Breaking: U.S. PCE Inflation Rises To 2.7% YoY, Bitcoin Bounces

Highlights

- The U.S. PCE and Core PCE all came in with expectations.

- This still suggests that inflation is still sticky.

- Bitcoin rose above $109,000 following the report release.

The August U.S. PCE inflation data has dropped in line with expectations, although it suggests that inflation remains sticky and way above the Fed’s 2% target. Bitcoin quickly rose on the back of the data release, but has already lost some of these gains.

PCE Inflation Rises In Line With Expectations, Bitcoin Rises

Bureau of Economic Analysis data shows that the PCE index rose to 2.7% year-over-year (YoY) and 0.3% month-over-month (MoM), both in line with expectations. The Core PCE index rose to 2.9% and 0.2%, both also in line with expectations.

However, the YoY August PCE inflation is an increase from the 2.6% in July, while the Core PCE remains the same from July. Notably, PCE is at its highest level since February earlier this year.

The PCE inflation data strengthens the case that Jerome Powell and some Fed officials made earlier this week, as they warned about rushing to make further rate cuts due to rising inflation. Meanwhile, despite this development, the Bitcoin price, which has been on a decline, sharply bounced on the back of the data release.

TradingView data shows that BTC broke above $109,000 and is now trading just under $109,500. The flagship crypto had earlier in the day dropped to as low as $108,713. The inflation data undoubtedly still puts it and the broader crypto market at risk of a further decline.

Impact On Further Rate Cuts This Year

The PCE inflation data, which is the Fed’s preferred inflation gauge, is the first major macroeconomic data to drop since the Fed made the first rate cut of the year last week. Attention will now turn to the upcoming PPI, CPI, and jobs data, which would also influence the next rate cut decision at the October FOMC meeting.

In the meantime, Fed officials look divided on whether to make further rate cuts or not to end the year. While officials like Powell have lowered expectations of more cuts, others, such as Michelle Bowman and Stephen Miran, are actively advocating for more cuts due to the softening labor market.

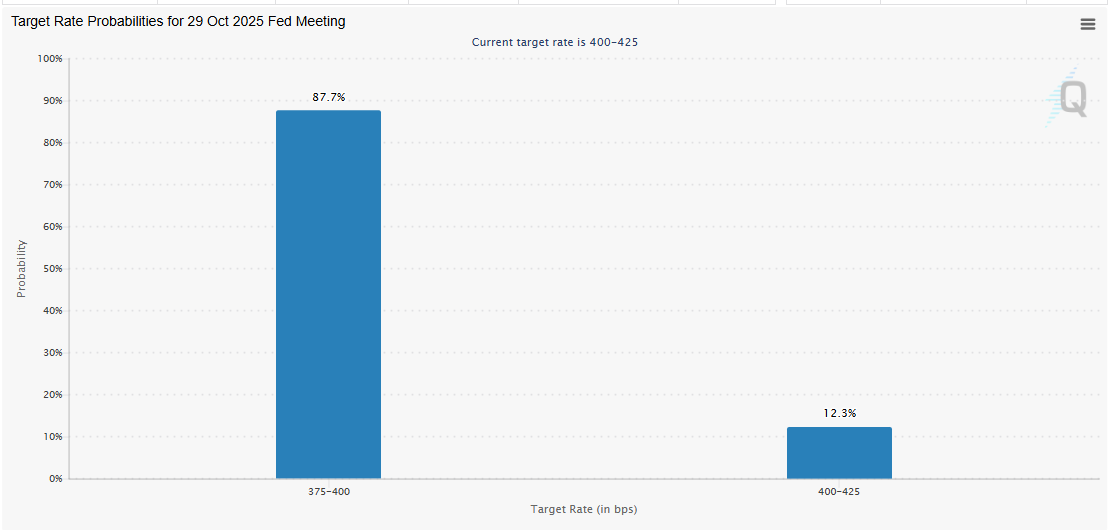

The odds of a 25 basis points (bps) Fed rate cut in October have remained steady following the PCE inflation data release. There is currently an 87.7% chance that the Fed will lower rates at the next FOMC meeting. Meanwhile, there is a 12.3% chance that the Fed will keep the benchmark rate unchanged.

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise