Breaking: U.S.-China Tensions Heat Up as China Imposes New Sanctions; Bitcoin Falls

Highlights

- China sanctioned Boeing, Northrop and 18 other American companies.

- This threatens to heighten tensions between both countries as the U.S. had earlier sold weapons to Taiwan.

- Bitcoin is down amid this development.

U.S.-China tensions are rising again, with China announcing new sanctions against American companies. Bitcoin has fallen amid this development, as the relations between the two countries were notably one of the market highlights this year.

China Imposes Sanctions on 20 U.S. Companies, Bitcoin Falls

According to a Bloomberg report, China announced sanctions against 20 U.S. defense companies and 10 executives, a move that signals its anger over the U.S. weapon sales to Taiwan. Boeing, Northrop, L3Harris Maritime Services, and Vantor are among the companies that the Chinese Foreign Ministry announced it is sanctioning.

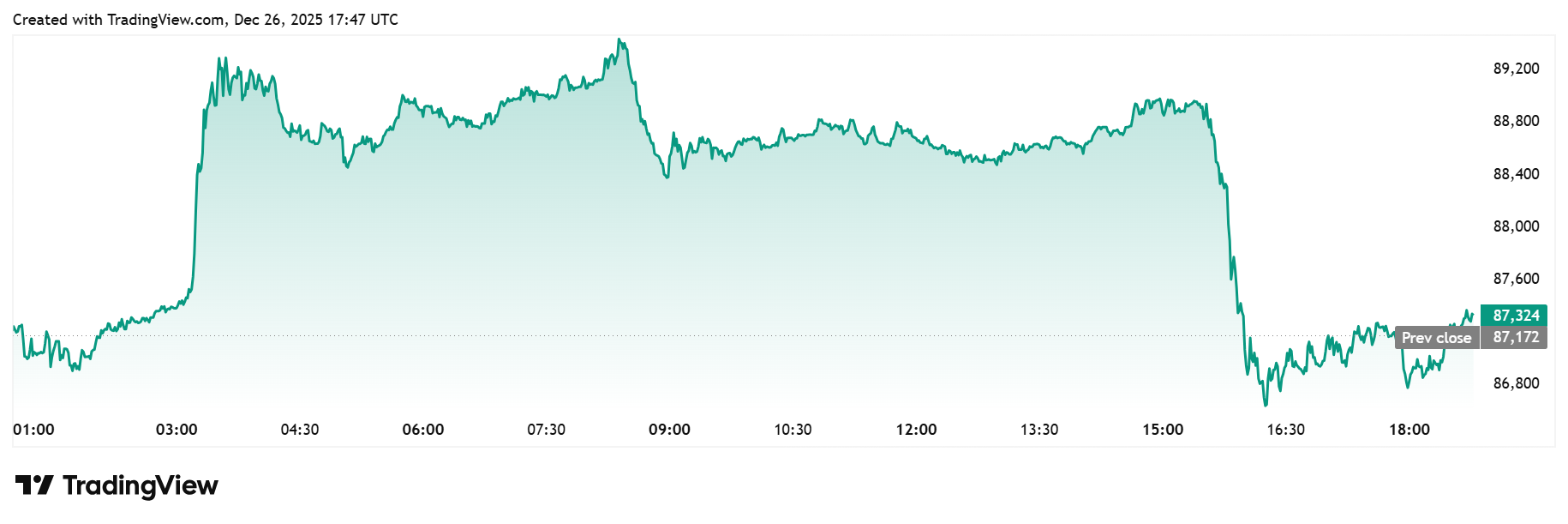

As part of the sanction, China will freeze assets that the companies hold in the country and also ban them from doing business with Chinese entities. The BTC price has fallen amid this development, with TradingView data showing the flagship crypto is currently trading around $87,000, down from an intraday high of around $89,000.

Meanwhile, China had described the U.S. arms sales to Taiwan as being “large-scale” after the U.S. State Department revealed last week that the Trump administration had approved a package worth up to $11 billion. “Any provocative actions that cross the line on the Taiwan issue will be met with a forceful response from China. Any enterprise or individual involved in arms sales to Taiwan will pay the price for their misguided actions,” a Foreign Ministry spokesperson said.

The U.S.-China Relations Impact On The Market

Notably, U.S.-China relations have been a market highlight this year, especially after Trump first imposed reciprocal tariffs on “Liberation Day” in April. The top two economies had first gone back and forth with reciprocal tariffs, which negatively impacted Bitcoin and the broader crypto market.

It is worth mentioning that Trump’s threat of a 150% tariff in October was one of the catalysts that led to the infamous October 10 crypto market crash. However, these trade tensions have since cooled off after the U.S. and China reached a one-year trade truce.

Prior to China’s latest sanctions on U.S. companies, BTC has failed to rally even as other major assets, including stocks and precious metals such as gold, reach new highs. This continues to add to concerns that Bitcoin and the broader crypto market may already be in a bear market, with crypto prices at risk of further decline.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Vitalik Buterin Maps Out Quantum Risks as Ethereum Foundation Unveils ‘Strawmap’

- BlackRock Adds $289M in BTC as Bitcoin ETFs Log 2-Week High Inflows Of $500M

- Glassnode Signals Bitcoin Still Faces Downside Risk Amid Massive Sell Pressure at $70K

- U.S House Introduces Bipartisan Crypto Bill To Protect Crypto Developers Amid DeFi Push Under CLARITY Act

- XRP News: Ripple Unveils Funding Hub To Support Innovation On XRPL

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs