Will U.S. CPI Data Help Bitcoin (BTC) Price Break This Key Resistance?

The modest crypto and stock market rally to start the new year will be put to test on Thursday when investors face the highly-anticipated U.S. inflation data. The CPI reading could very well play a role in determining the magnitude of the next interest rate increase that the Federal Reserve decides to implement. It is anticipated that the Consumer Price Index (CPI) reading, which will be released on January 12, would lend credence to the argument that inflation is fading, hence providing a potential opening for riskier assets, like Bitcoin.

CPI Data Of 6.5% Expected

According to prominent industry experts, the CPI for December is anticipated to show annual inflation at 6.5-6.6%, which would be a decrease from November’s reading of 7.1%. This data is seen as a significant marker for investors attempting to figure out the next market movements. In a telecasted interview on CNBC, Gilman Hill’s Jenny Harrington predicts a CPI of 6.6% which she thinks to “make sense” considering the broader market overview.

Harrington was further quoted as saying,

I don’t think that kind of reading triggers a spark that drives the market way up from here.

In addition, the CEO of Gilman Hill Asset Management pointed out that the earnings are likely not going to be particularly good, but the most important takeaway was that the 6.6% reading would set “a floor” in the market. This would give market participants the impression that the marketplace is most likely not going to further lows or highs, but that it would be just “okay.”

Read More: Will Bitcoin Price Pumps Ahead As BTC future ETFs Regain Attraction

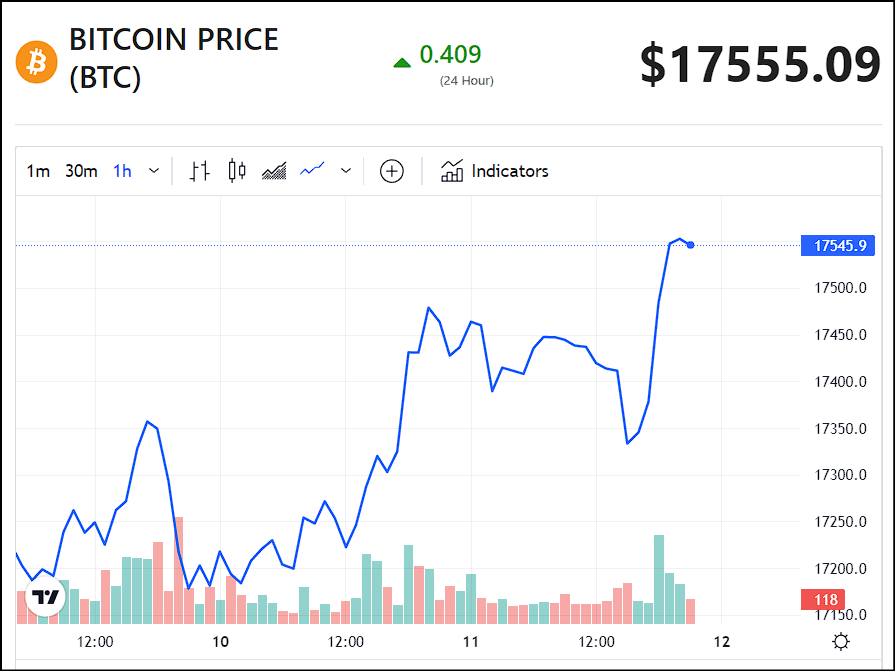

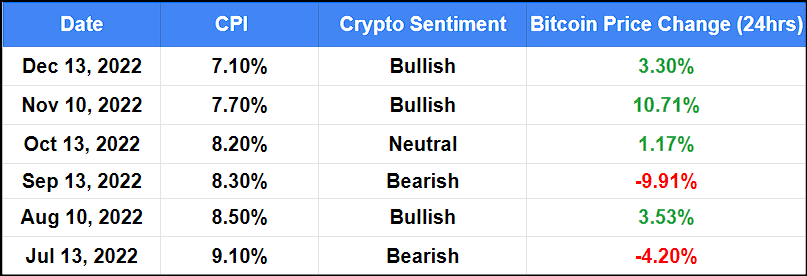

The Bitcoin (BTC) price made a fleeting but encouraging return to $17,500 overnight on January 11 as the newly found strength from the beginning of 2023 persisted. However, if Bitcoin’s change in price can be extracted from the most recent six CPI readings, it provides us with a clearer picture of how the market has reacted to the global macroeconomic data.

Bitcoin (BTC) Price Reaction

The release of the U.S. Consumer Price Index (CPI) on January 12 could make matters more difficult, particularly in the event that inflation exceeds expectations in a positive direction. Since the beginning of 2023, BTC’s price has been benefiting from a weaker U.S. Dollar. This is due to the fact that the U.S. Federal Reserve (Fed) is leaning toward a smaller interest rate hike of 25 basis points at its upcoming monetary policy meeting on February 1.

However, the flagship cryptocurrency is presently trading at a major resistance level, and the next CPI data is expected to play a significant part in determining the direction of the coin’s price in near future. According to crypto trading expert Credible Crypto, Bitcoin has reached a break-even point and has warned investors and traders alike to exercise caution in the crypto market.

Looks like we made it! Lots of relief on alts across the board but now is really the moment of truth with BTC at local supply. Going to get some sleep and will see how things look in the AM but have to urge caution here on the markets in general. $BTC https://t.co/sI2OHTMuVC pic.twitter.com/XJ7eOvbLX4

— CrediBULL Crypto (@CredibleCrypto) January 9, 2023

Complementing this, another popular Bitcoin evangelist & digital asset trader Johnny, who goes by the alias CryptoGodJohn on Twitter, cautioned on witnessing massive “bull tweeting as BTC sits under higher time frame resistance at $17,600″. He further argued that the CPI data could whipsaw the prices back to “where they were last week,”.

As things stand, the Bitcoin (BTC) price is currently being traded at $17,555. This represents an increase of 0.43% on the day, in contrast to a gain of 4.31% during the week, as per CoinGape’s crypto market tracker.

Also Read: Nearly $12 Billion Vanishes From Binance’s Assets; What’s Going On?

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Indiana Signs Bitcoin Bill Into Law Allowing Crypto in Retirement Plans

- ‘Time to Act Is Now’: CFTC Chief Pushes Swift Passage of CLARITY Act

- Trump Tells Congress to Pass Crypto Market Bill ‘ASAP,’ Blasts Banks for Stalling

- BTC Price Bounces as Spot Investors Buy The Dip Amid Iran War Jitters

- CFTC Chief Mike Selig Signals US Crypto Perpetual Futures Rollout in Coming Weeks

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs