TrueUSD Stablecoin Makes the Biggest Bitcoin Trading Pair, Here’s How

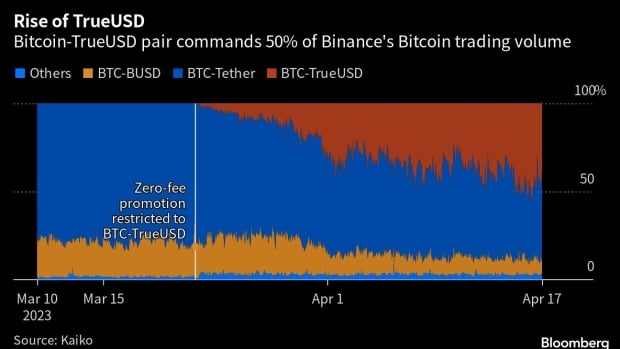

In an interesting development, the little-known stablecoin TrueUSD is making the largest Bitcoin trading pair, as per the data provided by the crypto research platform Kaiko. Thanks to the major shift spurred by crypto exchange Binance earlier this year.

Last month on March 22, crypto exchange Binance scrapped its zero-fee Bitcoin trading promotions, except for Bitcoin-TrueUSD. This provided a significant boost in demand for the TrueUSD stablecoin. Thus, TrueUSD’s share in Bitcoin trading volumes on crypto exchange Binance jumped to a staggering 50% which was almost negligible ahead of Binance’s scraping off a zero-fee call last month.

As we know, stablecoins are the crucial elements of the crypto sector wherein investors often park funds for using them in trading. As the name suggests, these digital assets should have a stable value, typically $1. Besides, these stablecoins are often backed by reserves such as cash and bonds. Commenting on the recent surge in demand for TrueUSD, Conor Ryder, a research analyst at Kaiko, said:

The stablecoin “is the benefactor of increased volumes now, even if the reasons why Binance granted TUSD this gift are unclear”.

The Surge In TrueUSD’s Stablecoin Circulation

Earlier this year in February, the New York regulators ordered Paxos, the issuer of Binance-branded stablecoin BUSD, to cease the minting of new tokens. It led to a major shakeout in the $132 billion stablecoin sector. This is exactly when the circulation of TrueUSD stablecoin started rising.

Now, with a market value of $2 billion, TrueUSD is the fifth-largest stablecoin in the market. This marks a jump of 3x in TrueUSD’s market value which was $755 million at the beginning of 2023.

Despite, TrueUSD’s parabolic rise, Tether’s USDT stablecoin still contributes the largest liquidity for the Bitcoin trading pairs. “Market depth data on Binance shows us that BTC-USDT is still king from a liquidity standpoint, with market makers evidently more comfortable with exposure to Tether over TUSD,” Ryder wrote.

The BTC-USDT trading pair accounts for 80% of total trading volumes across centralized crypto exchanges. On the other hand, TrueUSD is at 9% and is all set to take the second spot in the coming months.

- Will Bitcoin, ETH, XRP, Solana Rebound to Max Pain Price amid Short Liquidations Today?

- 3 Top Reasons XRP Price Will Skyrocket by End of Feb 2026

- Metaplanet CEO Simon Gerovich Defends Bitcoin Strategy Amid Anonymous Allegations

- “Sell Bitcoin Now,” Peter Schiff Projects Further BTC Price Crash to $20k

- 8 Best Decentralized Crypto Banking Solutions in 2026 – Top List Reviewed

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying