Breaking: U.S. CPI Comes In Lower Than Expectations, Bitcoin Rises

Highlights

- The CPI inflation data came in lower than expectations.

- Bitcoin rose above $111,000 on the back of the data release.

- Traders are now pricing in two more Fed rate cuts this year.

The U.S. CPI inflation data came in below expectations, increasing the odds of two more rate cuts this year. Bitcoin rose on the back of the data release, seeing as the Fed could make another rate cut at the upcoming FOMC meeting next week.

CPI Inflation Data Rises To 3% Year-On-Year, Bitcoin Surges

Bureau of Labor Statistics (BLS) data shows that the U.S. inflation data for September rose to 3% year-on-year (YoY), which was below expectations of 3.1%. The monthly CPI came in at 0.3%, below the expectations of 0.4%.

Meanwhile, the Core CPI rose to 3% YoY, below expectations of 3.1% and 0.2% month-on-month (MoM), below the expectation of 0.3%. This again indicates that inflation remains steady amid the Fed’s concerns over rising inflation.

This data release comes despite the U.S. government shutdown. As CoinGape reported, the BLS had rescheduled the inflation data release from October 15 to today due to the shutdown, while mentioning that this was the only data they would release during the shutdown.

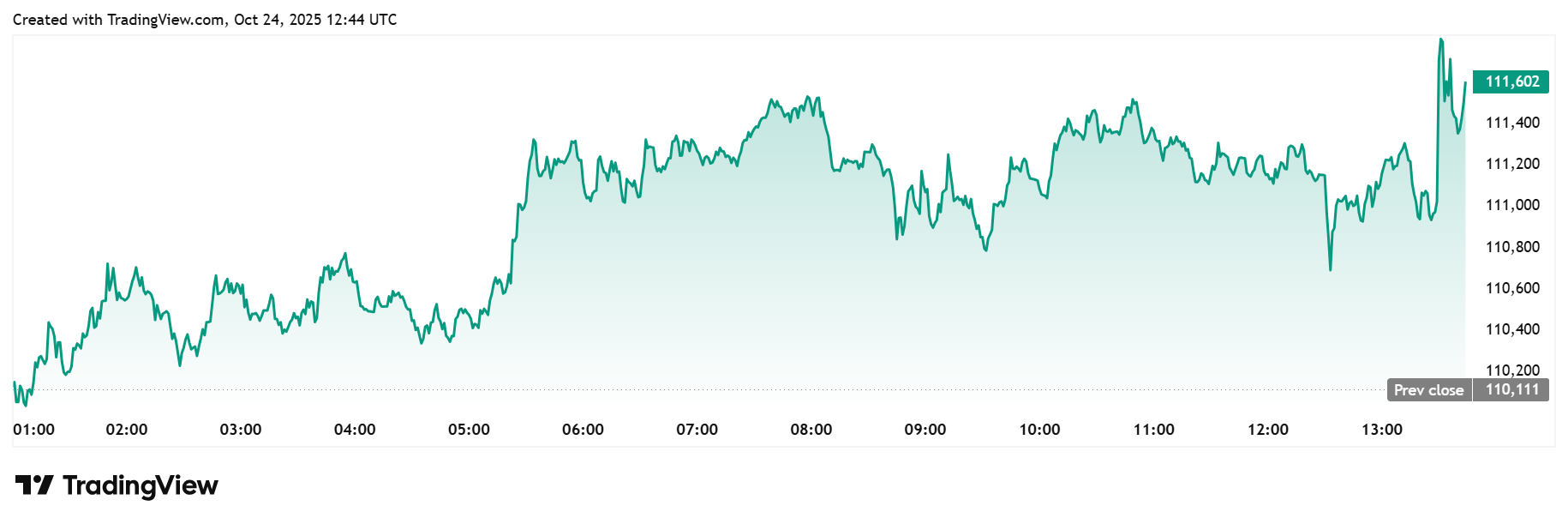

The CPI inflation data has provided a boost for the crypto market, with the Bitcoin price rising on the back of the data release. TradingView data shows that the flagship crypto sharply broke above $111,000 following the data release.

Notably, the crypto market had surged earlier in the day as market participants awaited the inflation data. Factors such as Trump’s confirmed meeting with China’s President Xi Jinping had also contributed to the market rally earlier today.

Now, the CPI data has further contributed to this bullish momentum. This comes as traders price in another Fed rate cut at next week’s FOMC meeting, with the committee likely to lower rates by 25 basis points (bps).

Odds Of Two More Rate Cuts Rise

CME FedWatch data shows that there is currently a 98.9% chance that the Fed will lower rates by 25 bps. Fed Governor Stephen Miran has advocated for a 50 bps rate cut, but that looks unlikely to happen.

Meanwhile, the soft CPI inflation data also increased the odds of another 25 bps Fed rate cut at the December FOMC meeting. There is currently a 94.5% chance that the Fed will lower rates by 25 bps at that meeting.

The potential Fed rate cut next week is believed to be priced in and may not have as much impact on crypto prices. Notably, BTC had surged to a new all-time high (ATH) above $120,000 earlier in the month as the market priced in the rate cut.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Ripple Could Gain Access to U.S. Banking System as OCC Expands Trust Bank Services

- $2T Barclays Explores Blockchain For Stablecoin Payments and Tokenized Deposits

- Breaking: U.S. PPI Inflation Rises To 2.9%, BTC Price Falls

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Bitwise CIO Calls Bitcoin Selloff ‘Classic Cycle,’ Dismisses Manipulation Rumors

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs