Upbit To Suspend Deposit and Withdrawal of Crypto Exceeding 1 Million Won

Highlights

- Upbit to suspend deposits and withdrawals of digital assets of 1 million won for Ten&Ten.

- The move comes in response to suspension of use and termination of Ten&Ten's Travel Rule Solution service.

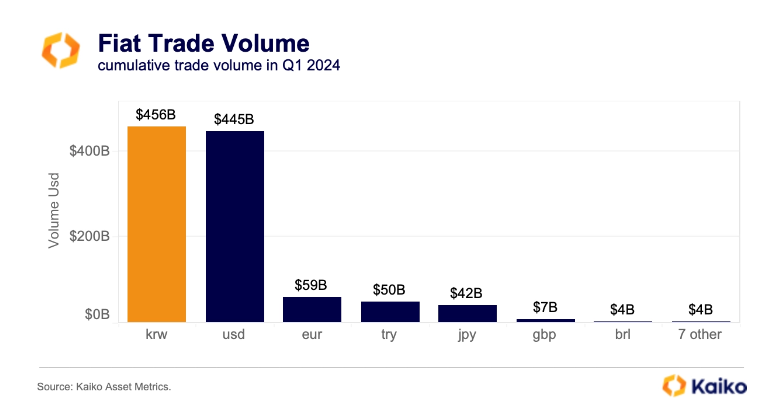

- South Korean Won (KRW) overtook the US Dollar (USD) in terms of crypto trading volume in Q1.

Upbit, South Korea’s largest crypto exchange and one of the top 10 crypto exchanges globally, on Wednesday said it will suspend deposits and withdrawals of digital assets of 1 million won (approx $721). The move comes in response to changes to the virtual asset service provider (VASP) Ten&Ten, one among the providers of deposits and withdrawals of 1 million won or more.

Upbit Suspending Crypto Deposits and Withdrawals

Crypto exchange Upbit announces suspension of deposits and withdrawals of digital assets of 1 million won and above for Ten&Ten, as per a notice on April 17.

The suspension of use and termination of Ten&Ten’s Travel Rule Solution service is the reason behind Upbit’s suspension of deposits and withdrawals of more than 1 million won. The Ten&Ten exchange services stopped transaction support on April 15 and the last date to withdraw crypto assets is April 22 at 10:00 KST.

The virtual asset service provider (VASP) Ten&Ten helped the crypto exchange offer crypto deposits and withdrawals of over 1 million won. Other VASPs that allow deposits and withdrawals over 1 million won are Bblock, Gopax, FlatExchange, Aprobit, Prabang, Borabit, BTX, Flybit, Foblegate, Bithumb, Coinone, Korbit, Coredocs, GDAC, Hanbitco, Qbit, Korea Digital Asset Trust (KDAC), Oasis Exchange, Cardo, Bikmon.

Also Read: Ripple Vs SEC Lawsuit: Ripple CLO Cools Down Settlement Debates, XRP Price Reverses

Korean Won Fiat Trade Volume Exceeds USD

South Korean Won (KRW) overtook the US Dollar (USD) in terms of crypto trading volume in Q1. Kaiko data revealed that transactions on centralized cryptocurrency exchanges involving the Won exceeded $456 billion. This narrowly edges out the cumulative trading volume of the US Dollar, which posted figures around $455 billion.

The largest centralized crypto exchanges in South Korea are Upbit, Bithumb,, Coinone, and Korbit. This indicates the major crypto exchange volumes globally come from South Korea as crypto prices rally in this bull cycle. Spot and derivatives trading volumes also are increasing from South Korea in April as crypto adoption rises amid crypto-friendly trading environment in the country.

Also Read: Bitcoin ETF Outflows Hit $58 Million, GBTC Outflows Slow Down

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Hong Kong Moves Closer to Crypto Tax Cuts Amid Stablecoin Regulatory Framework

- Popular Analyst Willy Woo Predicts Major Bitcoin Price Crash, Bear Market Bottom Timeline

- Vitalik Buterin Maps Out Quantum Risks as Ethereum Foundation Unveils ‘Strawmap’

- BlackRock Adds $289M in BTC as Bitcoin ETFs Log 2-Week High Inflows Of $500M

- Glassnode Signals Bitcoin Still Faces Downside Risk Amid Massive Sell Pressure at $70K

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs