Top Reasons Why Crypto Market is Down Today (Feb 16)

Highlights

- The crypto market has seen renewed selling pressure amid macro uncertainty.

- Bitcoin, Ethereum, and XRP decline as liquidations accelerate losses.

- Investor sentiment weakens while outflows signal cautious positioning.

Today, the Crypto market declined by 3.65% over the past 24 hours, pushing total capitalization down to $2.35 trillion.

Major digital assets were under pressure during the session through renewed selling pressure and forced liquidations. The Bitcoin price remained sideways around $68,000 following a sharp correction previously.

Ether price hovered around $2,000, with a still present bearish momentum and pessimistic investor mood. Meanwhile, XRP price traded near $1.47 after breaking above a lower trendline boundary.

Here, Why Crypto Market Down Today?

Crypto prices slid on Monday as the Crypto Market stayed under pressure ahead of major U.S. data releases. Bitcoin dropped early and dragged the majority of large tokens down.

Altcoins followed suit, taking on a wary tone throughout the exchanges in the global market. According to Coinglass data, an amount of positions worth approximately 325 million was liquidated within 24 hours.

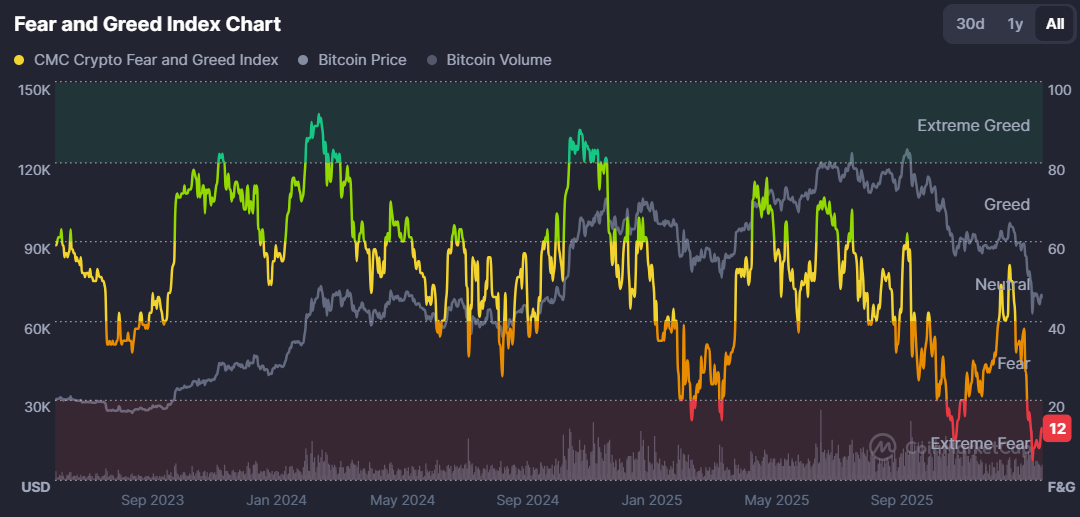

The total of approximately 240 million was obtained via long wagers, indicating forced selling. Risk mood was still pessimistic, as the Crypto Fear & Greed Index was at the border of the extreme fear point at 12.

A heavy key event to watch on this week’s calendar is being followed by traders that has a potential to shock the prices either way.

Important ones will be Federal Reserve meeting minutes and core PCE inflation report.

The decline came as a surprise to some investors following the rekindled rate-cut expectations following the lower U.S. inflation rates.

The official data revealed that January CPI decreased to 2.4% compared to 2.7% year over year. The yields in Treasury eased, and the 10-year yield dropped to about 4.05, its lowest since early December.

Nevertheless, traders went down to minimum exposure and hung until the policies came into focus. The focus is also on February 20, when the U.S. Supreme Court could decide on Trump tariffs. Any change in trade policy would bring volatility to the Crypto Market this week.k.

Bitcoin, Ethereum, and XRP Fall as Crypto Market Consolidation Deepens

The Bitcoin, Ethereum, and XRP moved lower as major cryptocurrencies faced renewed pressure and broader market uncertainty. Bitcoin slipped 2.37% to $68,737 and continued to trade within a narrow range.

If the bullish market makes a comeback, a breakout above $70,000 could encourage buyers and set the stage for a move toward the $72,000 resistance as per the detailed Bitcoin price analysis.

The critical support is between $68,000 and $67,000. A decisive fall below this point can put Bitcoin at risk of the mid-$66,000 region.

Ether price dropped 4.38% to 1,976% as loss failed to retain recent gains. The token must regain the $1,990 pivot and stabilize. Any failure to recover may result in a retest of the $1,800 swing low. The ETH price is above $1,950, which could permit short-term consolidation and restrict further losses.

XRP price declined by 9% to $1.47, with sellers driving the day. The token can stabilize when it retains the support at $1.46. Any fall below this may lead to a fall to levels as low as $1.40.

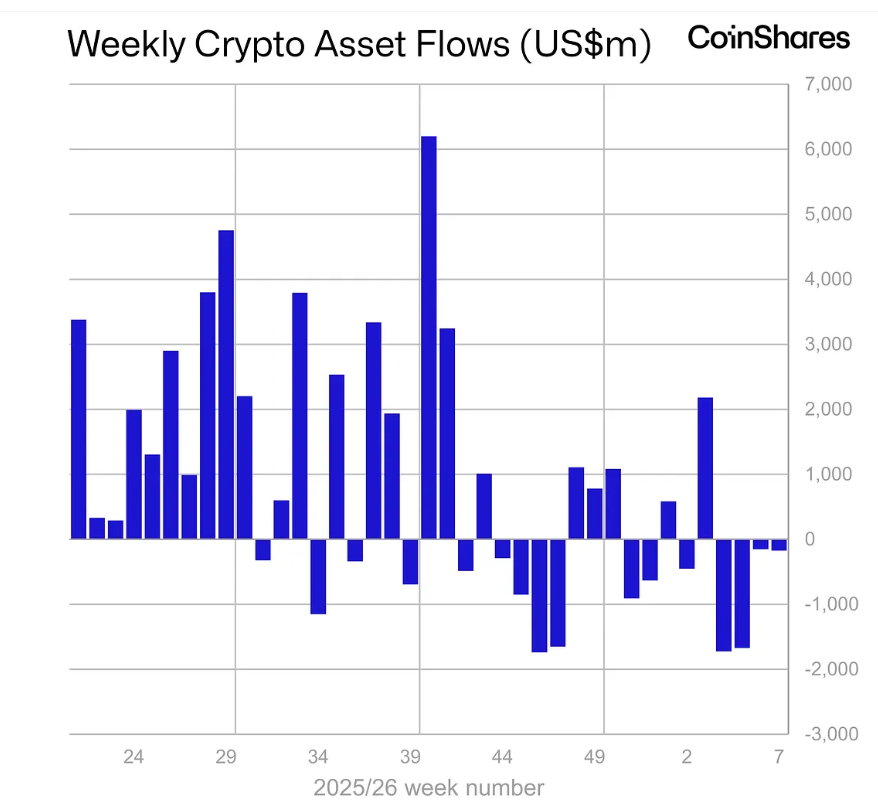

Digital asset investment product recorded a fourth week of outflows. The overall withdrawals were at US 173 million. Bitcoin and Ethereum were first from the outflows, and XRP and Solana were funded by new capital.

Frequently Asked Questions (FAQs)

1. Why is the crypto market down today?

2. Could macro events affect crypto prices this week?

- Harvard Management Co (HMC) Cuts BlackRock Bitcoin ETF Exposure by 21%, Rotates to Ethereum

- Morgan Stanley, Other TradFi Load Up SOL as Solana RWA Tokenized Value Hits $1.66B ATH

- Trump’s WLFI Slides 8% as Senators Tell Bessent To Review World Liberty’s UAE Stake

- XRP Price Slides Under $1.5 Amid $50M Market Dump on Upbit

- Is Bitcoin Bottom Still Far Away as Matrixport Says More Bear Market Signals Are Emerging?

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value