Turks Look for Bitcoin (BTC) As Lira Collapses, BTC Is Now The World’s Third-Largest Currency

Bitcoin (BTC) has time-and-again proved that it is the ultimate saviour of the world against the inefficient fiat systems and government agencies. Over the last week, the Turkish Lira plunged another 14% against the U.S. Dollar which resulted in Turks searching for Bitcoin (BTC) in order to protect their wealth.

Over the last weekend, Google searches for Bitcoin (BTC) in Turkey shot up to the roof almost doubling as we can see a sharp spike in the chart below.

Turkish Lira fell 14% against the US Dollar today.

Google searches of "Bitcoin" doubled today. pic.twitter.com/yS4CHn4iHr

— Documenting Bitcoin 📄 (@DocumentingBTC) March 22, 2021

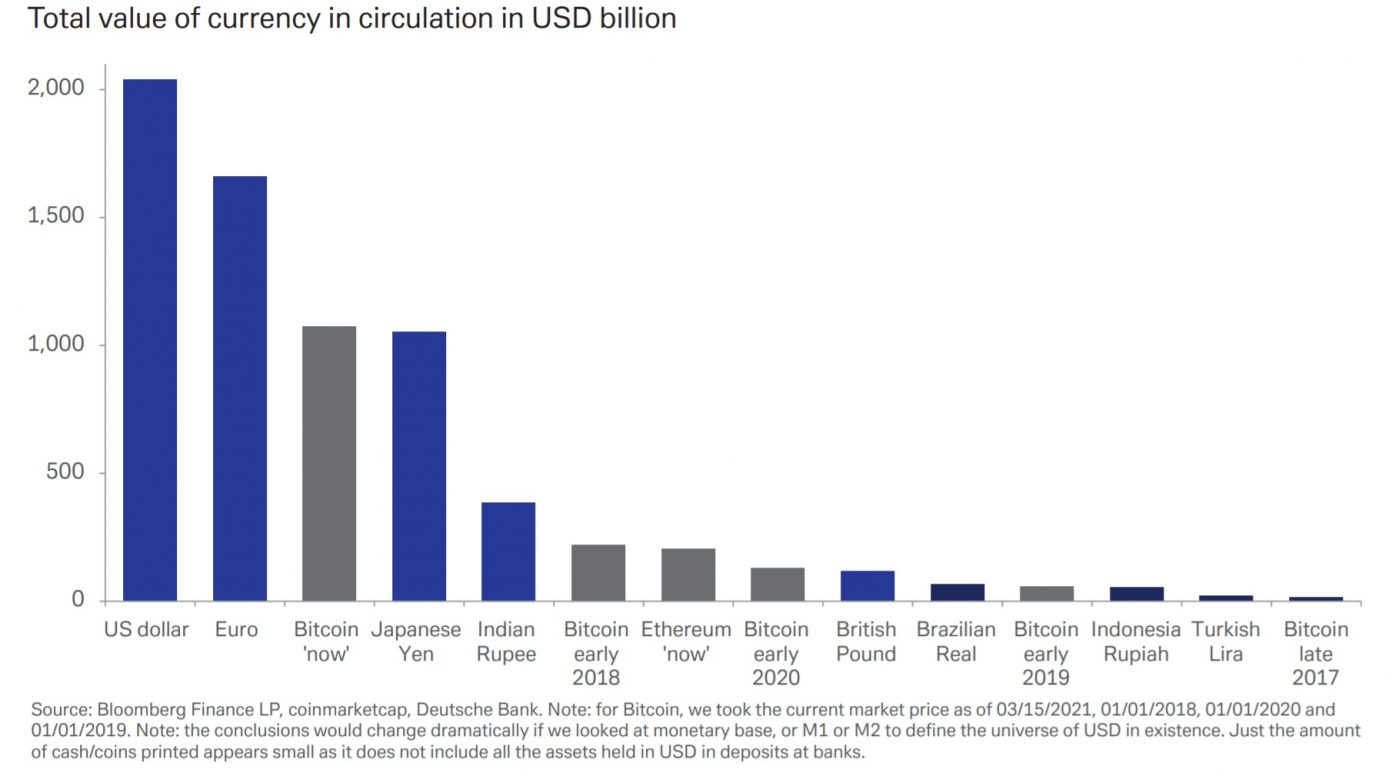

With the way that Bitcoin (BTC) has performed over the last few months, the trust in the world’s largest cryptocurrency is also building up strongly. At press time, Bitcoin is trading at a price of $57,783 with a market cap of $1.078 trillion. With this, Bitcoin (BTC) has cemented its position strongly thereby being the world’s third-largest currency in terms of the total value in circulation, notes Deutsche Bank in its latest published report.

Deutsche Bank: Bitcoin (BTC) Too Important to Ignore

Deutsche Bank acknowledged that even government institutions and central bank institutions have started acknowledging the role of cryptocurrencies and accepted the fact that they are here to stay. In the report, Deutsche Bank research analyst Marion Laboure, Ph.D. writes:

“Bitcoin’s market cap of $1 trillion makes it too important to ignore. As long as asset managers and companies continue to enter the market, bitcoin prices could continue to rise”.

However, the report goes on acknowledging the fact that “bitcoin transactions and tradability are still limited”. While discussing Bitcoin’s status as either a commodity, currency, or equity, the report states that BTC occupies the top-ten spot both as a stock as well as a currency.

Bitcoin’s jump to being the world’s third-largest currency in circulation is because of the vast increase in the BTC price currently. The report adds: “In early 2019, bitcoin represented ‘only’ 3% of the US dollars in circulation, but in February 2021 it surged beyond 40% of the US dollars in circulation.”

- Trump’s Board Of Peace Eyes Dollar-Backed Stablecoin For Gaza Rebuild

- Trump’s World Liberty Financial Flags ‘Coordinated Attack’ as USD1 Stablecoin Briefly Depegs

- Trump Tariffs: U.S. Threatens Higher Tariffs After Supreme Court Ruling, BTC Price Falls

- Fed’s Chris Waller Says Support For March Rate Cut Will Depend On Jobs Report

- Breaking: Tom Lee’s BitMine Adds 51,162 ETH Amid Vitalik Buterin’s Ethereum Sales

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?