Breaking: U.S. Core PCE Inflation Surges 4.7%, More Interest Rate Hikes Ahead?

Inflation in the United States, as measured by the Personal Consumption Expenditures (PCE) Price Index, increased to 5.4% on a yearly basis in January from 5.3% in December. This comes following the announcement released by the U.S. Bureau of Economic Analysis. The number came in higher than the 4.9% that was anticipated by market participants.

Core PCE Inflation Rises 4.7%

On Friday, the preferred inflation gauge used by the Federal Reserve flashed a negative reading once again, adding to the growing body of evidence suggesting that interest rates will need to be increased in the near future in order to bring prices back under control. The annual Core PCE Price Index, which is the preferred gauge of inflation, increased to 4.7% from 4.6% in the same period, which is significantly more than the projection of 4.3% that was made by analysts. Both core PCE inflation and overall PCE inflation increased by 0.6% on a month-to-month basis.

Read More: Check Out The Top 10 DeFi Lending Platforms Of 2023

This meant that the core rate of PCE inflation rose for the first time in four months, to 4.7%, which is still significantly higher than the 2% objective that the Fed has set. The findings add to concerns that the Federal Reserve may need to maintain higher interest rates for a longer period of time in order to stem the tide of rising prices.

Market Reactions

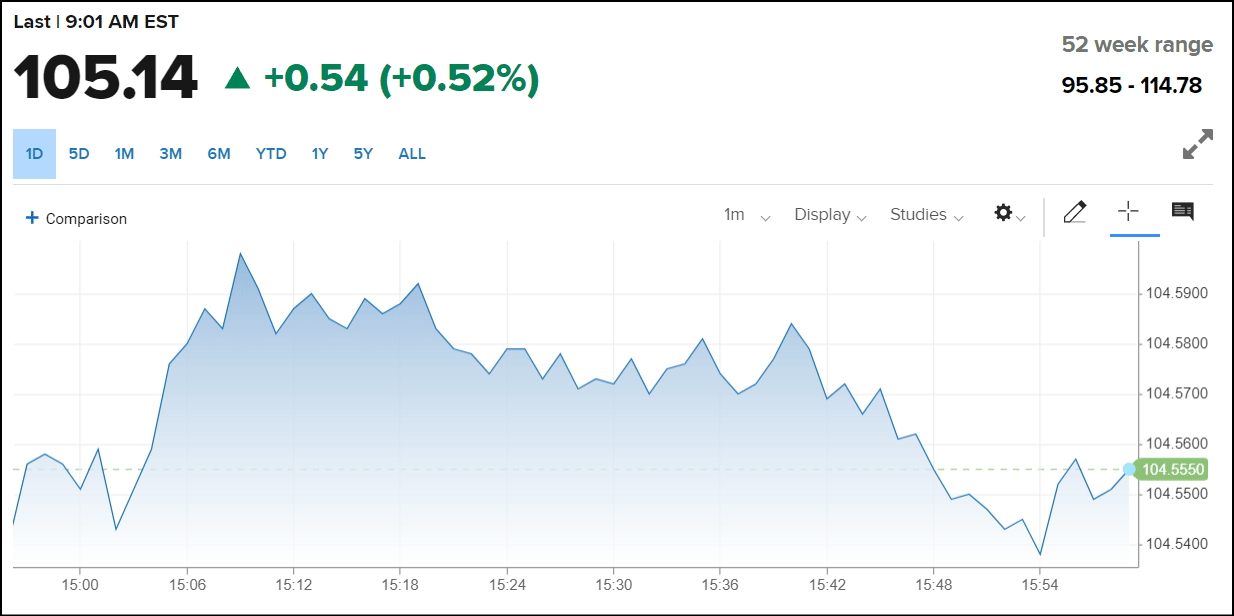

The news was met with a dismal response from the U.S. financial markets, and investors swiftly adjusted their forecasts for future official interest rates. At the time of publishing, the yield on the benchmark 2-year Treasury note–which is a rough proxy for Fed forecasts–has risen by 7 basis points to a level of 4.77%, which was the highest level it had been since October. The dollar index also rose by 0.52% to 105.14, marking a new high for the period of seven weeks. This indicator compares the value of the US dollar to a group of currencies from developed markets. In the meantime, S&P 500 futures had a loss of more than 1.3%, while the Dow futures dropped more than 300 points following the hot inflation report.

On the other hand, the crypto market has witnessed a significant dump across cryptocurrencies. Bitcoin (BTC), the flagship digital asset and the one with the largest market capitalization, is presently trading at $23,750. BTC’s price reflects a decline of 0.61% over the last one hour and a decline of 2% over the course of the past 24 hours. Coming second to Bitcoin, Ethereum’s (ETH) price is maintaining its position at $1,634 at the time of writing.

Also Read: New AI Product Sparks Optimism For Hedera; Is HBAR Price Eyeing $1?

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- XRP News: XRPL Set to Add Options Trading for Investors Amid Major Upgrade

- Is World War III Near? Bitcoin Price Drops As UK, France, Germany Consider Iran Action

- Is Bitcoin Dead? Here’s What the Data Really Says

- US-Iran War: Meme Coin Market Plunges After Iranian Drone Hits US Embassy in Kuwait

- Arthur Hayes Sees 5x HYPE Token Rally as Oil Perps Pump on Hyperliquid Amid U.S.–Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs