TrueUSD (TUSD) Depegs, Rises To 70% On Curve Pool After Prime Trust Disaster

While TrueUSD (TUSD) denies its exposure to crypto custodian Prime Trust, it has depegged for the second time this month. Prime Trust was placed into receivership on Tuesday after rival BitGo called off its bid to acquire Prime Trust.

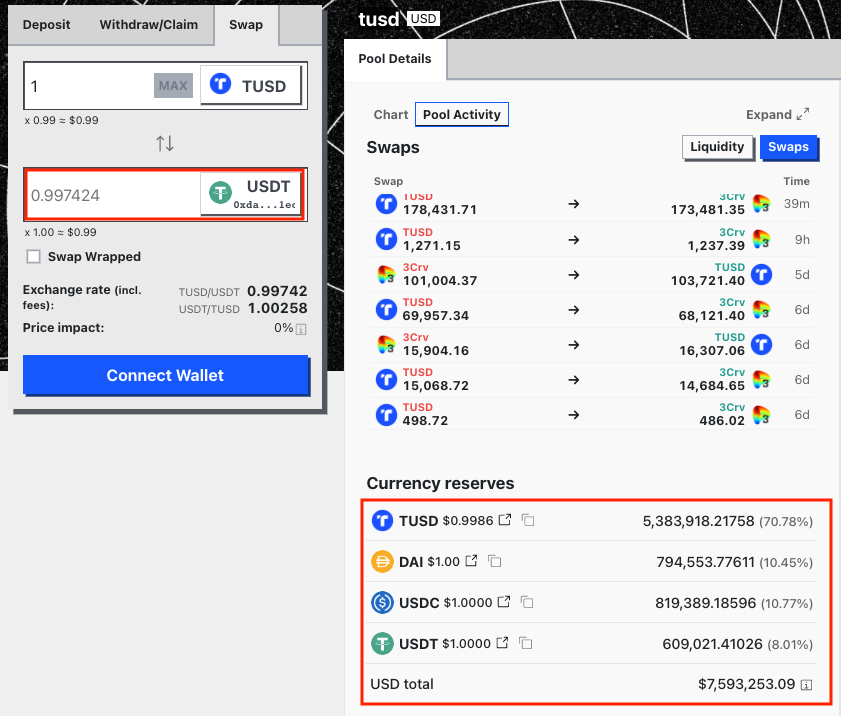

TUSD stablecoin fell to 0.9974 against Tether (USDT) on Binance and 0.80 on Binance.US amid exposure to Prime Trust. Maverick Protocol (MAV) launchpool on Binance starting to withdraw TUSD. Moreover, reserves on Curve pool has imbalanced further, rising more than 70%. The TUSD deposit and loan interest rates in Aave V2 soared, with the deposit interest rate reaching 42% and loan interest rate reaching 54%.

As a result, whales and investors are taking arbitrage opportunities to swap TUSD for USDC and other stablecoins. TUSD has $20 million in plunge protection buys down to $0.997, but $21 million would take it down to $0.70 on Binance.

Notable crypto experts including Adam Cochran, The Wolf Of All Streets, and Parrot Capital took to Twitter to warn about TUSD depeg risks. Moreover, TUSD reserves attestation was provided by The Network Firm (formerly Armanino), the same audit firm that was in charge of FTX.US audits. Adam Cochran said:

“Wait, the auditor who has been attesting to the TUSD audits (in Prime Trust) was the old FTX auditor who set up under a new name after the FTX scandal?!?!? These guys literally audited the biggest grift in history and just renamed themselves?!?”

Also Read: Shibarium Testnet Reaches 25 Million Transactions, SHIB & BONE To Rally?

Binance Exposure to TUSD and Prime Trust

Binance started supporting TUSD stablecoin after the US regulator ordered Paxos to stop minting Binance USD (BUSD) stablecoin.

TUSD reserves are majority held in Prime Trust, First Digital, Capital Union, Manual, and BitGo. According to TUSD real-time reserve balance, the token supply stands at 3.139 billion TUSD and USD-denominated collateral held in accounts is $3.14 billion.

CoinGape Media earlier reported Prime Trust started holding Binance customers’ cash via partner banks in March. The custodian was linked to FTX and its executives.

Also Read: Bloomberg Analysts Increasingly Bullish On BTC Price Amid BlackRock, Fidelity Bitcoin ETF

- Bitcoin Price Today As Bulls Defend $65K–$66K Zone Amid Geopolitics and Tariffs Tensions

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act