Breaking: U.S. Jobs Data Comes In Below Expectations, BTC Price Spikes

Highlights

- Nonfarm payroll came in at 22,000, way below the forecast of 75,000.

- The Bitcoin price has climbed from an intraday low of around $109,300.

- Traders are now pricing in a 50 bps rate cut.

The August U.S. jobs data again shows that the labor market is weakening, with the figure coming in way below expectations. This provides a bullish outlook for the BTC price and the broader crypto market as traders price in Fed rate cuts.

U.S. Job Data Comes In Weak, BTC Price Rises

Bureau of Labor Statistics data shows that the U.S. economy added only 22,000 jobs in August, way below the forecast of 75,000 and also below the 79,000 recorded in July. Meanwhile, the unemployment rate rose to 4.3% in line with expectations.

This U.S. job data indicates that the labor market is weakening, which is usually bullish for the BTC price and other crypto assets, as the Fed needs to step in and lower rates. TradingView data shows that the flagship crypto spiked on the back of the data release, reaching as high as $112,900 on the day.

Bitcoin has climbed from an intraday low of around 109,300 ahead of the U.S. jobs data release in anticipation of a weak report. However, BTC is now looking to rally higher with the nonfarm payrolls figure coming in way below expectations.

Fed Chair Jerome Powell had already signaled that they might have to lower rates at the next FOMC meeting, with the downside risk to the labor market rising. The market was already pricing a 25-basis-point (bps) rate cut before now, but with the jobs data, there is now the possibility of the Fed cutting rates by 50 bps.

Traders Begin Pricing In 50 Bps Rate Cut

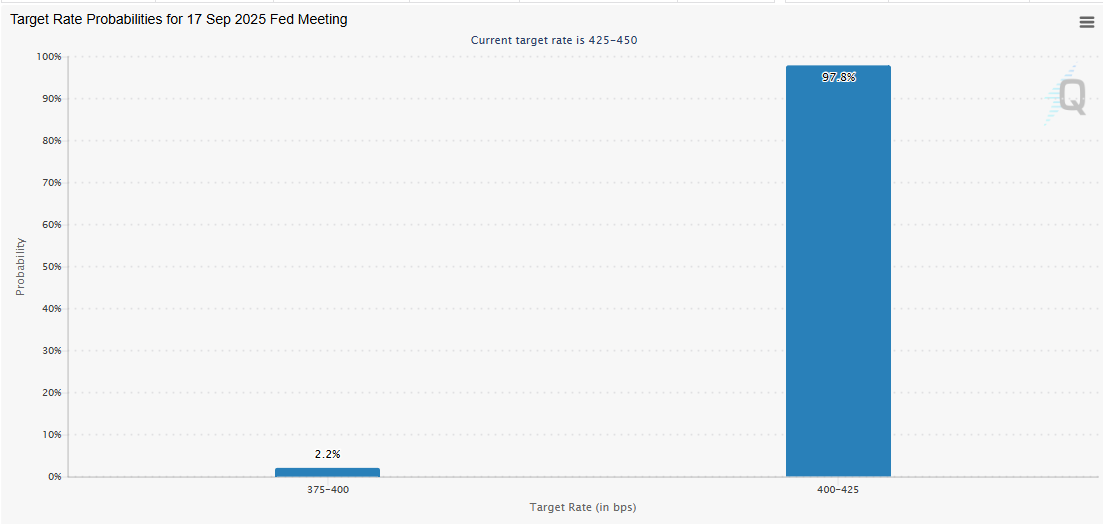

CME FedWatch data shows that traders are now pricing in the possibility of the Fed making a 50 bps rate cut at the September FOMC meeting. There is currently a 2.2% chance of that happening, down from zero before the U.S. jobs data release.

Meanwhile, there is a 97.8% chance that the Fed will make a 25 bps rate, meaning that traders do not envisage the Fed keeping rates steady at the meeting. Now, all eyes will be on the CPI and PPI data, which will be released next week. The odds of a 50 bps rate cut could rise if the inflation data comes in line or below expectations.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Democrats Convene US Senate Crypto Bill Meeting as a16z Briefs Republicans on CLARITY Act & AI

- After 820% Gains: Privacy Coins Evolve into Payment Rails

- Bitcoin Price Rebounds as Jane Street “10 am Dump” Pattern Stops Amid Lawsuit

- US OCC Proposes Rule to Implement GENIUS Act & Prohibits Stablecoin Yield

- ETHZilla Abandons Ethereum, Rebrands as Forum to Focus on RWA Tokenization

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

- COIN Stock Price Prediction as Wall Street Pros Forecast a 62% Surge

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

Buy Presale

Buy Presale