US PCE Cools To 2.2%, Matrixport’s Bitcoin Price Target In Q4

Highlights

- US PCE Inflation Falls to 2.2%, supporting further 50 bps Fed rate cuts.

- Matrixport predicts massive BTC price rally in Q4.

- BTC price jumps after the PCE inflation data.

The personal consumption expenditures (PCE) price index in the United States cools further to 2.2%, reported the U.S. Bureau of Economic Analysis on Friday. Experts such as Matrixport and QCP Capital forecast a Bitcoin price breakout for a massive rally in Q4. Can BTC price hit $100K in the coming months?

US PCE Inflation Falls to 2.2%

The U.S. Bureau of Economic Analysis released the Federal Reserve’s preferred inflation gauge US PCE data for August today, September 27. The annual PCE comes lower at 2.2% against the expected 2.3%, down from 2.5% last month. Also, the month-over-month inflation rose 0.1% after a 0.2% increase the previous month.

The annual core US PCE inflation jumps to 2.7%, in line with market expectations, rising from 2.6% in the earlier month. The monthly core PCE comes in at 0.1%, falls from 0.2% last month.

The Federal Reserve cut interest rates by 50 bps this month, triggering an upside momentum in Bitcoin price and the broader crypto market. With Q4 historically bullish for the crypto market, experts anticipate more rate Fed rate cuts this year and spot Bitcoin ETFs inflow will support a rally to $100K.

CME FedWatch tool shows an increase in probability for 50 bps from 49.3.7% to 53.3% after the latest inflation data, supporting further bullishness in markets.

US dollar index (DXY) turns volatile and moves near 100.5 after PCE inflation data. Moreover, the US 10-year Treasury yield drops slightly to 3.751%, after rising for the last two weeks. Notably, Bitcoin price moves in the opposite direction to DXY and Treasury yield. Traders await for DXY and Treasury yield to stabilize before deciding to invest.

Bitcoin Price Set to Rally in Q4

Matrixport, which accurately predicted BTC price during last year’s rally and a sell-off after spot Bitcoin ETFs approval, has released its forecasts for Q4. The crypto research firm predicts another historically bullish quarter for Bitcoin price. This also means the end of a six-month consolidation phase.

Historically, Bitcoin has recorded an average 40% gain from October to March over the past decade. Matrixport analysts believe that history will repeat in the coming months and Bitcoin price may see a similar rally.

Bitcoin rally is supported by factors including Fed rate cuts, China stimulus, MicroStrategy’s increased BTC holdings, and spot Bitcoin ETFs inflow. The latest US PCE inflation data also supports a further rally in Bitcoin to new ATH in October, said the firm.

QCP Capital said the macro environment is showing increasing support for risk assets. BTC broke above the descending trendline and flipped $65,000 resistance into support. Bitcoin and Ethereum options also show a bullish outlook, with a move to $70,000.

On-chain data indicates enough liquidity for BTC until the $68K level. Bitcoin and other risk assets are gaining, though this liquidity boost could roll over into October. A breakout above $68K will raise the odds of hitting a new ATH by a great deal.

BTC price currently trades at $65,814 after hitting a high of $66,480. Furthermore, the trading volume has taken a dip after yesterday’s massive day, but the overall sentiment among traders remain bullish.

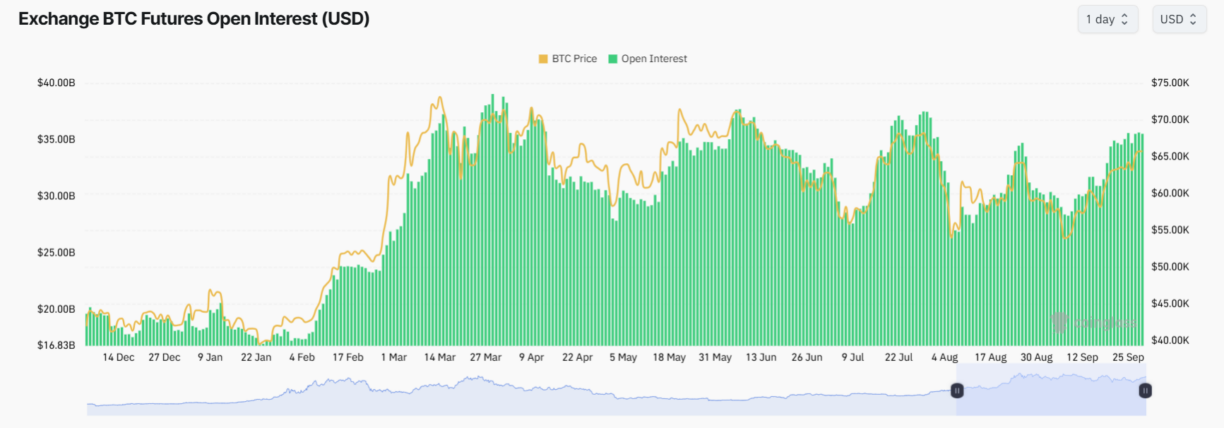

Coinglass data indicates that traders are liquidating their short positions on Bitcoin and other cryptocurrencies. BTC futures open interests rose as traders disregarded options expiry day. It has increased to $35.94 billion, increasing gradually to reclaim the March levels.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Core Scientific Sells 1,900 BTC as Bitcoin Miner Pivots to AI, CORZ Stock Dips

- Bitcoin News: VanEck CEO Projects Gradual BTC Rally in 2026 as ETFs Sees $458M Inflows

- Bitcoin, Gold Slip as Donald Trump Says “Unlimited Munition Stockpiles” for US-Iran War

- Crypto Prices Today: BTC, ETH, XRP Prices Surge Despite Iran’s Strait of Hormuz Closure

- Nasdaq Brings Prediction Markets to Wall Street with New SEC Filing

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

Buy $GGs

Buy $GGs