Fed Rate Cut Watch: Can Powell’s Speech Keep the Crypto Rally Alive This Week?

Highlights

- Crypto market cap hits $4.06T as Bitcoin steadies near $116K.

- Altcoin rotation gains steam: ETH +8.2%, SOL +17.1% in 7 days.

- Powell’s FOMC speech could decide if the rally continues or cools.

The cryptocurrency market is expecting a big week ahead, as the U.S. Federal Reserve prepares the FOMC meeting (16th-17th September). Bitcoin is settling at about $116,000, while top altcoins like Ethereum and Solana are gaining momentum. The driving factor is the hope that the Fed rate cut is finally approaching. However, the burning question here is whether or not Fed Chair Jerome Powell’s speech tomorrow will keep the rally alive.

Altcoins Take the Lead At Fed Rate Cut Hopes

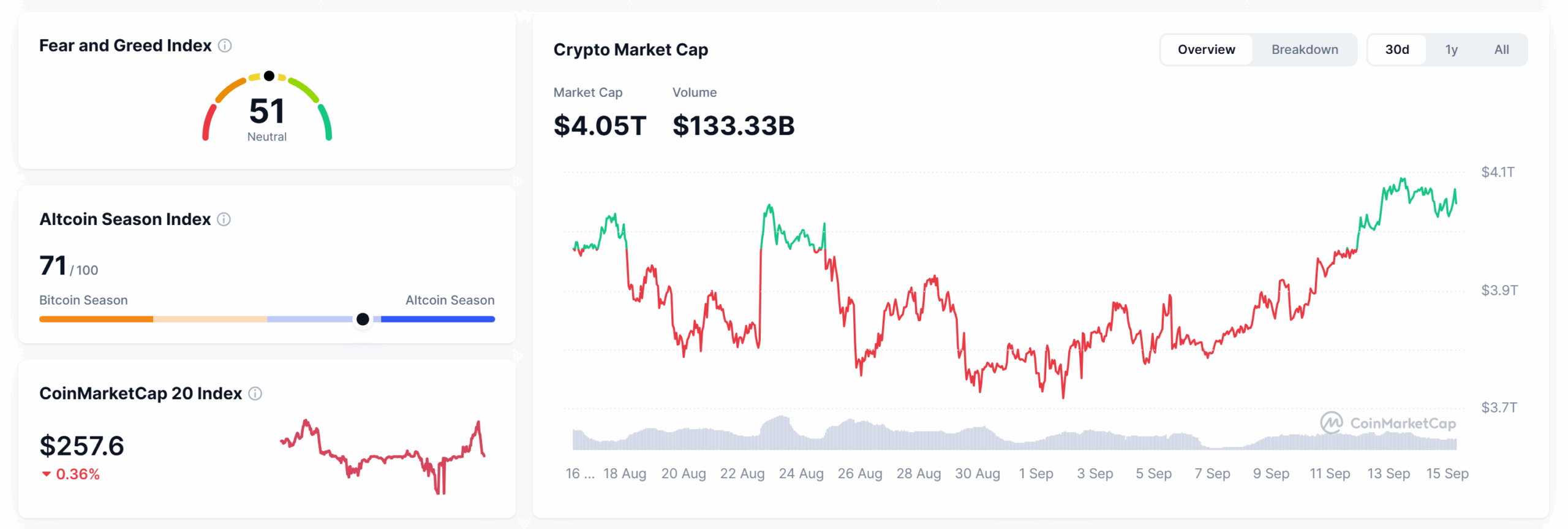

The crypto market today records a global market cap of around $4.06 trillion, a climb of about 6% over the past week. Bitcoin’s dominance has dropped to 57%, its lowest level in eight months. According to CoinMarketCap, the Altcoin Season Index is at 71/100, indicating that altcoins are outperforming, and traders’ focus has been shifted to these assets.

ETH has experienced a weekly growth by 8.2% to trade at $4,644, with ETF inflows as the primary driving factor. Solana price soared to 17.1% with a total value locked (TVL) of over $13 billion. The increased ETH/BTC ratio by 3.8% also shows that the altcoin rotation is on.

- Crypto Market Overview (Source: CoinMarketCap)

Why the Fed Rate Cut Matters

The crypto momentum is happening because the market is hoping that the Fed will cut rates soon. This move makes risk assets like digital currencies more appealing to investors.

Last week’s U.S inflation data presented mixed signals. In August, the Consumer Price Index (CPI) climbed by 0.4%, pushing up the annual inflation to 2.9%. However, the Producer Price Index (PPI) dropped by 0.1% month-over-month, but rose by 2.6% in a year. This demonstrates that costs remain high.

On the other hand, only 22,000 new jobs were added in August, as job growth slowed sharply. Unemployment currently holds at 4.3%. This week, futures markets have a 93% chance ofa 0.25% rate cut. But here is the catch. The cut itself may be largely priced in, but what Powell says afterward could make all the difference.

Powell’s Words Could Tip the Scale

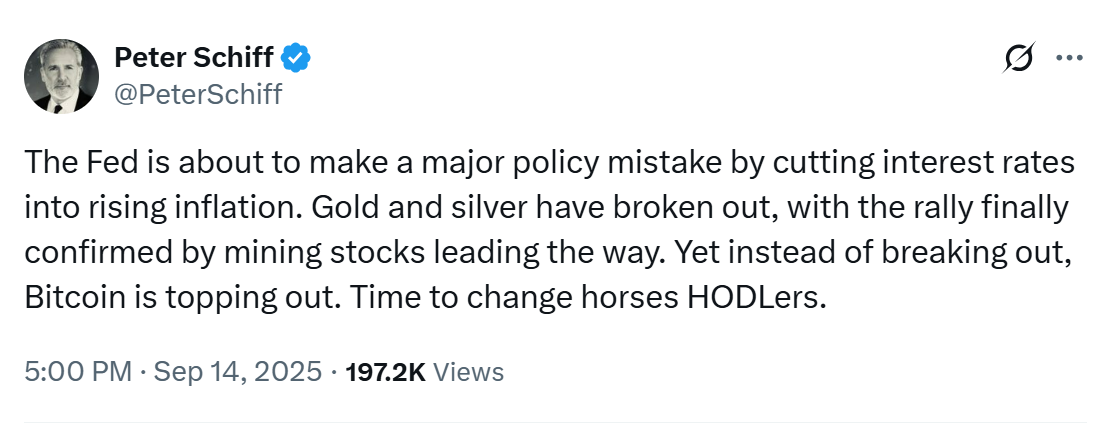

Should Powell finally hint that more cuts are likely in the coming months, the crypto rally could continue. This is especially true with the already outperforming altcoins. But if he sounds cautious and sticks to a “wait and see” approach, insisting on the Fed still fighting inflation, investors might lock in profits. This could cool off the market, and Bitcoin could top out, as Peter Schiff warns.

- Peter Schiff warns Bitcoin is topping out (Source: X.com)

Final Thoughts

Altcoins are already gaining momentum as Bitcoin dominance dips to eight-month lows. Solana and Ethereum lead with the Altcoin Season Index sitting at 72. This week, though, the entire market is watching Powell. His words will decide whether the crypto rally continues or pauses. If the Chair hints at further Fed rate cuts, the rally has room to grow. Otherwise, the market could face volatility.

Frequently Asked Questions (FAQs)

1. Why has been crypto market rallying?

2. What’s the significance of Powell’s FOMC speech?

3. Which altcoins are outperforming Bitcoin right now?

- Breaking: U.S. PCE Inflation Rises To 2.9% YoY, Bitcoin Falls

- BlackRock Signals $270M Bitcoin, Ethereum Sell-Off as $2.4B in Crypto Options Expire

- XRP News: Dubai Tokenized Properties Trading Goes Live on XRPL as Ctrl Alt Advances Project

- Aave Crosses $1B in RWAs as Capital Rotates From DeFi to Tokenized Assets

- Will Bitcoin, ETH, XRP, Solana Rebound to Max Pain Price amid Short Liquidations Today?

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans