Trump Tariffs: Secretary Bessent Declares ‘Fantastic’ Trump–Xi Talks, Bitcoin Breaks $113,000

Highlights

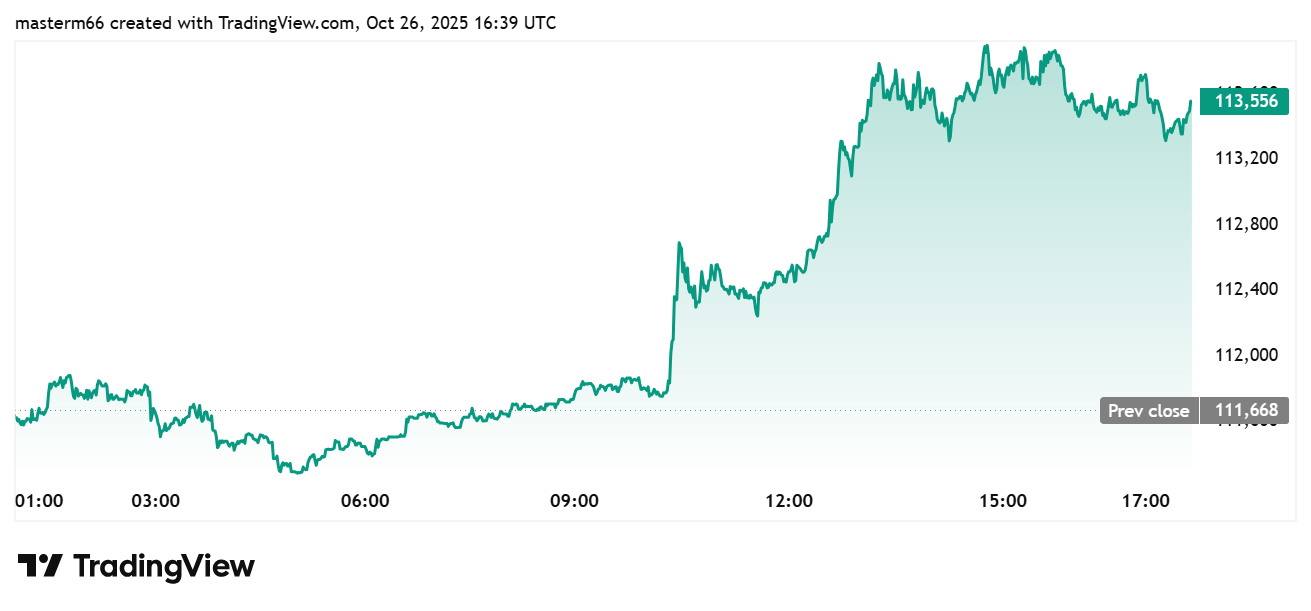

- Bitcoin tops $113,000 as positive Trump–Xi meeting fuels strong optimism in global markets.

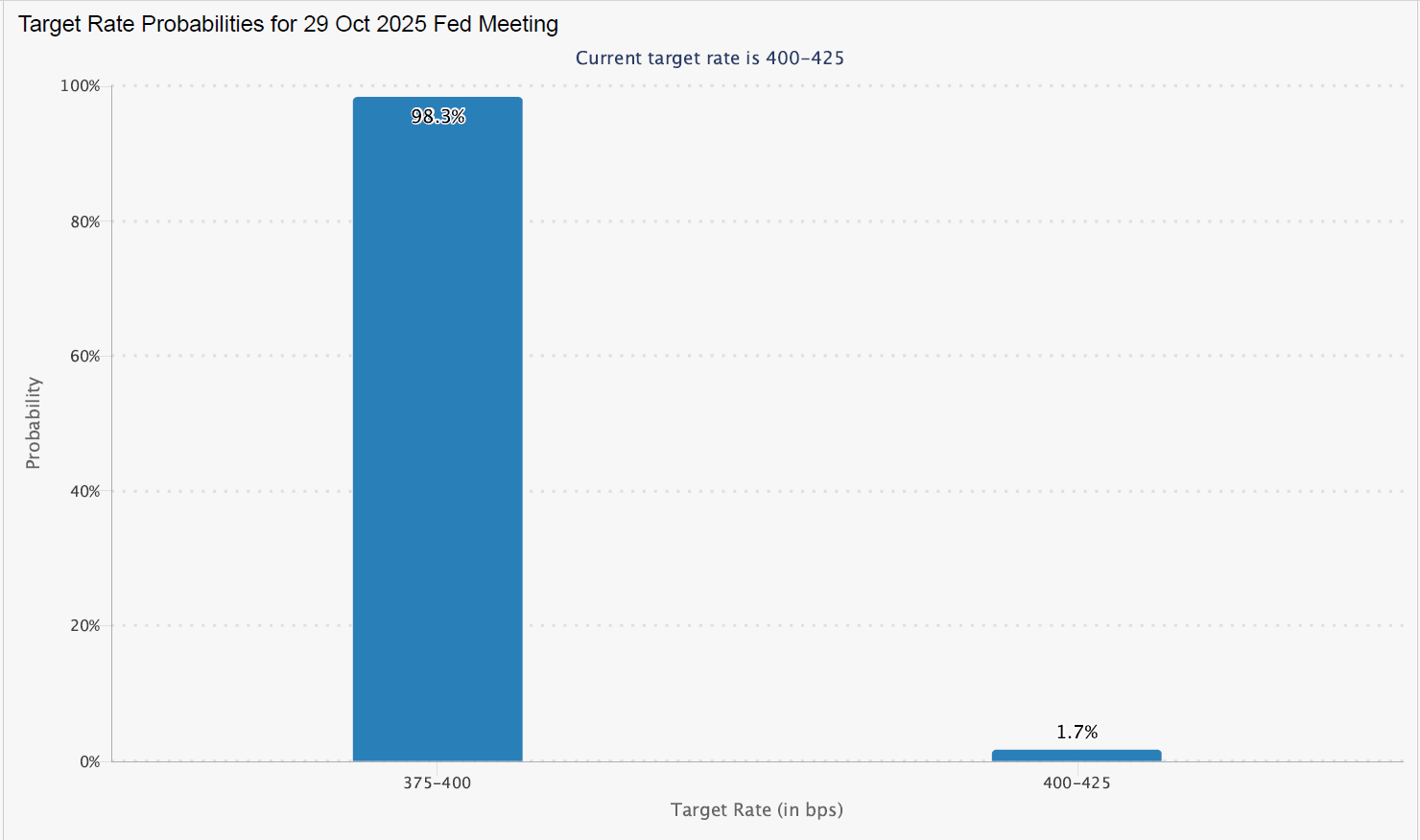

- CME data shows 98.3% chance of Fed rate cut by October.

- U.S.–China negotiators reach consensus on trade issues, easing macro uncertainty.

Bitcoin (BTC) has climbed above $113,000 as optimism grew ahead of President Donald Trump’s meeting with Chinese President Xi Jinping. The rally coincided with remarks from U.S. Treasury Secretary Scott Bessent, who said the two leaders now have “the framework” for a productive discussion.

Optimism Ahead of Trump–Xi Meeting Fuels Bitcoin Rally

Bessent told NBC’s Meet the Press that the talks will be “fantastic for U.S. citizens, for U.S. farmers, and for our country in general.” His statement came just hours before the meeting, which investors see as a key step toward easing global trade tensions.

.@SecScottBessent on President Trump’s meeting with Xi Jinping: “I believe that we have the framework for the two leaders to have a very productive meeting for both sides — and I think it will be fantastic for U.S. citizens, for U.S. farmers, and for our country in general.” pic.twitter.com/0DpRyk45Js

— Rapid Response 47 (@RapidResponse47) October 26, 2025

The upbeat tone helped strengthen broader market sentiment, with BTC price gaining 1.62% over the last 24 hours, according to TradingView. The leading cryptocurrency traded around $113,479 after surging from its previous close of $111,668.

Traders Bet on Fed Rate Cuts as Liquidity Expectations Rise

This improving sentiment coincides with rising expectations of monetary easing. According to CME Group’s FedWatch data, markets now assign a 98.3% probability of another Federal Reserve rate cut. The move is expected to take place by the October 2025 meeting.

The information indicates that many now believe that U.S. interest rates will be lowered further than the current 400-425 basis points. This will also indicate that the market has turned towards easing. These expectations are considered a liquidity force for risk assets, especially Bitcoin.

Fresh Trade Momentum Adds to Bitcoin’s Bullish Boost

According to a Bloomberg report, top U.S. and Chinese trade negotiators reached a preliminary consensus on a wide range of economic issues. This clears the way for Presidents Trump and Xi to finalize a sweeping trade deal later this week.

The two sides reportedly agreed on contentious points such as export controls, fentanyl regulation, and shipping levies. The move marks the most significant progress since tensions peaked earlier this month.

Bessent said he expects Trump’s earlier threat of 100% tariffs on Chinese goods was “effectively off the table.” These developments helped stabilize market expectations that had been rattled by the prospect of another tariff escalation.

Chinese trade envoy Li Chenggang also confirmed both sides reached consensus on fentanyl and port service fees. This signals a softening tone from Beijing after weeks of heated exchanges.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Senate Eyes CLARITY Act Markup This Month as Banks, Crypto Continue Stablecoin Yield Talks

- Why XRP Price Rising Today? (2 March)

- Breaking: Bitcoin Price Rises to $70k as Gold Crashes Amid U.S.-Iran Conflict

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

Buy $GGs

Buy $GGs