Tron Founder Justin Sun To Buy 52.9K Ethereum, What’s Happening?

Highlights

- Tron Founder Justin Sun has recently applied to acquire nearly 53K ETH from Lido.

- Sun has recently dumped Ethereum as the crypto soared past the $4K level.

- Ethereum price was up more than 2% today, with recent whale activity indicating further gains ahead.

Tron founder Justin Sun has fueled discussions in the market with his recent plans to accumulate nearly 53K ETH. Notably, this development has gained additional interest as the Ethereum price has once again crossed the $4,000 mark recently, with a surge of about 2% in its last 24-hour value. On the other hand, it also comes after Sun has made a significant ETH selloff recently, which has sparked concerns among investors over its potential impact on the asset’s price ahead.

Tron Founder Justin Sun Plans To Bag 53K ETH

Tron Founder Justin Sun plans to acquire nearly 53,000 ETH, sparking discussions in the market. Notably, this move came just after Sun dumped a massive amount of the crypto recently, which has fueled speculations over its potential impact on Ethereum price.

Notably, top on-chain analytics and transaction tracking platform, Spot On Chain has reported the recent development. According to the report, Sun has recently applied to withdraw 52,905 ETH, worth around $209 million, from Lido. Notably, the report also noted that this move is part of his accumulation of 392,474 Ether, which he “allegedly bought” at around $1.19 billion through three wallets between February and August.

Meanwhile, his current ETH holdings showed that he has an estimated profit of around $349 million, indicating a 29% RoI. Notably, Sun has dumped 29,920 Ethereum, worth around $119.7 million, to HTX exchange last week, after the crypto’s price has touched $4k.

Will It Impact Ethereum Price?

The latest ETH price noted a surge of about 2% in the last 24 hours and traded at $4,008, while its one-day trading volume soared 11% to $31 billion. The crypto has touched a 24-hour high of $4,020 while noting a monthly gain of 27%. On the other hand, CoinGlass data showed that ETH Futures Open Interest soared nearly 5%, suggesting strong market confidence towards the asset.

However, the recent move by Justin Sun has fueled speculations over his next move with his ETH holdings. Precisely, a flurry of market experts are discussing if Sun would continue his Ether selling spree, which might impact Ethereum price ahead.

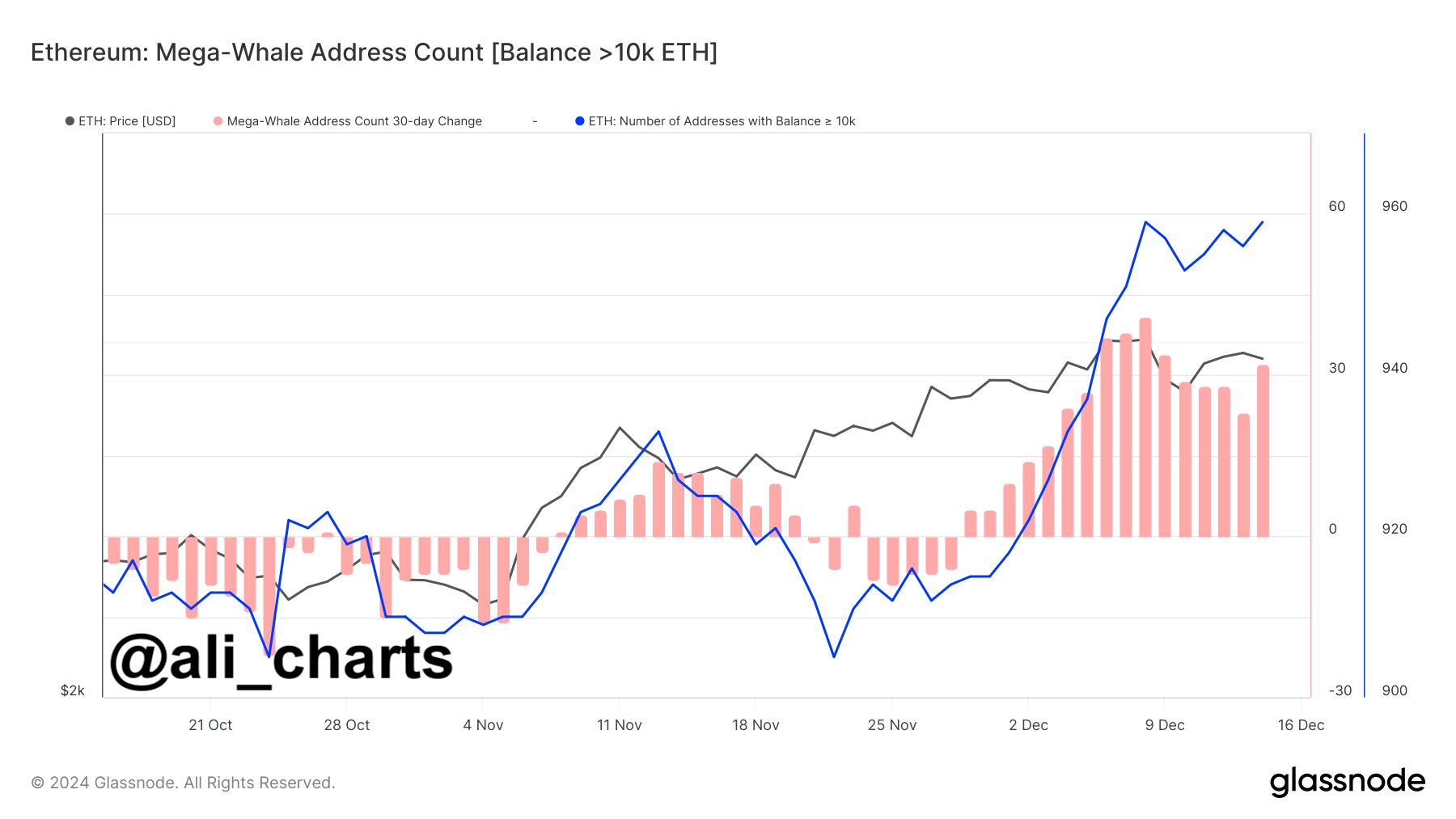

Meanwhile, despite the concerns, other Ether market trends appear to be optimistic. For context, recent Ether whale activities and other market trends hint that the crypto can hit a new ATH soon.

In addition, popular crypto market expert Ali Martinez has recently said that ETH whales are on a buying spree since the crypto has soared past the $3,300 mark. Besides, a recent analysis showed that ETH price could target the brief $15K mark next, which has further fueled market sentiments.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Senate Eyes CLARITY Act Markup This Month as Banks, Crypto Continue Stablecoin Yield Talks

- Why XRP Price Rising Today? (2 March)

- Breaking: Bitcoin Price Rises to $70k as Gold Crashes Amid U.S.-Iran Conflict

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

Buy $GGs

Buy $GGs