Crypto Billionaire Arthur Hayes: TradFi’s Spot Bitcoin ETF Pursuit Will Kill Bitcoin

BitMEX founder Arthur Hayes has a new warning for the crypto community as spot Bitcoin ETF approval by the U.S. Securities and Exchange (SEC) is almost here. If TradFi asset managers, such as BlackRock, become too successful with spot Bitcoin ETF, they will completely destroy Bitcoin, said Arthur Hayes. Fundamentally losing the crypto movement to separate money and finance from the state.

TradFi Could Kill Bitcoin

Arthur Hayes in his new blog on December 23 red flags potential efforts by traditional finance firms to kill Bitcoin. He warns “If ETFs managed by TradFi asset managers are too successful, they will completely destroy Bitcoin.”

“If you dug a hole and deposited gold and reams of paper and came back in 100 years, the gold and paper would still exist. Bitcoin is completely different. Bitcoin is the first monetary asset in human history that exists only if it moves.”

Arthur Hayes asserts world’s largest TradFi asset manager Blackrock is in the asset accumulation game. They will store Bitcoin and issue a tradeable security, people will purchase Bitcoin ETF derivatives rather than buying and hodling Bitcoin in self-custodial wallets.

In the future, there will be no actual use for the Bitcoin blockchain and this will end up with miners turning off their machines. Miners only receive Bitcoin income if the network is used. With Bitcoin being stored in a vault, “Without the miners, the network dies, and Bitcoin vanishes.”

Also Read: BlackRock Prepares for $3 Million Seed Funding for Bitcoin ETF Next Week

2024 As the Year of Bitcoin

Arthur Hayes predicts 2024 as the year of Bitcoin as spot Bitcoin ETF gets approved by the U.S. SEC, elections, and surge in global money printing.

The chart clearly shows Bitcoin (white) up 228% as compared to gold (yellow), the S&P 500 (green), and the Nasdaq 100 (red) since 2020.

BTC price fell over 1% in the past 24 hours, with the price currently trading at $43,613. The 24-hour low and high are $43,351 and $44,367, respectively. Furthermore, the trading volume has decreased by 11% in the last 24 hours, indicating a decline in the interest of traders.

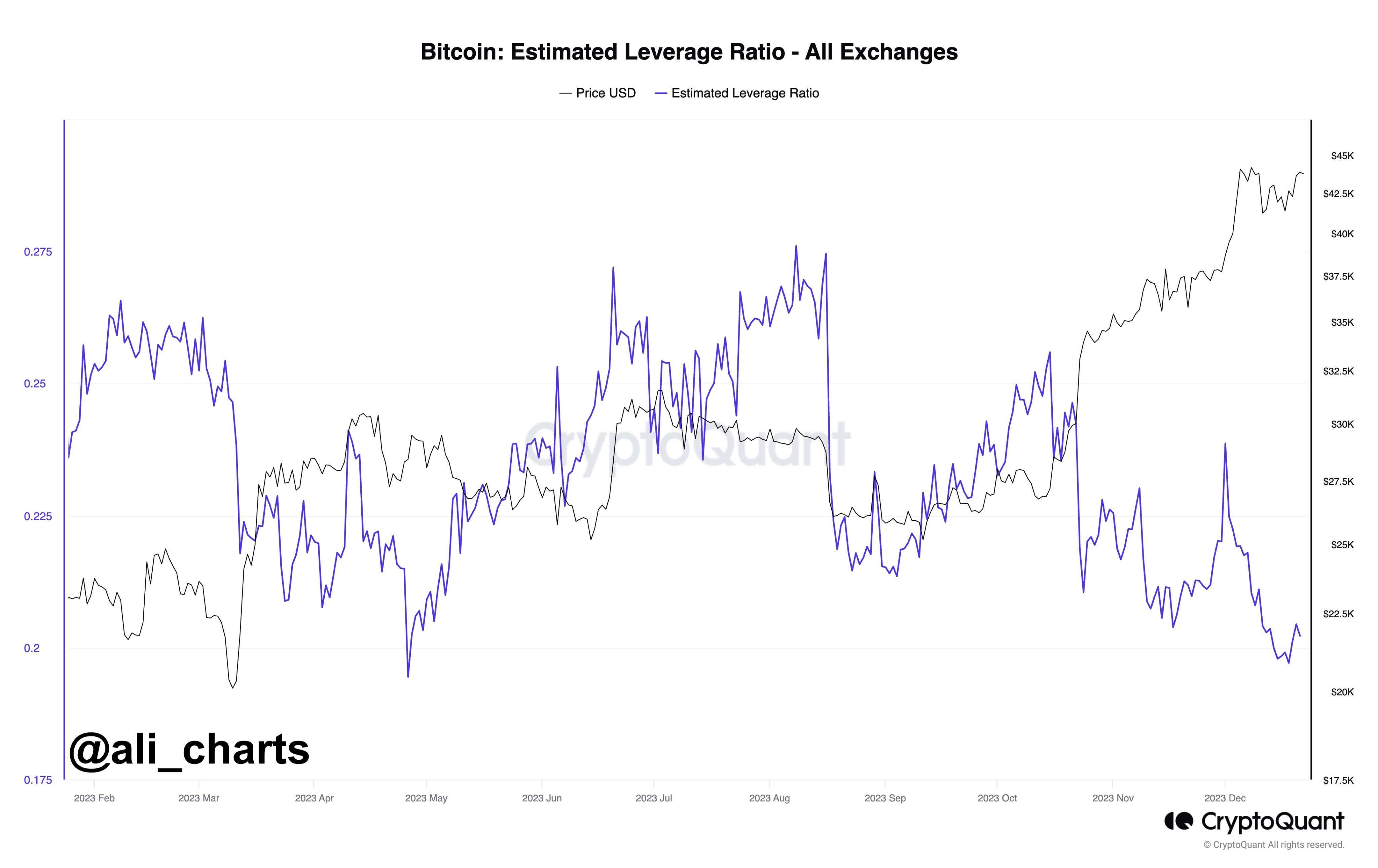

Analyst Ali Martinez revealed a more cautious approach in the crypto market despite the BTC price uptick. A decrease in the Estimated Leverage Ratio is a sign of reducing leverage risk by traders.

Also Read: Shiba Inu Whale Moves 4 Tln SHIB, Shytoshi Kusama Spotlights LEASH Listing

- Expert Predicts Deeper Bitcoin Decline as JPMorgan CEO Warns of Similarities to the 2008 Financial Crisis

- Trump Won’t Pardon FTX’s Sam Bankman-Fried (SBF), White House Says

- Third Spot SUI ETF Goes Live as 21Shares Fund Launches on Nasdaq

- Mark Zuckerberg’s Meta Reportedly Eyes Stablecoin Integration This Year Amid Regulatory Clarity

- Coinbase Rivals Robinhood As It Rolls Out Stocks, ETFs Trading In ‘Everything Exchange’ Push

- Sui Price Eyes Recovery as Third Spot SUI ETF Debuts on Nasdaq

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

Claim Card

Claim Card