US FED Injects $13.5B in Liquidity Overnight as QT Ends, Bitcoin & MSTR Stock React

Highlights

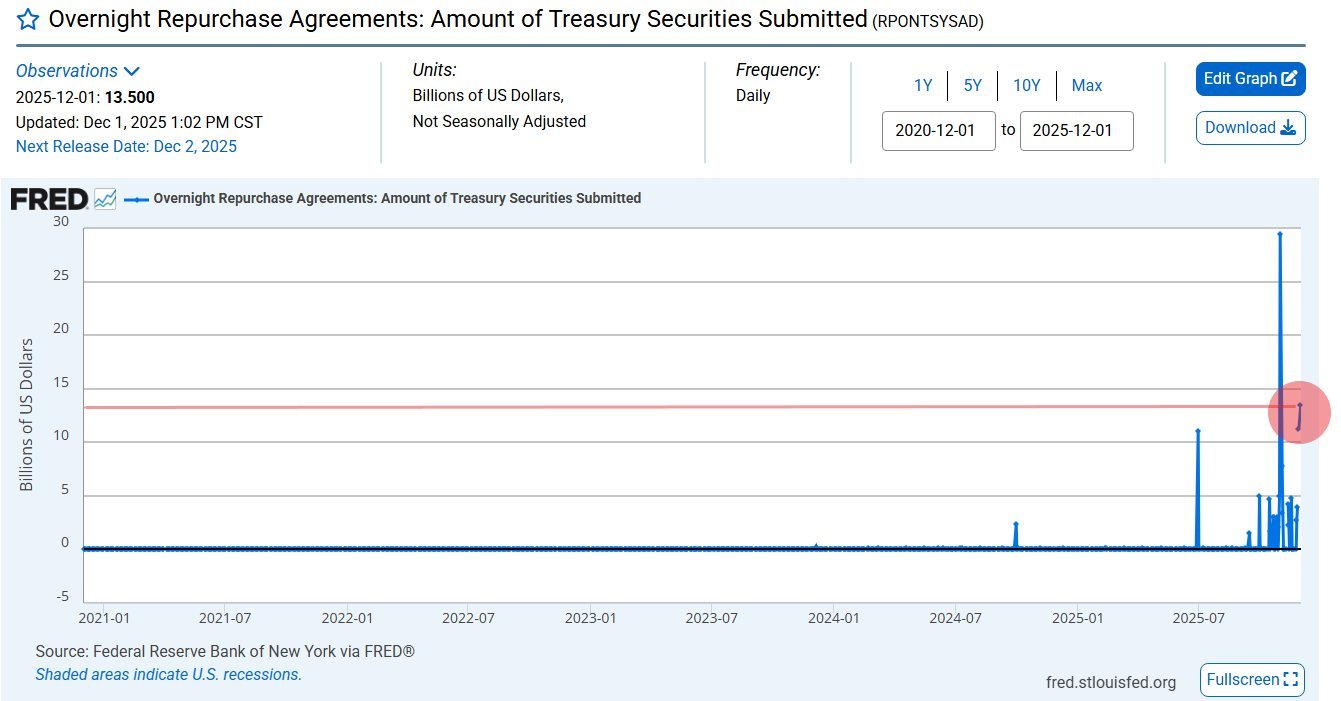

- US Federal Reserve (FED) injects $13.5 billion overnight into the financial system.

- This follows $25 billion in liquidity injection in the morning repo operation as QT ended.

- Bitcoin and MSTR stock saw cautious bounce ahead of next week's FOMC interest rate decision.

The US Federal Reserve (FED) injected $13.5 billion into the banking system through overnight repurchase agreements as quantitative tightening (QT) ended on Monday. This marks the second-largest liquidity injection since the Covid pandemic, triggering trading actions in Bitcoin and MSTR stock.

Massive Liquidity Pump by the US FED as Quantitative Tightening Ends

The U.S. Federal Reserve conducted a $13.5 billion overnight repurchase agreement (repo) operation on December 1, according to Federal Reserve Bank of New York data.

The massive liquidity injection is one of the largest in recent years, marking the second-biggest liquidity injection since 2020 and even exceeding the Dot Com Bubble in the early 2000s, according to Barchart.

Notably, this follows another $25 billion in liquidity injection in the morning repo operation. The collateral included $12.5 billion in treasuries and $12.5 billion in mortgage-backed securities.

On October 31, the FED injected $29.4 billion into the banking system to ease liquidity concerns, the largest liquidity pump since the Covid pandemic. Typically, this is bullish for risk assets like Bitcoin, but it revealed that banks were scrambling for short-term liquidity amid stress from the prolonged government shutdown.

The repo provides short-term funding for primary dealers and banks. Repo demand generally rises when liquidity is tight and balance sheets are stressed.

According to Lyn Alden, founder of Lyn Alden Investment Strategy, the condition echoes the September 2019 repo crisis when demand prompted the Federal Reserve to conduct emergency repo operations for months.

However, the repo operations happened as the Fed ended quantitative tightening, as crypto stocks, Bitcoin, and crypto assets saw massive declines. This raises questions over the timing of the liquidity injection.

Traders Respond to Bitcoin and MSTR Stock

Traders reacted immediately to the Fed liquidity injection, causing a slight cautious rebound in Bitcoin as they await cues from economic events ahead of next week’s FOMC interest rate decision.

BTC price jumped 2% over the past 24 hours following a drop $83,862. The price is currently trading at $86,900, with an intraday high of $87,325. Furthermore, trading volume has further increased by 13% in the last 24 hours, indicating a rise in interest among traders.

Meanwhile, MSTR stock has bounced 0.68% during the pre-market trading hours. Strategy stock closed 3.25% lower at $171.42 on Monday due to a panic selloff in the crypto market. The firm also purchased $11.7 million in Bitcoin, bringing its total holdings to 650,000 BTC.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Senator Elizabeth Warren Targets Trump-Affiliated World Liberty Financial Over Bank Charter Bid

- JPMorgan Projects Bullish Crypto Market in H2 Following CLARITY Act Approval

- Hong Kong Moves Closer to Crypto Tax Cuts Amid Stablecoin Regulatory Framework

- Popular Analyst Willy Woo Predicts Major Bitcoin Price Crash, Bear Market Bottom Timeline

- Vitalik Buterin Maps Out Quantum Risks as Ethereum Foundation Unveils ‘Strawmap’

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs