Just-In: Trump-Backed WLFI Token Slips as Jump Crypto Begins Profit Booking

Highlights

- Jump Crypto moves some WLFI tokens to Binance from 100 million received from team.

- WLFI token dips 6% after skyrocketing 26% today after government shutdown ending news.

- WLFI futures open interest plunges nearly 5% in a few hours.

Trump family-backed World Liberty Financial’s WLFI token dips more than 6% as Jump Crypto started profit booking on Monday. The move comes as the crypto token skyrocketed 26% after Republicans reached a deal with Democrats to end the largest-ever US government shutdown.

Jump Crypto Transfers WLFI Token Worth Millions to Binance

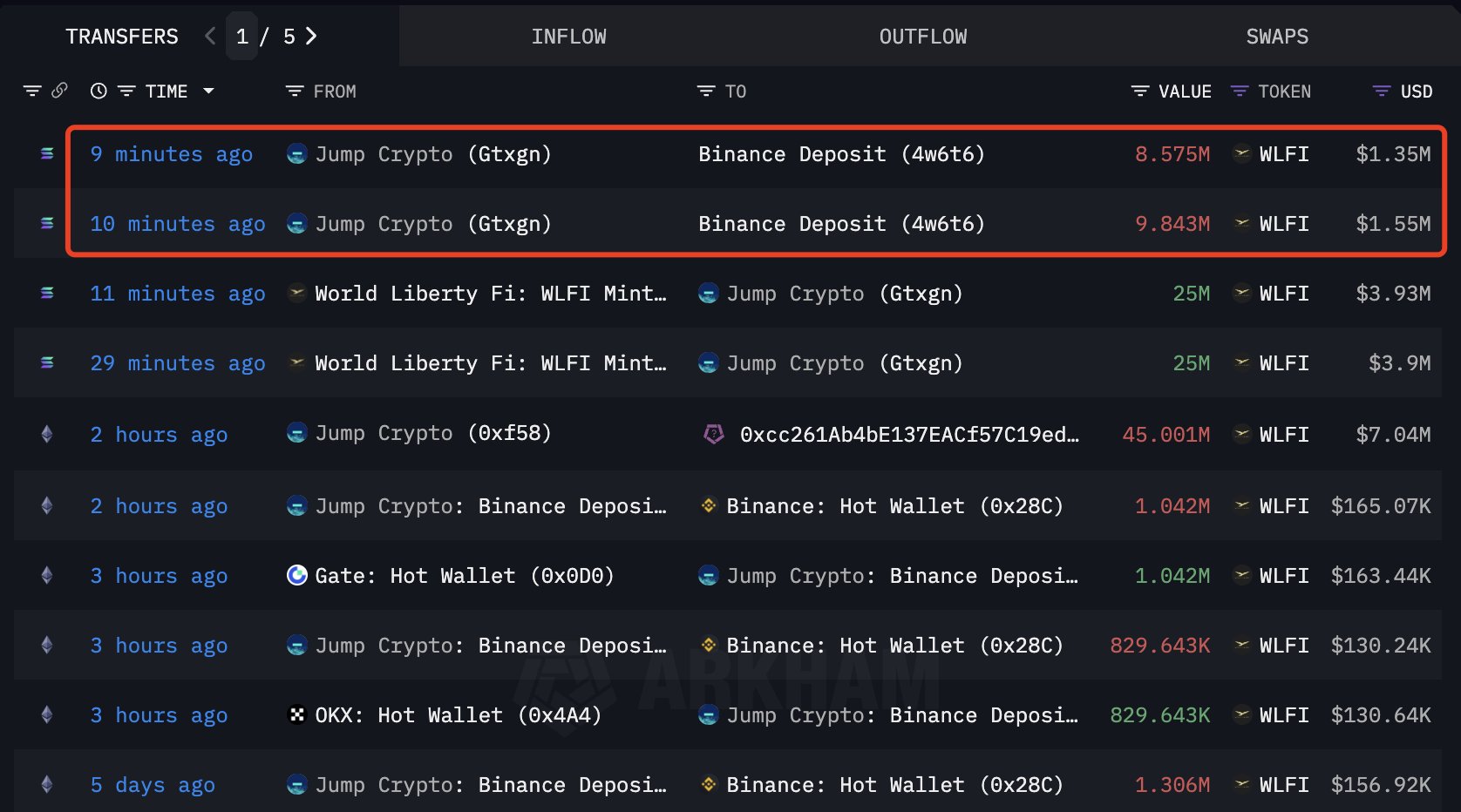

Jump Crypto, a subsidiary of proprietary trading firm Jump Trading, has just dumped 18.42 million WLFI token, Lookonchain reported on November 10. The institution moved tokens worth $2.9 million to Binance crypto exchange.

Jump Crypto received another 100 million WLFI tokens worth $15.4 million from World Liberty Financial earlier today. The wallet still holds 182.172 million in WLFI tokens worth $27.3 million, as per Arkham data. Crypto holdings in the wallet are valued at almost $1 billion, with Bitcoin, Solana, stablecoins USDT and USDC as the largest holdings.

Recently, Jump Crypto rotated large amounts of SOL to BTC despite the spot Solana ETF launch. The trading firm transferred the unstaked 1.1 million SOL worth $205 million to Galaxy Digital for $265 million in BTC.

Massive 23% Price Spike After the US Government Shutdown News

WLFI token spiked 23% in an hour following the Senate reaching a bipartisan agreement to end the longest-ever US government shutdown. President Donald Trump earlier revealed that they are getting close to ending the shutdown. The US government is expected to reopen this Friday after the House voting on the funding bill due Wednesday.

Profit booking by Jump Crypto caused the token to pare more than 6% after 26% gains over the past 24 hours. The price is currently trading at $0.153. The 24-hour low and high are $0.119 and $0.168, respectively. Furthermore, trading volume has increased by a massive 608% in the last 24 hours.

CoinGlass data showed profit booking by derivatives traders. At the time of writing, the total WLFI futures open interest jumped 41% to $280 million in the last 24 hours. However, WLFI futures OI on Binance, OKX, and Bybit plunged more than 5%, 8% and 4%, respectively. This signals massive selling in the derivatives markets.

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise