‘Trump Insider Whale’ Increases Bitcoin Short to $485M Amid Crypto Market Crash

Highlights

- Trump Insider Whale expands Bitcoin shorts to $485 million as market declines sharply.

- BlackRock deposits $77.67 million BTC to Coinbase Prime, fueling further bearish sentiment.

- Bitcoin social sentiment hits multi-year low after Friday’s major flash crash.

The entity known as the “Trump Insider Whale” has deepened his bearish stance against Bitcoin. He expanded his short positions to $485 million as the Bitcoin price experiences another sharp downturn.

The move, disclosed by Arkham Intelligence, comes as Bitcoin faces intensified selling pressure following large-scale BTC deposits by BlackRock to Coinbase Prime.

Hyperunit Whale Extends Short Positions on Bitcoin

According to Arkham data, the whale has now added an additional $150 million to his shorts. This brings the total to $485 million, with approximately $22 million in unrealized profit.

Referred to as the Hyperunit Whale by Arkham, the whale previously shorted Bitcoin worth $340 million. The address linked to the whale, holding over $5.4 billion in assets, has been a consistent source of high-impact trades since last Friday.

Arkham data indicates that this trader gained nearly $200 million from shorting the market during the last major Bitcoin selloff. The whale’s aggressive positioning reflects growing expectations of continued weakness in risk assets. When whales expand shorts during a crash, it usually means the sentiment is still fearful, not exhausted

BlackRock’s BTC Deposit Fuels Bearish Momentum

Adding to the negative sentiment, Lookonchain revealed that BlackRock deposited 704 BTC (worth $77.67 million) into Coinbase Prime. At the time of writing, Bitcoin price trades around $111,618 down more than 3% in 24 hours. The combined effect of large institutional transfers and leveraged short positions has deepened uncertainty in the near-term outlook.

BlackRock just deposited 93,158 $ETH($364M) and 704 $BTC($77.67M) to #CoinbasePrime.https://t.co/qmuDIrP9my pic.twitter.com/SWeksmFNLS

— Lookonchain (@lookonchain) October 14, 2025

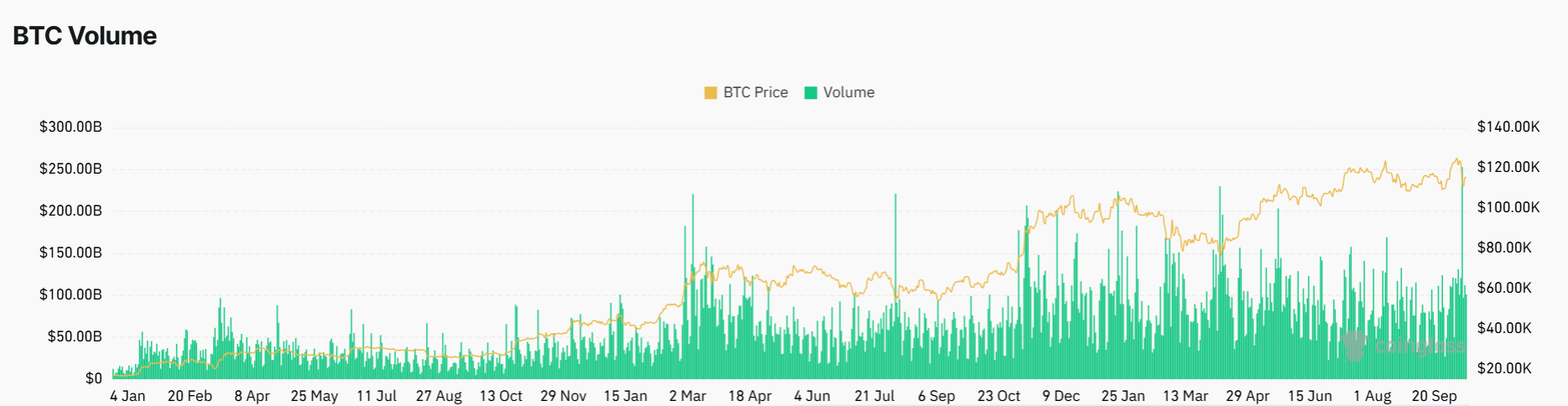

CoinGlass data showed that Bitcoin’s futures volume rose 3.19% to $129.48 billion. Also, open interest declined 2.90% to $72.87 billion, pointing to position closures amid volatility.

Bitcoin Sentiment Hits Multi-Year Low

In addition, market analyst Ali reported that social sentiment around Bitcoin has dropped to its lowest level in years following Friday’s flash crash. The chart from Santiment provided in his post reveals that retail excitement has plummeted drastically.

Social sentiment around Bitcoin $BTC dropped to its lowest level in years following Friday’s flash crash. pic.twitter.com/PCGr5aZrnz

— Ali (@ali_charts) October 14, 2025

Historically, the accumulation by institutional players often happens after similar sentiment collapses. In contrast, famed hedge fund manager Paul Tudor Jones predicted an explosive Bitcoin rally.

Still, several traders have become risk-averse as the crypto market decline continued. However, the fact that the whale’s action means that recovery might be delayed.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: Trump Says The U.S.-Iran War Could End Soon, Mulls Taking Over Strait Of Hormuz

- Bhutan Dumps More Bitcoin as BTC Price Climbs Amid Falling Oil Prices

- Bitget Upgrades Agent Hub to Enable OpenClaw, Claude Code to Trade Crypto in Real Time

- Why Next Two Weeks Are Do or Die for Crypto Market?

- Breaking: Tom Lee’s BitMine Acquires 60,976 ETH As BMNR Stock Eyes Recovery

- Top Analyst Explains Why Pi Network Price May Soar to $0.50 This Week

- Is MSTR Stock Going to Rally $150?

- Bitcoin And XRP Price Prediction As US Oil Prices Fall Sharply- Will This Spark a New Bull Rally?

- Is It a Good Time to Buy XRP As Price Falls 64% From All-time High

- Will Crypto Market Crash This Week? Analysts Predict Timeline for Volatility

- Gold Price Prediction Ahead of March 18 FOMC Meeting

Buy $GGs

Buy $GGs