Trump’s Truth Social Files For Bitcoin, Ethereum, Cronos Crypto ETFs Amid Institutional Outflows

Highlights

- Trump Media's Truth Social has filed Bitcoin, Ethereum, and Cronos crypto ETF applications.

- New funds combine digital asset exposure with staking rewards, 0.95% management fee.

- Filing follows $410 million Bitcoin ETF outflows as institutional investors reduce crypto positions.

The Truth Social Fund, linked with the Trump Media, has sought approval from the U.S. SEC for two crypto exchange-traded funds (ETFs). This comes as the institutional flows became negative in key digital asset products.

The filings come after the U.S. spot Bitcoin ETFs registered a net outflow of $410.37 million on February 12. No BTC fund reported daily inflows on this day.

Truth Social files for Two Crypto ETFs

The Truth Social Cronos Yield Maximizer ETF that targets exposure to CROs, as well as staking rewards, is one of the crypto products proposed, according to a press release. The second fund, known as the Truth Social Bitcoin and Ether ETF, will track the performance of Bitcoin and Ethereum and consists of an Ether staking income.

The CRO fund will monitor the performance of the Cronos token with additional yield from staking efforts. The Ether staking reward and spot price exposure will be the main focus of the Bitcoin and Ether ETF.

Top crypto exchange Crypto.com will offer custody services, liquidity, and staking services for both funds for the Truth Social crypto ETFs. Yorkville America Equities will be the investment adviser, and the management fee is suggested to be 0.95%.

Steve Neamtz, the President of Yorkville America Equities, stated that Truth Social intends to provide crypto ETFs that can provide financial benefits through capital growth and income opportunities.

Kris Marszalek, co-founder and CEO of Crypto.com, said that the platform will assist in trading access and will be used to provide the underlying digital asset infrastructure of the suggested funds.

After regulatory approval, shares would be offered via the broker-dealer of Crypto.com, which is Foris Capital US LLC. The addition of CRO will add another category of tokens in the U.S ETF pipeline.

The largest asset manager in the world, BlackRock, previously submitted an S-1 to the SEC in respect to its iShares Bitcoin Premium ETF. The fund’s listing will be on Nasdaq. However, the asset manager has yet to reveal the ticker or the management fee for the fund. The Trust will mainly comprise BTC, iShares Bitcoin Trust ETF shares, and cash.

Outflows in Crypto ETFs Increase

The filing from Truth Social comes at a time of continued crypto ETF outflows. These are an indication of a drop in demand after the dominance of inflows earlier in the week. According to SoSoValue statistics, the IBIT by BlackRock recorded the greatest daily withdrawals of all the Bitcoin ETFs, with $157.56 million.

Fidelity’s FBTC came second with $104.13 million, while there were also withdrawals from other BTC ETFs. The exceptions were WisdomTree’s BTCW and Hashdex’s DEFI, both of which recorded no inflows or outflows.

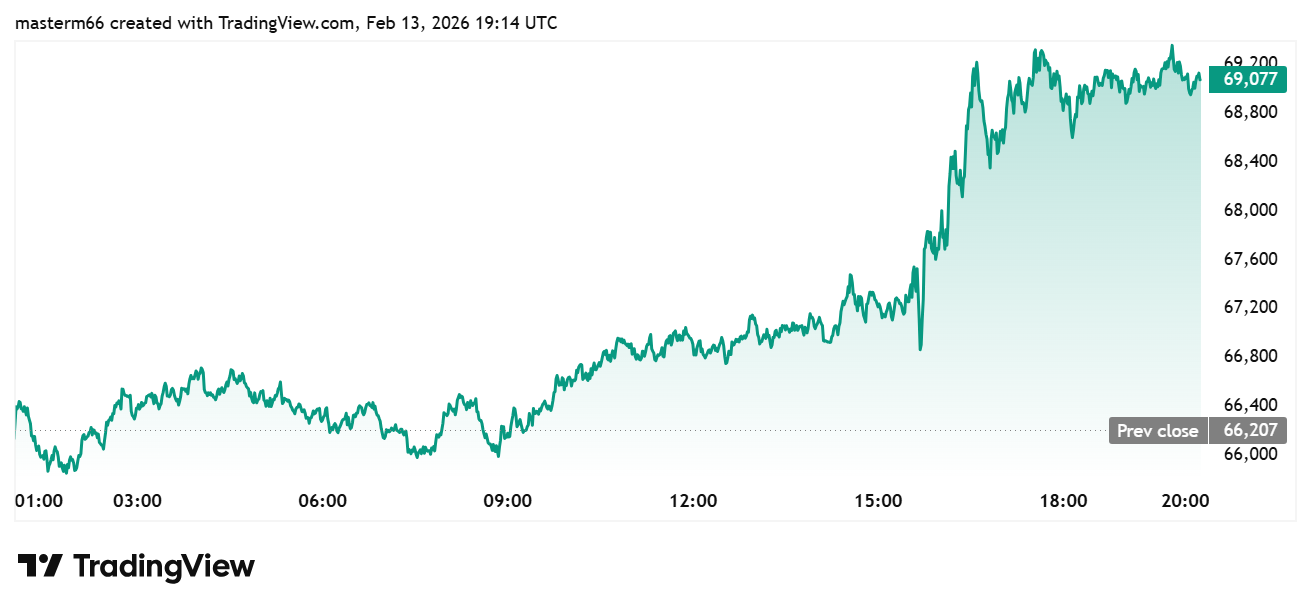

In the meantime, the BTC price traded at approximately $68,950, as of this writing, per data from TradingView. It rose approximately 4% on the day, even after the outflows in the ETFs continued from the previous day.

This divergence in prices indicates that the spot demand was unaffected even when institutional flows became negative. Net outflows of approximately $144.84 million were also registered on the day from Ethereum products.

- Bitcoin Sell-Off Ahead? Garett Jin Moves $760M BTC to Binance Amid Trump’s New Tariffs

- CLARITY Act: Trump’s Crypto Adviser Says Stablecoin Yield Deal Is “Close” as March 1 Deadline Looms

- Trump Tariffs: U.S. To Impose 10% Global Tariff Following Supreme Court Ruling

- CryptoQuant Flags $54K Bitcoin Risk As Trump Considers Limited Strike On Iran

- Why Is Bitdeer Stock Price Dropping Today?

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?