Trump’s World Liberty Expands USD1 Supply Amid ALT5 Sigma Insider Trading Allegations

Highlights

- World Liberty Financial (WLFI) minted $205M worth of USD1 stablecoin, expanding supply to $2.4B.

- The move represents a 9% increase, solidifying USD1 as the sixth-largest stablecoin by market cap.

- ALT5 Sigma, WLFI’s treasury arm, denied insider trading allegations linked to venture capitalist Jon Isaac.

Trump’s World Liberty Financial (WLFI) has expanded the circulation of its stablecoin USD1, minting $205 million. This comes as its treasury firm, ALT5 Sigma, finds itself at the center of insider trading allegations.

World Liberty Expands USD1 Supply by 9%

In a recent X post, the Trump family-backed crypto venture World Liberty confirmed it minted $205 million worth of USD1 for its treasury. This lifted the stablecoin’s supply to a new record of $2.4 billion. The latest issuance marks the token’s most significant expansion since April. It also cements its status as the sixth-largest stablecoin by market capitalization.

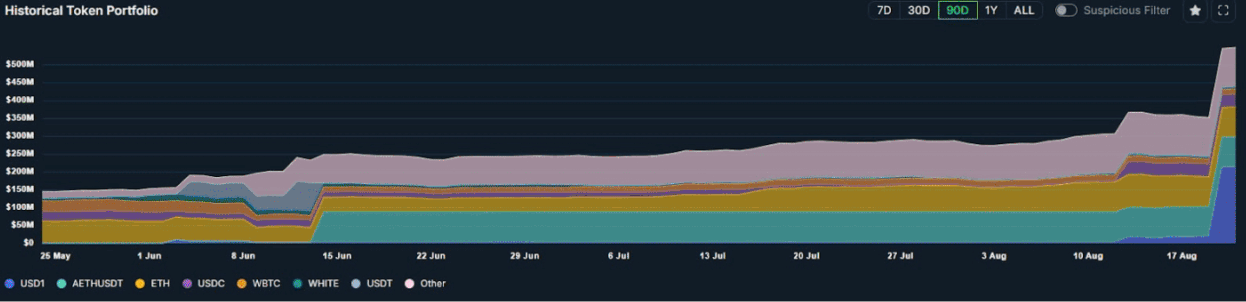

USD1, launched earlier this year, has quickly climbed the ranks, though it still trails industry leaders such as Tether and Circle. According to analytics firm Nansen, the new minting boosted WLFI’s treasury reserves to $548 million, with USD1 now representing the largest share of its crypto holdings.

At $212.59 million, the stablecoin accounts for nearly 40% of the portfolio, ahead of its position in AETHUSDT at $84.86 million. Experts suggest the move may be strategic ahead of the WLFI governance token launch. The token is expected to begin trading in September with a staggered community-focused unlock schedule across both centralized and decentralized platforms.

ALT5 Sigma Dismisses Insider Trading Allegations

Amid these bullish updates, World Liberty’s crypto vehicle, ALT5 Sigma, has been forced to issue strong denials against claims of insider activity tied to its $1.5 billion treasury funding round.

Several media outlets alleged that venture capitalist Jon Isaac, purportedly linked to ALT5’s leadership, was under investigation by the US SEC. Both ALT5 and Isaac swiftly rejected the reports.

“The company does not know about any current investigation regarding its activities by the US SEC,” ALT5 Sigma stated. They clarified that Isaac has never served as its president or advisor. Isaac himself echoed this in a follow-up, stressing that he leads Nasdaq-listed Live Ventures and holds no executive role at ALT5. However, he remains a major shareholder with over one million shares.

Setting the record straight on reports from @CoinpediaNews and @theinformation: I am NOT the president of ALT5 Sigma and I am NOT under SEC investigation mentioned in these reports.

I am the CEO of Live Ventures Incorporated (NASDAQ: LIVE), a publicly traded company. Any SEC…

— Jon Isaac (@Jonisaac702) August 19, 2025

According to reports, in 2024, Isaac had already signed a consulting contract with ALT5 Sigma. He allegedly contributed strategically to product development, restructuring, and client acquisition. This included a $540,000 note, later converted into equity.

His name also appeared in disclosures involving earnings inflation and share sales. This has drawn scrutiny over the firm’s $1.5 billion direct offering designed to bolster World Liberty’s USD1 reserves.

Meanwhile, the Trump-backed Initiative continues to advance its broader strategy. The crypto vehicle ALT5 Sigma was launched to boost its treasury plans and expand into the market. WLFI token’s upcoming launch will prioritize fairness through community-driven unlocks and governance votes. Listings on major exchanges are also expected over the next two months.

Analysts argue that the quick uptake of USD1 indicates that investors are very interested in stablecoins with political branding. Striking a balance between the need to reassure investors and aggressive growth will be crucial to its success.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs