Trump-Backed American Bitcoin Debuts on Nasdaq, ABTC Stock Surges

Highlights

- The listing follows the completion of a merger with Gryphon Digital Mining.

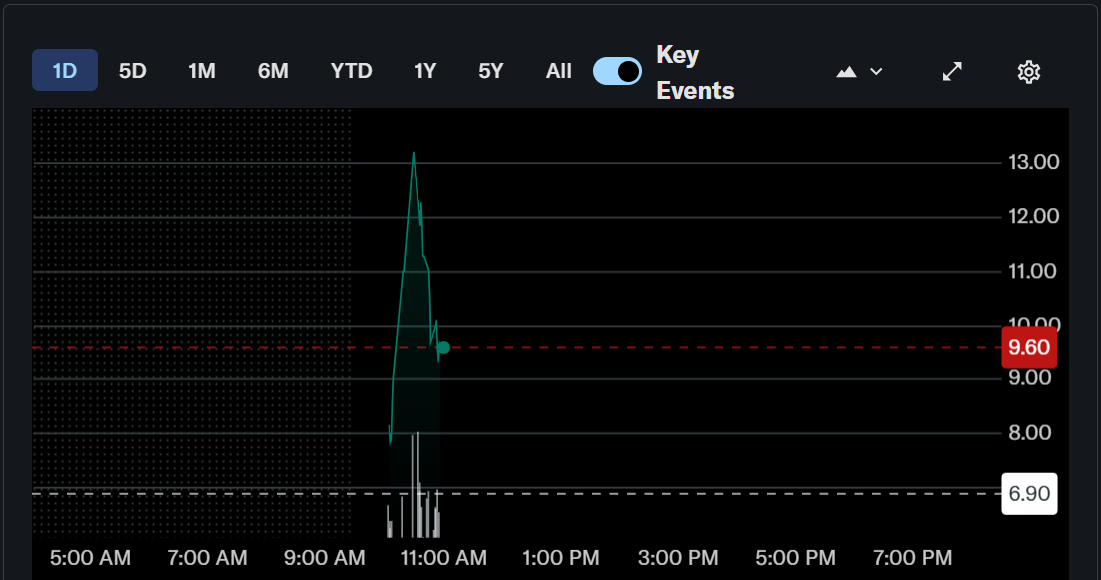

- The ABTC stock surged as much as 60% upon listing.

- The company currently holds 2,443 BTC.

Trump-backed mining company American Bitcoin has listed on the Nasdaq today. This follows a merger with Gryphon Digital Mining, which the company completed last week. The ABTC stock has surged as much as 60% following the Nasdaq listing, reaching $13.

American Bitcoin Lists On Nasdaq, ABTC Stock Rises

According to a WSJ report, the Bitcoin mining and accumulation business, which Donald Trump’s two eldest sons co-founded, listed its shares on the Nasdaq today under the ticker ‘ABTC.’ Eric and Donald Trump Jr., Bitcoin miner Hut 8, and other shareholders will own about 98% of the company.

This follows a merger with Gryphon Digital Mining, which the company’s shareholders approved last week during a special meeting. Investors in Gryphon’s stock, ‘GRYP,’ will hold the remaining 2% of the shares in American Bitcoin.

The Trump brothers had first formed the company through a merger with Hut 8 back in March earlier this year. Hut 8 had swapped its bitcoin mining division in exchange for an 80% ownership stake.

American Bitcoin had, in June, raised $220 million in cash and Bitcoin from investors, including the Winklevoss twins, Cameron and Tyler. The company used the proceeds to acquire more BTC and mining equipment.

Meanwhile, Yahoo Finance data shows that the ABTC stock surged as much as 60% upon its debut on the Nasdaq. The stock is currently trading at around $9, still up over 40% today.

Plans To Become The Greatest BTC Treasury Company

Commenting on this development, Eric Trump told WSJ that they have become the “obvious name in crypto.” He added that his company will be the greatest treasury company. Meanwhile, in an X post, he remarked that he had put a “tremendous amount of love and work” into the company over the past 12 months.

I have put a tremendous amount of love and energy into @AmericanBTC over the past 12 months. It is a huge honor to be listed on the @Nasdaq and begin trading today! #ABTC https://t.co/w1EPqdnyLh

— Eric Trump (@EricTrump) September 3, 2025

Notably, American Bitcoin currently holds almost 2,443 BTC on its balance sheet as it adopts Michael Saylor Strategy’s Bitcoin treasury model. Eric Trump had previously stated that they want to eventually become the largest Bitcoin holder, surpassing Strategy and other top holders.

BitcoinTreasuries data shows that the Bitcoin miner currently ranks as the 25th largest public Bitcoin holder, just above the Smerter Web Company and behind Sequans Communications. Strategy is the largest public holder with 636,505 BTC.

Expansion Into Several Spheres Of Crypto

Meanwhile, this development comes just two days after the Trump family flagship crypto venture, World Liberty Financial, made its WLFI token tradeable. Thanks to that, the president’s family amassed as much as $5 billion in paper wealth.

The Trump family continues to expand its crypto business. Besides American Bitcoin and the DeFi project WLFI, the U.S. president has his own meme coin, TRUMP coin, while World Liberty Financial issues the USD1 stablecoin.

Donald Trump Jr. had previously revealed that his family got into crypto because they were debanked. He noted how decentralization in the crypto space ensures everyone has access to financial services.

- Top 3 Reasons Why Crypto Market is Down Today (Feb. 22)

- Michael Saylor Hints at Another Strategy BTC Buy as Bitcoin Drops Below $68K

- Expert Says Bitcoin Now in ‘Stage 4’ Bear Market Phase, Warns BTC May Hit 35K to 45K Zone

- Bitcoin Price Today As Bulls Defend $65K–$66K Zone Amid Geopolitics and Tariffs Tensions

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible