Top Bitcoin Rich Lists: Who owns the most BTC in 2026?

Highlights

- Bitcoin Rich List highlights major influencers controlling significant Bitcoin holdings.

- Satoshi’s massive, untouched stash impacts Bitcoin’s market and future.

- Increasing the legitimacy and trust of Bitcoin are institutional investors, such as BlackRock.

Bitcoin has continued to shape the global financial landscape as the dominant cryptocurrency, maintaining a market cap of over $1.7 trillion in 2026. The Bitcoin rich lists reveal who controls the largest shares of this digital asset. These include individual whales, corporations, governments, and investment firms.

Their possessions enable them to have a large influence on the market behavior of Bitcoin and its overall financial ramifications. The current price of Bitcoin crashed to 89,628 and has a 24-hour trade volume of 47,494,914,560 USD. Bitcoin has fallen by 3.62% over the past day. BTc currently has a supply of 19,978,465 BTC coins and a max supply of 21,000, 000 BTC coins.

Who Owns the Most Bitcoin?

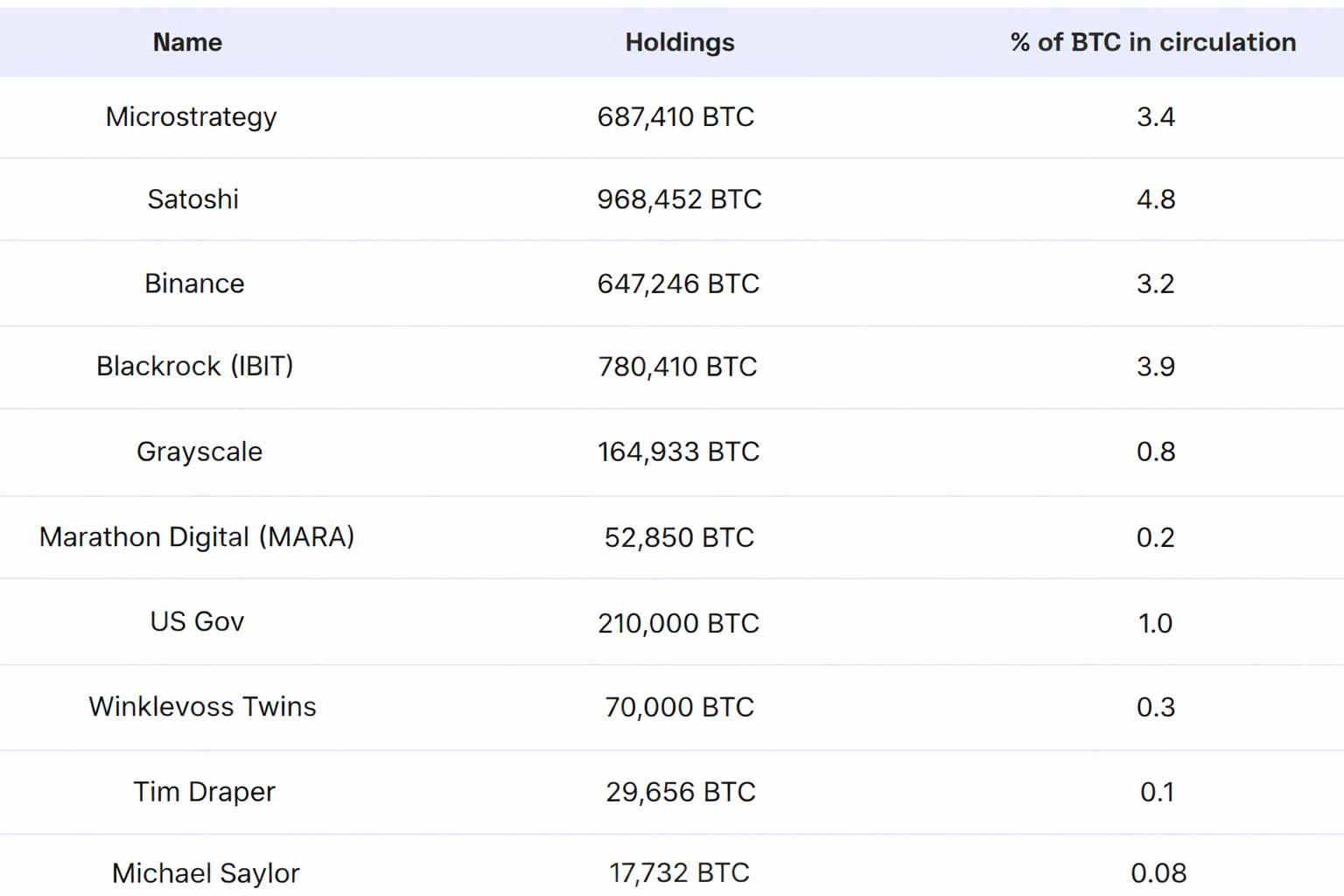

Satoshi Nakamoto tops the Bitcoin rich lists, owning 968,452 BTC. That equals around 4.8% of all circulating Bitcoin. These coins were mined early in Bitcoin’s history and remain untouched across roughly 20,000 addresses. The holdings of Satoshi are the largest known hoard, which makes them the most important part of the origin story of Bitcoin and its future influence.

MicroStrategy has the second position of 709,715 BTC. This constitutes 3.4% of Bitcoin in circulation. The company, under Michael Saylor, funds Bitcoin purchases by using debt. Their plan is to sell less of the coins at a later time at a higher price. The aggressive stance by MicroStrategy has led other companies to adopt the same moves in diversification of their treasury stockpile.

BlackRock has 780,410 BTC in its IBIT product. This is equivalent to 3.9% of the existing supply of Bitcoin. The institutional trust is a significant change as one of the largest investment companies in the world, BlackRock, has entered the Bitcoin market. Its position creates credibility and brings more traditional investors into the digital asset space.

Institutional and Government Players

The leading cryptocurrency exchange, Binance, holds 647,246 BTC or 3.2 %of the circulating supply. Being one of the world’s trading centers, the Binance holdings contribute to the market liquidity and platform activities. The high reserve also emphasizes the presence of the exchange in the crypto industry.

Grayscale, which is an asset manager that also provides investment products based on Bitcoin, has 164,933 BTC. That’s 0.8% of the total supply. Grayscale provides traditional investors with access to Bitcoin without the need to work with keys. This model has assisted in bringing on board more institutional capital into the space.

The American government has a surprisingly large amount of 210,000 BTC. That comprises 1 percent of the floating Bitcoin. This is mostly contributed by seizing assets during criminal investigations. These investments make the U.S. a strong player in the cryptocurrency market, either by coincidence or plan.

Marathon Digital (MARA) is a crypto mining firm that owns 52,850 BTC or 0.2. The company, as a miner, makes its earnings with the help of authenticating blockchain transactions in order to earn Bitcoin. The ability to hold a part of mined BTC helps them to enjoy a rise in its price in the future.

High-Profile Individual Bitcoin Holders

Tyler and Cameron Winklevoss, the twin brothers, are the owners of 70,000 BTC. This is 0.3 percent of the Bitcoin in circulation. They obtained initial Bitcoin exposure with the money they received as a settlement in their lawsuit against Facebook. Their faith in decentralized currency has continued to make them engaged as supporters and creators within the ecosystem.

Tim Draper, a venture capitalist holds 29,656 BTC, which is 0.1 of the circulating supply. The Mt. Gox incident was followed by a famous purchase of 40,000 BTC at an auction organized by the U.S. Marshals by him. The fact that Dolphin managed to back Bitcoin up indicates that he has always believed in the technology.

Michael Saylor is a personal shareholder of 17,732 BTC in addition to his holdings in the company. That would equate to 0.08% of the existing supply in Bitcoin. His personal investment confirms his commitment to Bitcoin beyond corporate strategy.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

Frequently Asked Questions (FAQs)

1. Who owns the most Bitcoin in 2026?

2. How much Bitcoin does MicroStrategy own?

- Bitget Unveils Upgrade For Stock, Gold Trading Alongside Crypto As Part Of Universal Exchange Push

- ChangeNOW Is Settling Crypto Swaps in Under a Minute.

- $3B Western Union Expands Into Crypto With USDPT Stablecoin Launch on Solana

- XRP News: Key Ripple Whale Indicator Turns Bullish After Months, Price Rally Ahead?

- Crypto Market Today: BTC, ETH, XRP, SOL, and DOGE Rally as Geopolitical Tensions Ease

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

Buy $GGs

Buy $GGs