Crypto ETFs On The Rise: Bitcoin ETF Inflows, Ethereum ETF Trading Taking The Charge

Exchange-traded funds have been the most discussed topic in the market for some time because of new milestones and updates related to the industry. These ETFs are a way to be part of the trading industry without bearing the risk, making it easier for beginners to trade. Now, there are more than 2500 listed ETFs, making it a market of Trillions. More importantly, the adoption is not limited to beginners only, as experienced investors are also moving towards the same. The demand for these exchange-traded funds began with the approval of Spot Bitcoin ETF at the beginning of 2024, moving towards the spot Ethereum ETF and much more. The industry is growing rapidly and making new milestones, impacting the performance of the crypto market, especially of Bitcoin.

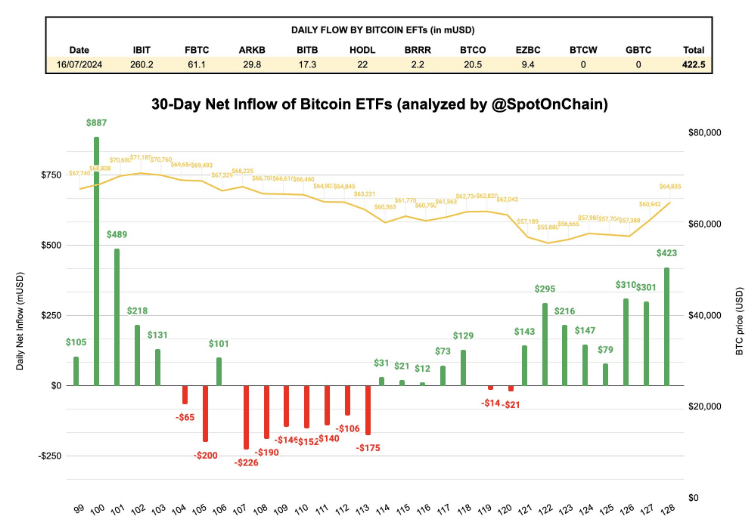

Bitcoin ETF Inflows Reached New ATH

Bitcoin ETF has maintained a steady flow over the last few days, pushing the Bitcoin price from its earlier crash to $54k to the current value of $ 65.8k despite the selling pressure with the Mt. Gox transactions. On analyzing the last 15 days’ reports, the Bitcoin ETF net flows are positive, with a net inflow of $423 Million on July 16, the highest since May.

The cycle of the high inflows has been maintained for eight consecutive days now, indicating high demand among investors. Based on the Spotonchain data, the total net flow has been more than $16B since the launch.

Ethereum Exchange Trading Fund Live

The Ethereum ETF was already approved weeks ago, but clearance of trading permission from the SEC was delayed. However, that has changed as the trading will be live from July 23, 2024, per SEC’s announcement.

Update: Nate’s instincts were right, hearing SEC finally gotten back to issuers today, asking them to return FINAL S-1s on Wed (incl fees) and then request effectiveness on Monday after close for a TUESDAY 7/23 LAUNCH. This is provided no unforeseeable last min issues of course! https://t.co/D21FD9Qf94

— Eric Balchunas (@EricBalchunas) July 15, 2024

The more pleasing news is the prediction of an inflow of $5B with the Ethereum ETFs within six months. But that is just a start, as Steno’s research has predicted an inflow of $20 billion in a year. Many believe it will give a tough surpass the popularity of Bitcoin ETF.

The impact will also be visible on Ethereum, and many have claimed the price to surge to $6K. With SEC’s announcement, the ETH price had surged, currently at $3.5K after a 3% hike in the last 24 hours.

Other Emerging Crypto ETFs

Right after the Ethereum Exchange-Traded Fund approval, investors and companies began to push the other crypto ETF’s hype in the market. Companies like VanEck and many others have already filed the S-1 form for the Solana Exchange Traded Fund. The Shiba Inu team has also stated why the Shib ETF will succeed greatly. On the other side, industry leaders are also focusing on Cardano and a few other altcoins.

The approval of Bitcoin ETF has opened the doors for others to do the same, and the impact will also be on the crypto market. It has to see how the crypto market benefits from these.

Continue Reading The Biggest Bitcoin Controversy: Kevin Day’s Mt. Gox Nightmare of $16 Billion

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Soars on Rumors of Trump’s 0% Tax Policy for Digital Assets

- Hong Kong Set to Launch Tokenized Bond Platform and Issue First Stablecoin Licenses

- US Senator Launches Probe Into Binance After Fortune Report on Sanctions Violations

- CLARITY Act Odds, Bitcoin Drop as Trump Skips Crypto in State of the Union Speech

- Tokenized Stock Market Gains Boost as Kraken and Binance Launches New Products

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

- Sui Price Eyes Recovery as Third Spot SUI ETF Debuts on Nasdaq

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

Claim Card

Claim Card