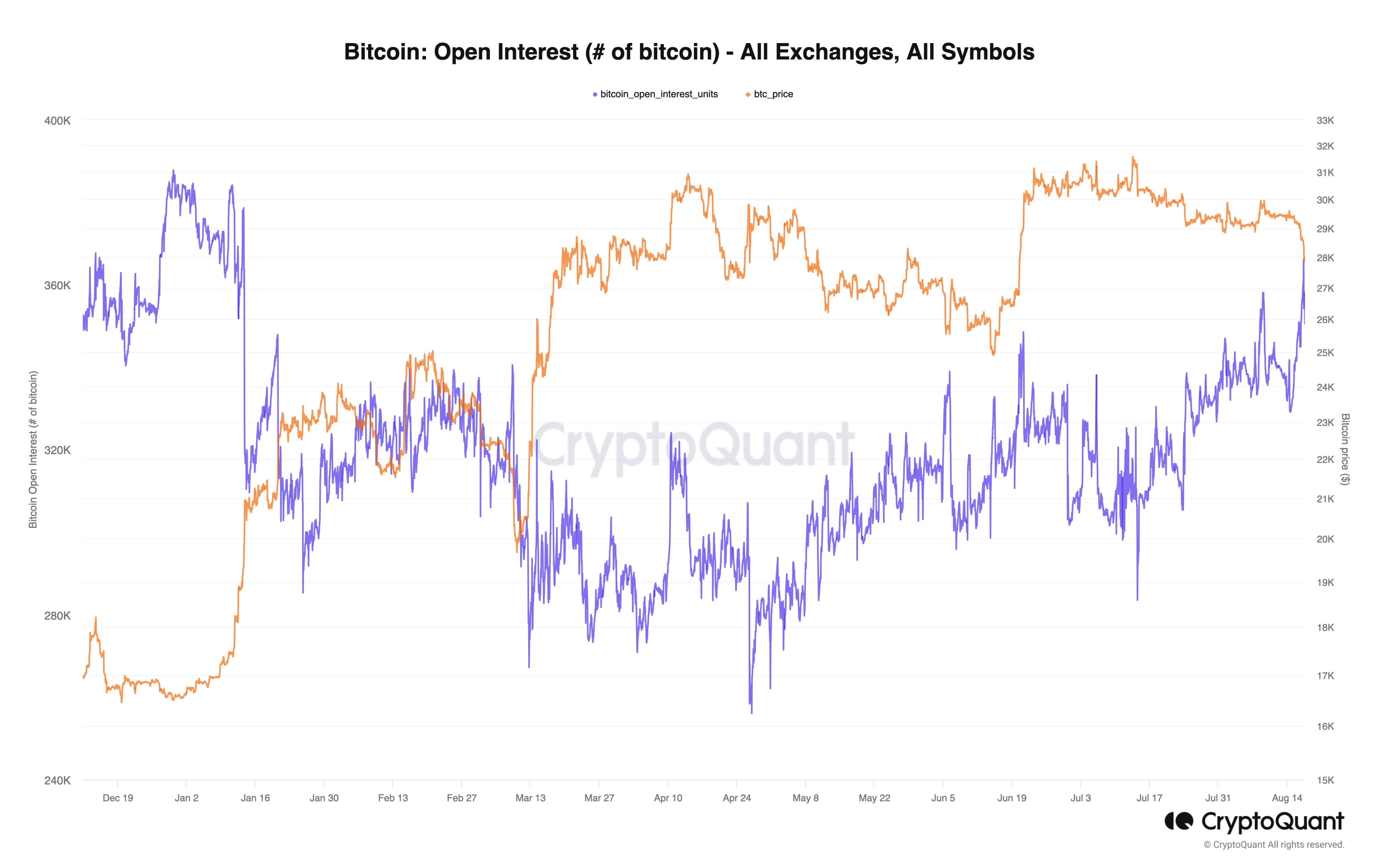

CryptoQuant revealed that the market structure was weakening since mid-July after Bitcoin failed to hold the $30k psychological level. Bitcoin open interest (OI) of short positions was increasing since mid-July amid price declines.

In addition, the selloff was preceded by a period of low demand for Bitcoin, resulting in a negative Coinbase premium. The BTC price remained stuck in a range near $29300. Also, an increase in whale spending activity before and during the selloff was recorded.

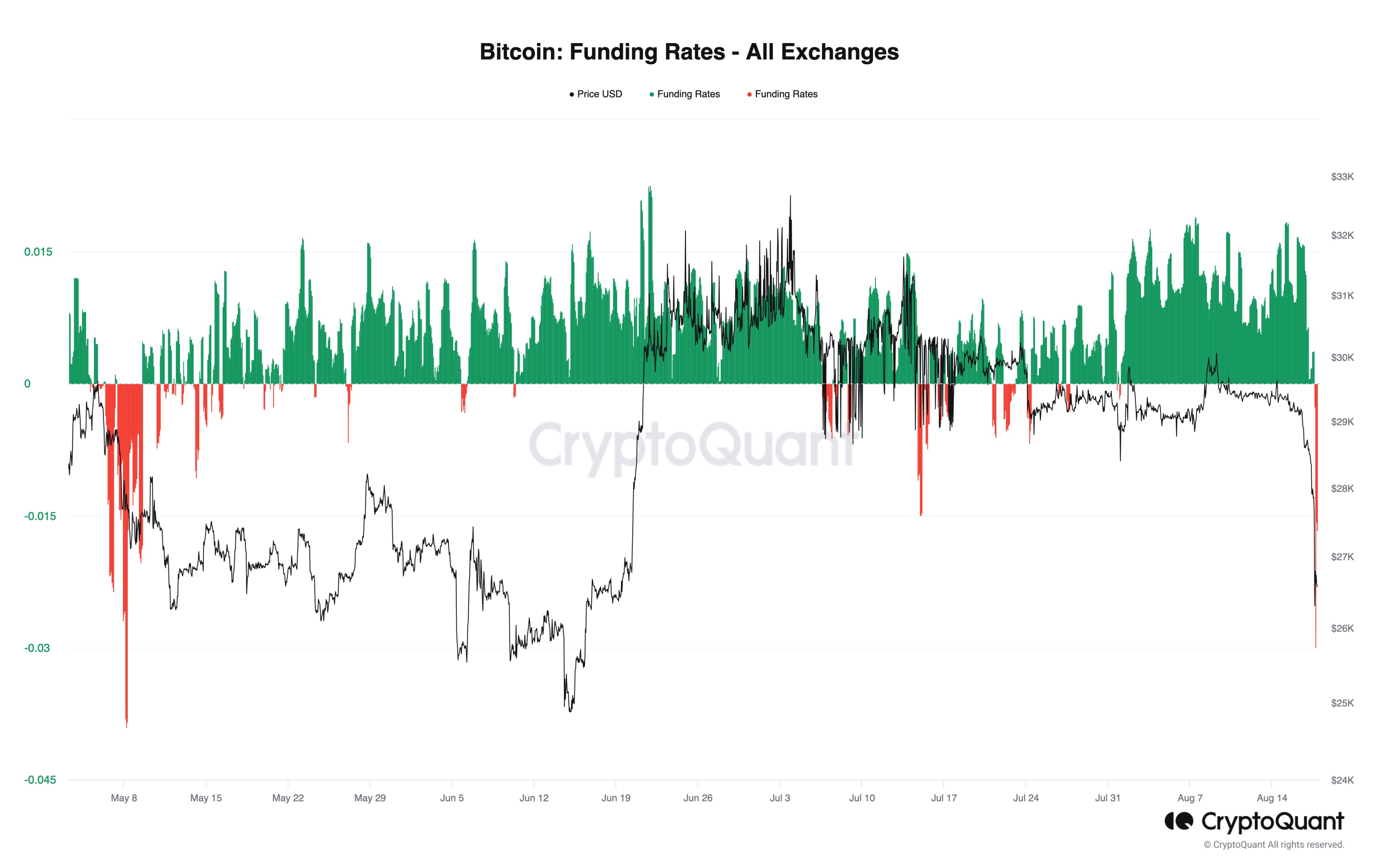

Currently, the sentiment remains negative, with negative funding rates indicating that traders are willing to go short. Traders are skeptical about recovery after longs liquidation. Thus, the price action to likely remain weak until the end of the month.

BTC price trades at $26,577, down 7% in the past 24 hours. Meanwhile, ETH price is trading at $1694, recovering from a 24-hour low after reports of SEC to approve Ether futures ETF.

Evergrande filing for bankruptcy?

Space X supposedly selling its #BTC holdings?

Largest $BTC liquidation event since FTX crash in November 2022?

Whatever the narrative

Whatever the catalyst

It doesn’t matter how to explain the move now that it has happened

Those who have… pic.twitter.com/p3zjqzi38U

— Rekt Capital (@rektcapital) August 18, 2023

Also Read: Shibarium Restarts Block Production, SHIB And BONE Rebounds

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Vitalik Buterin Maps Out Quantum Risks as Ethereum Foundation Unveils ‘Strawmap’

- BlackRock Adds $289M in BTC as Bitcoin ETFs Log 2-Week High Inflows Of $500M

- Glassnode Signals Bitcoin Still Faces Downside Risk Amid Massive Sell Pressure at $70K

- U.S House Introduces Bipartisan Crypto Bill To Protect Crypto Developers Amid DeFi Push Under CLARITY Act

- XRP News: Ripple Unveils Funding Hub To Support Innovation On XRPL

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs