Uniswap Price Eyes Recovery As Whale Bags $16M UNI From Binance

Highlights

- Uniswap price eyes recovery as a whale buys $16M UNI recently.

- Uniswap v4 records a massive reduction in gas fees as compared to v3.

- UNI price was down 3% today but technical trends hint at a breakout ahead.

Uniswap price has continued to stay in the red, hovering around the $9 mark, but recent developments indicate a strong recovery ahead. For context, whales or large investors have bagged nearly $16 million UNI over the past few days, signaling a strong confidence of the investors. Besides, the recent launch of Version 4 (v4) has also fueled optimism, positioning the decentralized exchange (DEX) for a strong performance ahead.

Uniswap Price Eyes Recovery Amid Massive Whale Buying

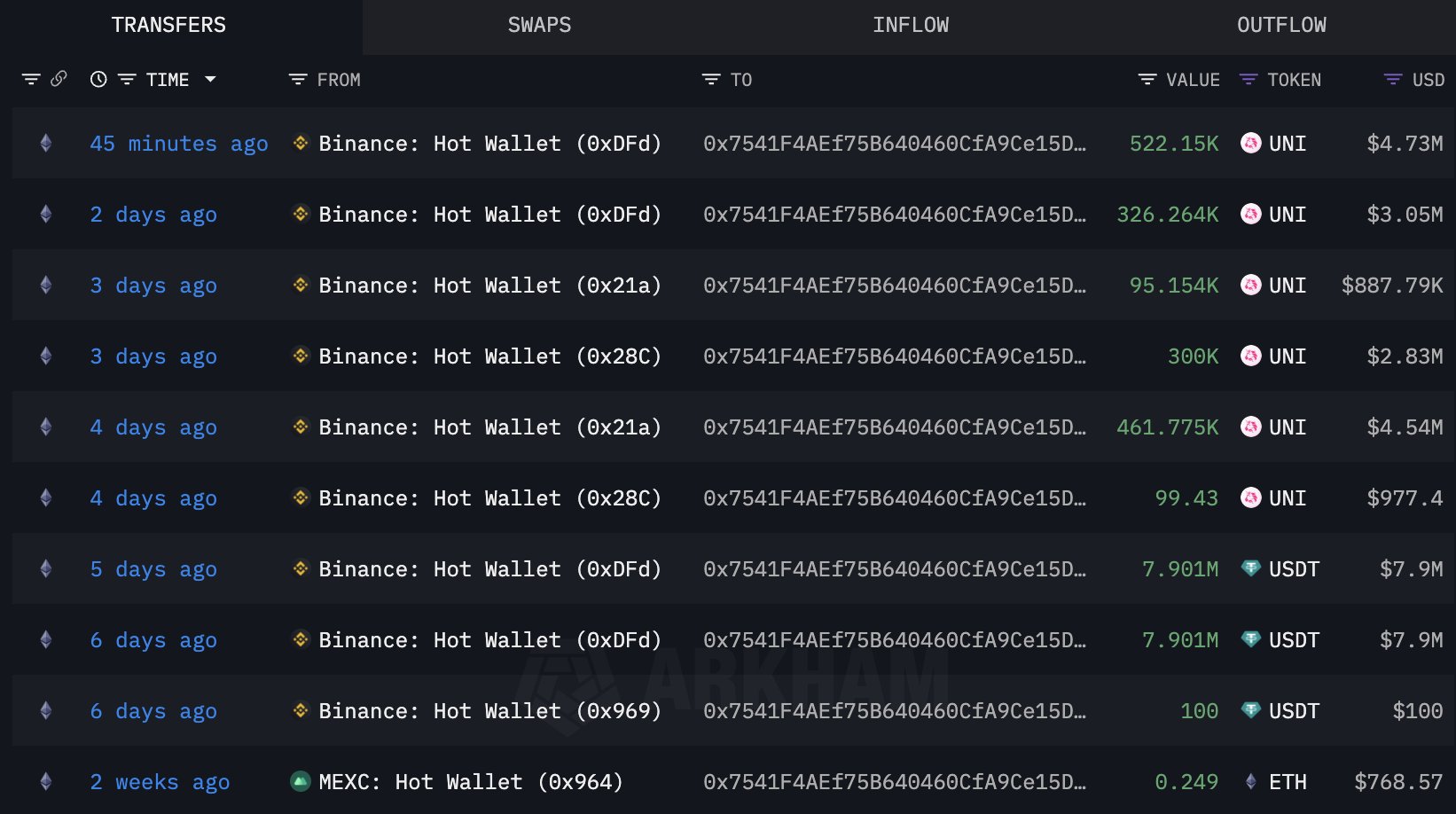

Investor sentiment toward Uniswap has seen a boost following a significant whale accumulation. According to on-chain data from Lookonchain, a UNI whale withdrew approximately 1.7 million tokens, valued at $15.54 million, from Binance over the past four days.

Such substantial acquisitions typically signal confidence among high-net-worth investors, often leading to positive price movements. Historically, whale movements have played a crucial role in influencing market trends, and this latest accumulation hints at a possible UNI price recovery. Having said that, it appears that the crypto is gearing up for a strong recovery ahead.

Besides, it appears that updates from these big exchanges also spark discussions in the market. For instance, Binance has recently revealed support for Berachain, triggering a massive surge in BERA price.

Uniswap v4 Launch Sparks Optimism

Adding to the bullish outlook, Uniswap recently launched its much-anticipated version 4 (v4) on January 31. The new upgrade introduces cost-efficient and customizable trading features, setting a new benchmark for decentralized exchanges.

The v4 version is now available on major networks, including Ethereum, Polygon, Arbitrum, Base, BNB Chain, Avalanche, and others. The platform revealed in a post on X that liquidity providers can now access the web app, with swapping capabilities rolling out soon. Meanwhile, with prior versions processing over $2.75 trillion in trading volume without security breaches, the latest iteration is expected to drive even higher engagement.

Gas Efficiency In Focus

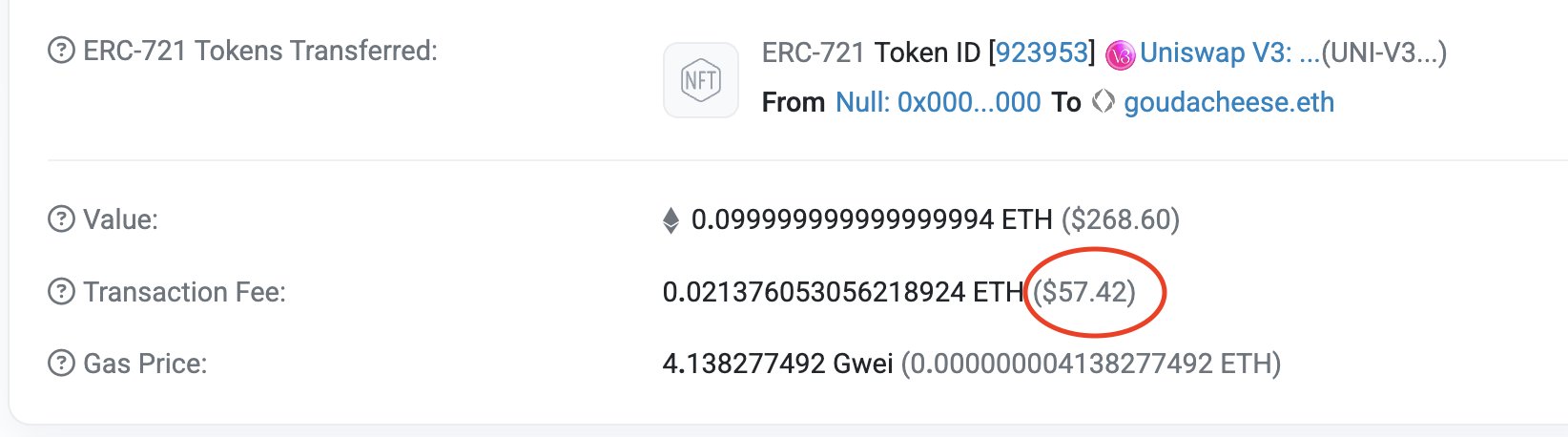

Uniswap Labs CEO Hayden Adams underscored the platform’s efficiency by comparing gas fees between v3 and v4. He revealed that creating a v3 pool on Ethereum Mainnet required 5,165,447 gas ($57.42), while the same action on v4 consumed just 431,860 gas ($4.63).

This significant reduction in gas costs makes the v4 a cost-effective choice for traders and liquidity providers. Lower transaction fees could also attract new users to the DEX, further strengthening its market position.

What’s Next For Uniswap Price?

Despite the Uniswap whale accumulation and other positive trends, UNI price today was down nearly 3% and exchanged hands at $9.15. Its one-day trading volume soared 5% to $223.17 million. However, the UNI Relative Strength Index was at 33, signaling the token is in an oversold condition.

Notably, this oversold indicator often signals a strong recovery ahead, as investors often take the opportunity to buy the dip. Having said that, With the UNI whale accumulation, v4 rollout, and increased gas efficiency, the UNI price is poised for a potential uptrend. If investor sentiment remains strong, the token could break past its current resistance levels and regain momentum.

- Trump’s Board Of Peace Eyes Dollar-Backed Stablecoin For Gaza Rebuild

- Trump’s World Liberty Financial Flags ‘Coordinated Attack’ as USD1 Stablecoin Briefly Depegs

- Trump Tariffs: U.S. Threatens Higher Tariffs After Supreme Court Ruling, BTC Price Falls

- Fed’s Chris Waller Says Support For March Rate Cut Will Depend On Jobs Report

- Breaking: Tom Lee’s BitMine Adds 51,162 ETH Amid Vitalik Buterin’s Ethereum Sales

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?