Breaking: U.S. PCE Inflation Comes In At 2.8% YoY, Bitcoin Reacts

Highlights

- The PCE inflation data rose to 2.8% in November, in line with expectations.

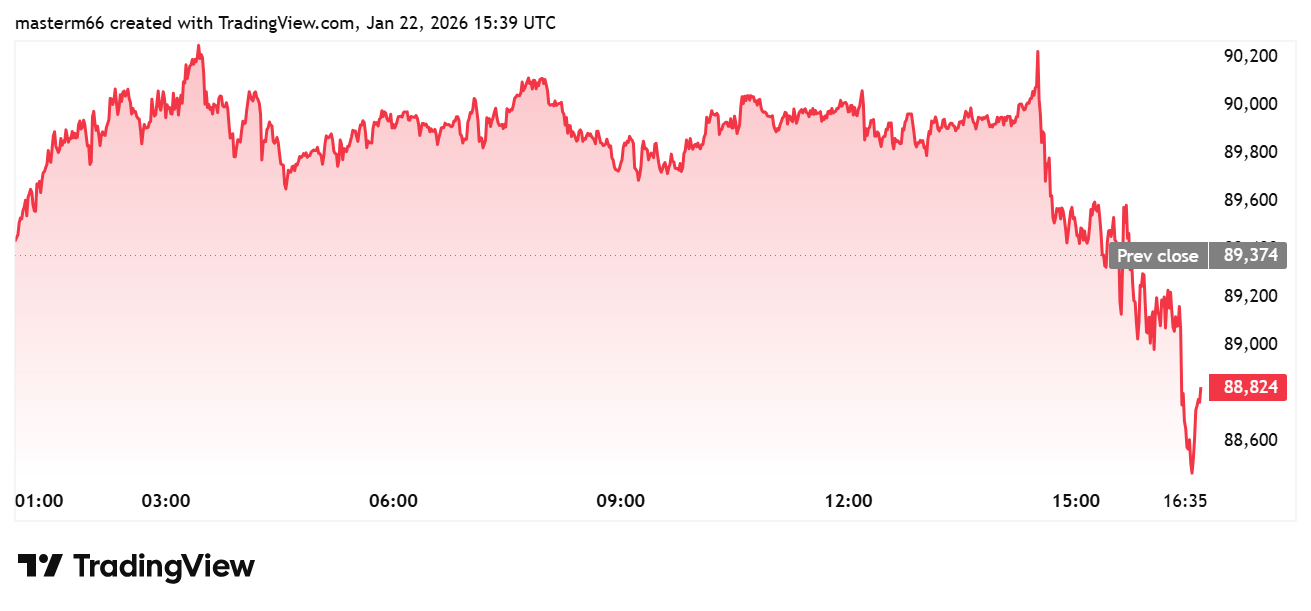

- Bitcoin dropped below $89,000 amid the inflation data release.

- Expectations on Fed rate cuts this year have dropped following the macro data release today.

The U.S. PCE inflation data have come in line with expectations, signaling that U.S. inflation remains elevated. Bitcoin reacted to the inflation data release, with the flagship crypto down on the day.

U.S. PCE Inflation Matches Estimates, Bitcoin Weakens

Bureau of Economic Analysis data shows that the November PCE came in at 2.8% year-over-year (YoY), in line with expectations. Month-over-Month (MoM), inflation rose to 0.2%, also in line with expectations.

The Core PCE inflation data also had similar readings in November, coming in at 2.8% YoY and 0.2% MoM, both in line with expectations. This signals that U.S. inflation remains elevated, strengthening the case for the Fed to hold rates at the January FOMC meeting next week.

The Fed is expected to hold rates steady after cutting rates three times last year. According to CME FedWatch data, there is a 95% chance they will hold rates steady.

The PCE inflation data release follows the PPI release, which also indicated that U.S. inflation remains elevated. The PPI rose 3% YoY in November, above expectations of 2.7%. Some Fed officials, such as Fed President Austan Goolsbee, have continued to raise concerns that inflation remains well above their 2% target.

Meanwhile, Bitcoin has further dropped following the release of this latest inflation data. At press time, the flagship crypto is trading at around $88,900, down from an intraday high above $90,000. BTC notably dropped from $90,000 earlier in the day following the release of the U.S. GDP and jobless claims data.

These macro data further dampen hopes of a Fed rate cut happening anytime soon. As CoinGape reported, the first Fed rate cut is now expected to come at the June FOMC meeting. The odds of the Fed making three rate cuts this year have dropped to 27%, according to Polymarket data.

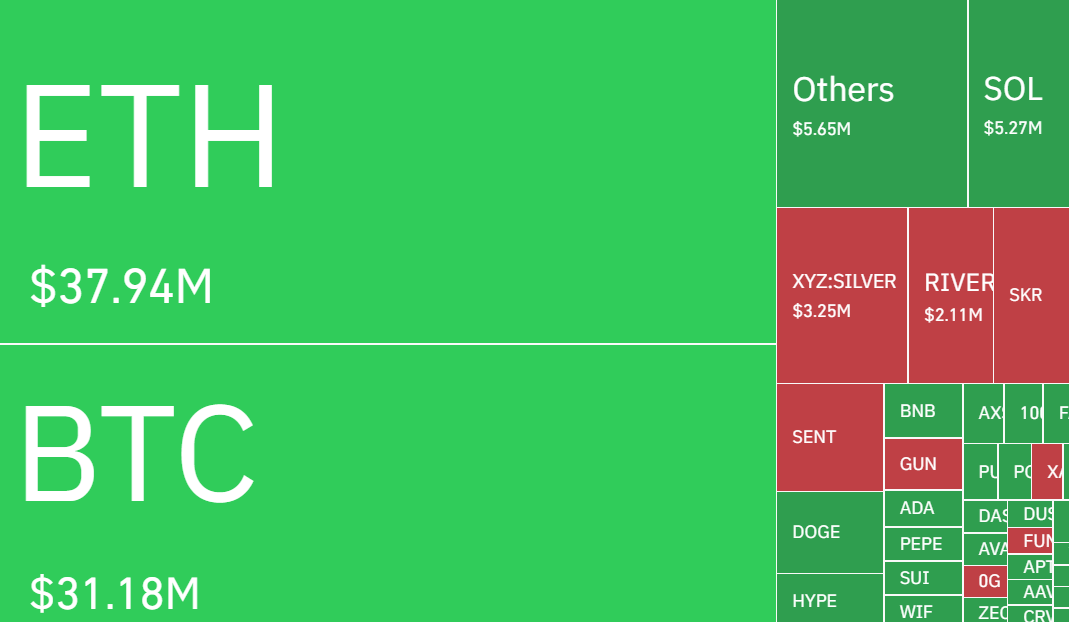

Bitcoin Liquidations Rose

The volatility in the futures markets was affected after the publication of the PCE inflation figures. According to the data provided by CoinGlass, around $101.9 million worth of positions had been liquidated during the last four hours.

Long positions recorded the highest amount in this window as an estimated amount of $83.2 million worth of those positions were wiped off. This was against the $18.7 million in short liquidations.

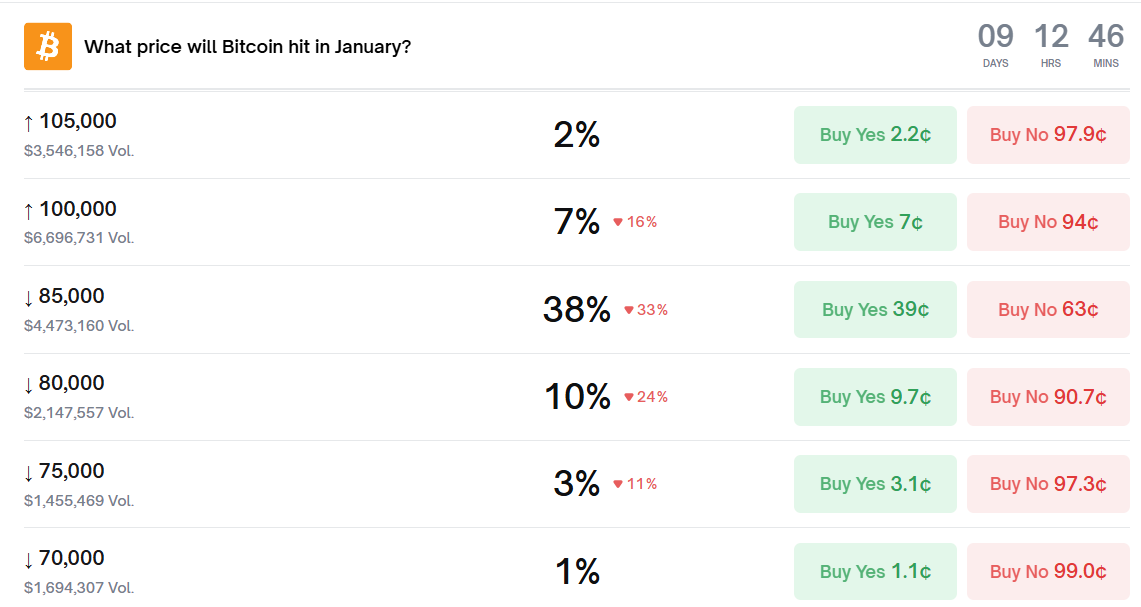

Data from Polymarket indicates that traders place only a 7% probability of Bitcoin rising to $100,000 in January. On the other hand, the odds of BTC remaining in the $85,000 level is the highest at 36%. Still, the Polymarket statistics indicate that there is a 10% probability that the BTC price will drop to $80,000.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Schiff Predicts BTC to Fall, Gold to Rise as Markets Price in Prolonged Iran War

- Institutional Re-Accumulation Signs Emerge as Bitcoin ETFs See $1.1B Net Inflows Since Iran War Began: Glassnode

- From Mining Pool to Infrastructure Platform: Nine Years of EMCD

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs