US Fed Prints $400 Billion, Bitcoin Price and Ethereum Set To Rally

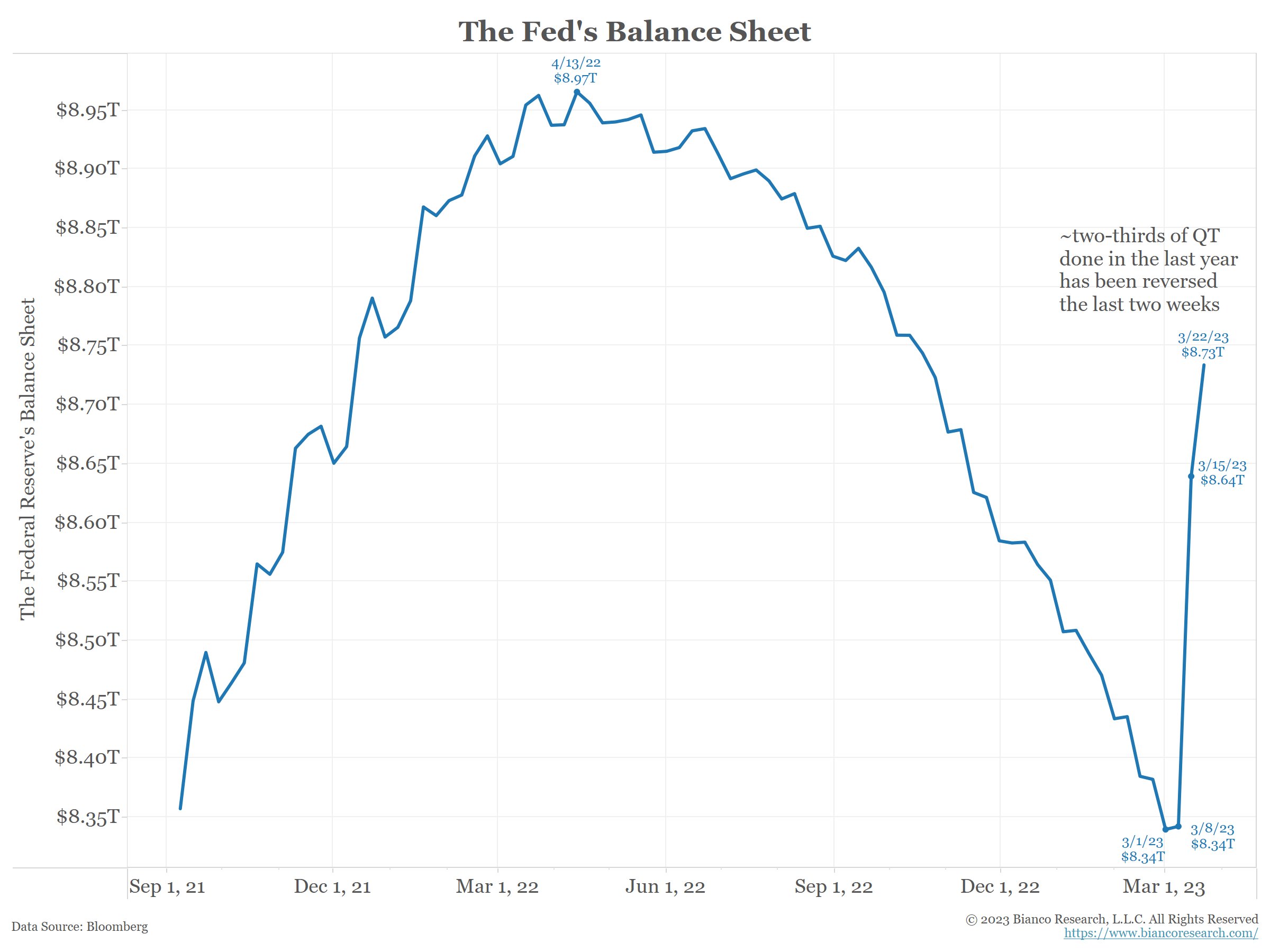

The U.S. Federal Reserve balance sheet rises almost $100 billion this week, taking the total to $400 billion. The central bank continues to print more money for rescuing cash-strapped banks since the collapse of Silvergate, Silicon Valley Bank, and Signature Bank. Bitcoin and Ethereum prices have soared higher as a result, with the crypto fear and greed index rising to 61.

US Banks borrowed a combined $163.9 billion from the U.S. Federal Reserve, against $164.8 billion in the earlier week. Borrowing rates by banks have increased after the Fed raised interest rates by another 25 bps to 4.75%-5% and Treasury Secretary Janet Yellen said no blanket insurance for all bank deposits.

Tesla CEO Elon Musk, billionaire Bill Ackman, former Coinbase CTO Balaji Srinivasan, and Ark Invest CEO Cathie Wood criticized the U.S. Federal Reserve’s rate hikes amid the banking crisis.

Bitcoin Price To Hit $35,000 and Ethereum Set For $2000?

Bitcoin price rises over 2% in the last 24 hours, with the price currently trading near $28,100. The 24-hour low and high are $27,359 and $28,729, respectively. While the BTC price has increased, the trading volume has decreased in the last 24 hours.

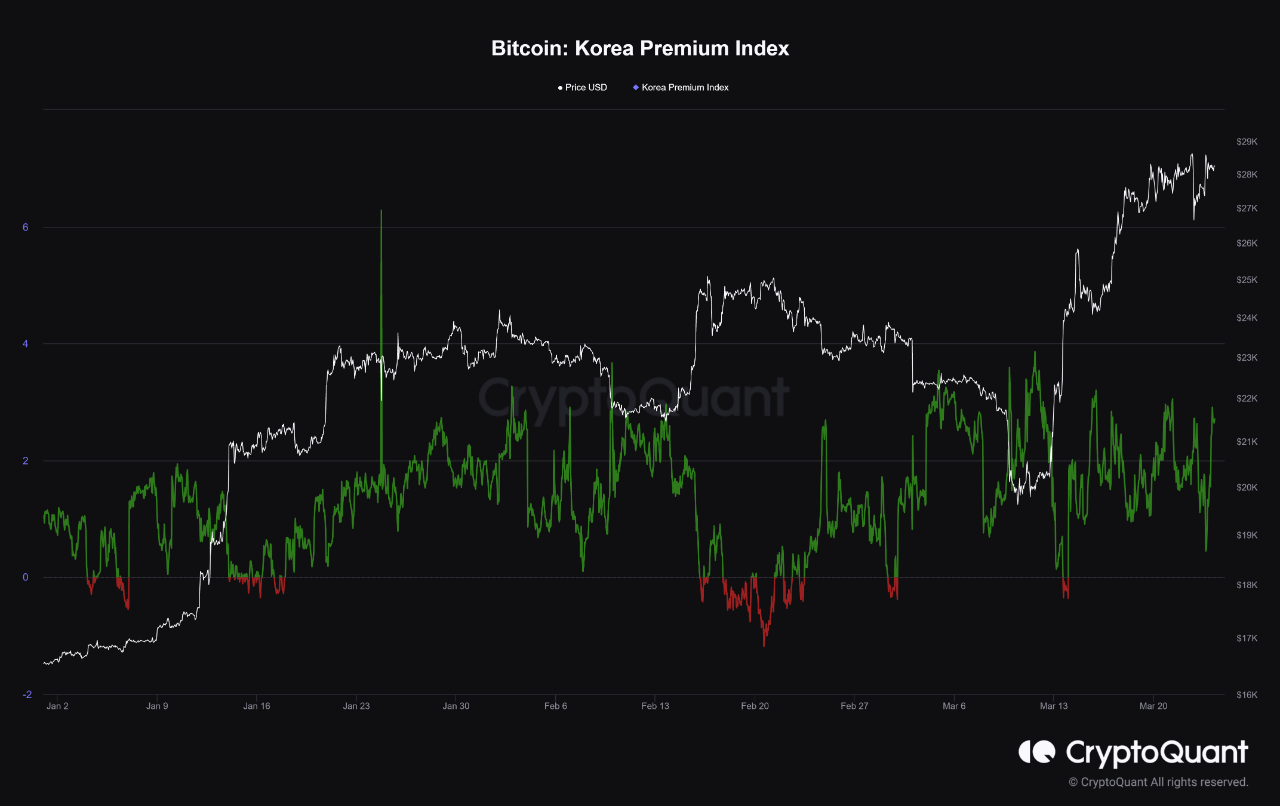

On-chain analysis and sentiment analysis revealed Coinbase Premium Index is decreasing and Korea Premium Index is increasing. High premium values indicate strong buying pressure by U.S. and Korean investors. However, the current scenario signals a more balanced price momentum.

Moreover, 4 on-chain metrics reveal potential correction in the BTC price for more upside moves in the coming days as positive sentiment rise. Analysts said Bitcoin has the potential to hit $35,000 amid the banking crisis.

Meanwhile, Ethereum price is also witnessing an upside move, with ETH price rising 3% in the last 24 hours amid bullish sentiment. ETH price is trading at $1,710, with a 24-hour high of $1,853. Ethereum price will be volatile amid high gas fees and the Shanghai upgrade set for April 12.

Also Read: Binance CEO “CZ”, Nic Carter On Repercussions Of Operation Choke Point 2.0

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Ripple Bets On AI Boom With Strategic Investment In AI Agent Infrastructure Startup

- Prediction Market News: Kalshi Fines MrBeast Associate Over Insider Trading Amid State Crackdown

- CLARITY Act: Banks, Crypto Yet To Agree On New Crypto Bill Draft As March 1 Deadline Looms

- Michael Saylor Predicts $50T From Bonds Could Flow Into Bitcoin Ecosystem as Digital Credit Evolves

- Bitcoin Treasury Firm GD Culture Authorizes Sale of 7,500 BTC as Expert Warns Of More ‘Pain’

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

- COIN Stock Price Prediction as Wall Street Pros Forecast a 62% Surge

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

Buy Presale

Buy Presale