Trump Threatens 100% Canada Tariffs as Bitcoin Holds $89K

Highlights

- Trump is threatening to impose 100% tariffs on Canada due to its possible trade deal with China.

- However, Bitcoin remains steady at about $89,000 as a likely U.S.-Canada trade hostility rises.

- Policy uncertainty clouds the market with liquidity remaining unaffected by the growing trade tensions.

The crypto market reacted cautiously as the U.S. President, Donald J. Trump, threatened that Canada would encounter a 100% tariff in case it strengthened its trade relationship with China. The remarks gave new geopolitical risks to global markets.

Trump Threatens Canada With Tariffs Over China Trade Relations

Trump posted on the Truth Social platform that Canada should not turn into a drop-off port through which Chinese merchandise can enter the United States. He cautioned that increased economic integration between Canada and China will expose the Ottawa government to Beijing and undermine home-grown industries.

Trump also stated that in case Canada conducted a trade agreement with China, America will automatically apply a 100% tariff on all Canadian products in the country. The declaration suggested an economic and national security challenge.

The comments came after a report talked about the changing relations Canada had towards China, making the warnings more politically and market relevant.

Cryptocurrency Prices Show Weak Response

Although there had been a rise in trade talks between Canada and China, the crypto market recorded limited price movement. Still, institutional positioning remains active. For instance, Ark Invest by Cathie Wood has applied to have a crypto index ETF that includes Bitcoin and altcoins like ETH, SOL, XRP, ADA.

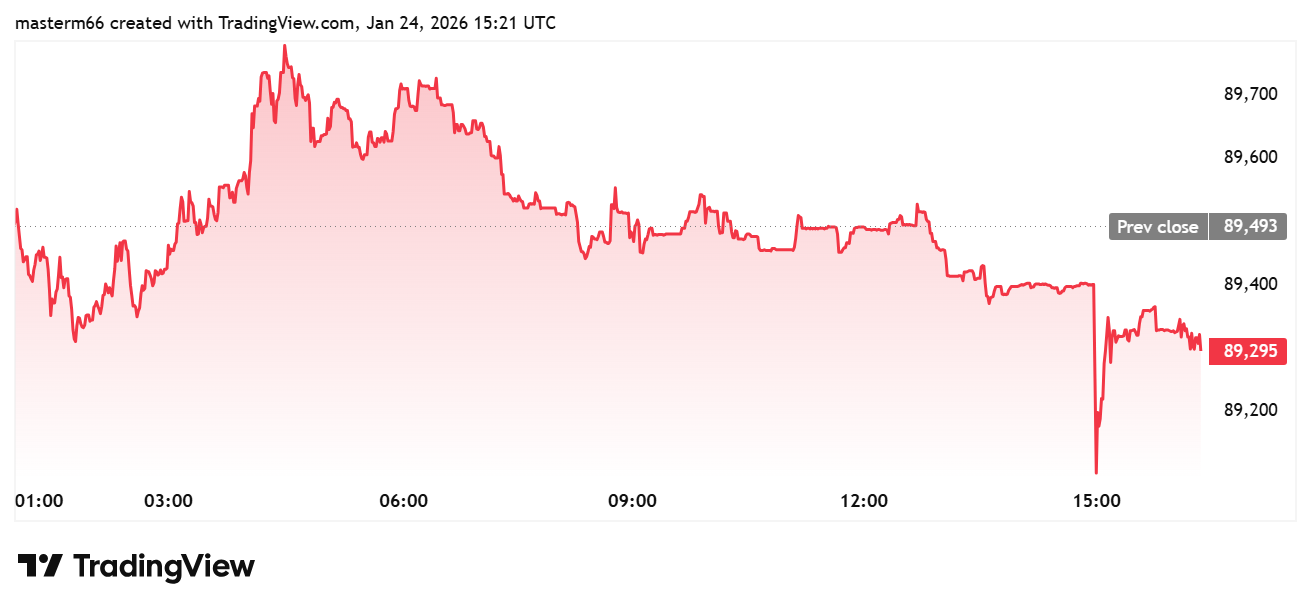

Bitcoin price was at almost $89,300 after a minor drop in the last hour and 24 hours, according to TradingView. Ethereum traded around the $2,948 range, showing small increases over the past day, but with intraday fluctuations.

However, among the other top altcoins in the crypto market, XRP traded at about $1.91 and with no price change within the hour, although it did not record significant gains in the last day. BNB and Solana demonstrated a mixed intraday performance whereas TRON showed a better short-term performance but a weaker performance over the past 24 hours.

Markets To Balance Trade Risk and Liquidity Conditions

The dampened crypto market reaction implies that traders are considering Trump’s tariff statements as a policy news as opposed to an economic shock. This warning follows the uncertainty in regulations as the crypto market bill markup is delayed again.

This is due to the cancellation of Monday’s voting session by the Senate following recent snowstorms. Traditionally, warnings involving trades will first impact traditional markets followed by crypto in the event that the Trump tariffs escalate risk-off flows.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Traders Predict Oil Prices to Rally Above $100 as Iran War Enters Week 2

- Prediction Market Kalshi Faces Class Action Over Iran War-Linked Bets

- Binance Responds To U.S. Senate Probe, Denies Iran Sanctions Violations

- Fed Rate Cut Odds Jump Following Huge U.S. Jobs Report Miss

- U.S.-Iran War: Trump Rejects Iran Deal as Rising Oil Prices Threaten Crypto Market Rebound

- Here’s Why Cardano Price Has Not Reclaimed $0.30

- Will XRP Price Crash as U.S. Nonfarm Payrolls Fell by 92,000 in February?

- Pi Network Price Eyes a 40% Surge as Pi Day Looms on March 14

- Top Reasons Why Circle Stock Price is Surging

- Gold Price Prediction as US-Iran War Hits the Second Week

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

Buy $GGs

Buy $GGs