US President Promises Deal With China on Everything As ‘Trump Insider’ Begins To Close Bitcoin Shorts- Is A BTC Recovery Ahead?

Highlights

- A “Trump insider whale” reportedly closed $86.6 million in Bitcoin short position.

- The move comes as U.S. President Trump expresses optimism about a potential economic deal with China.

- Market sentiment has rebounded, with Bitcoin recovering to around $110,000.

The “Trump insider whale” has begun closing its Bitcoin short positions just as the U.S. President signals optimism about an economic agreement with China. The crypto market has also rebounded, with most tokens now in the green.

Trump Insider Whale Closes Major Bitcoin Short Positions

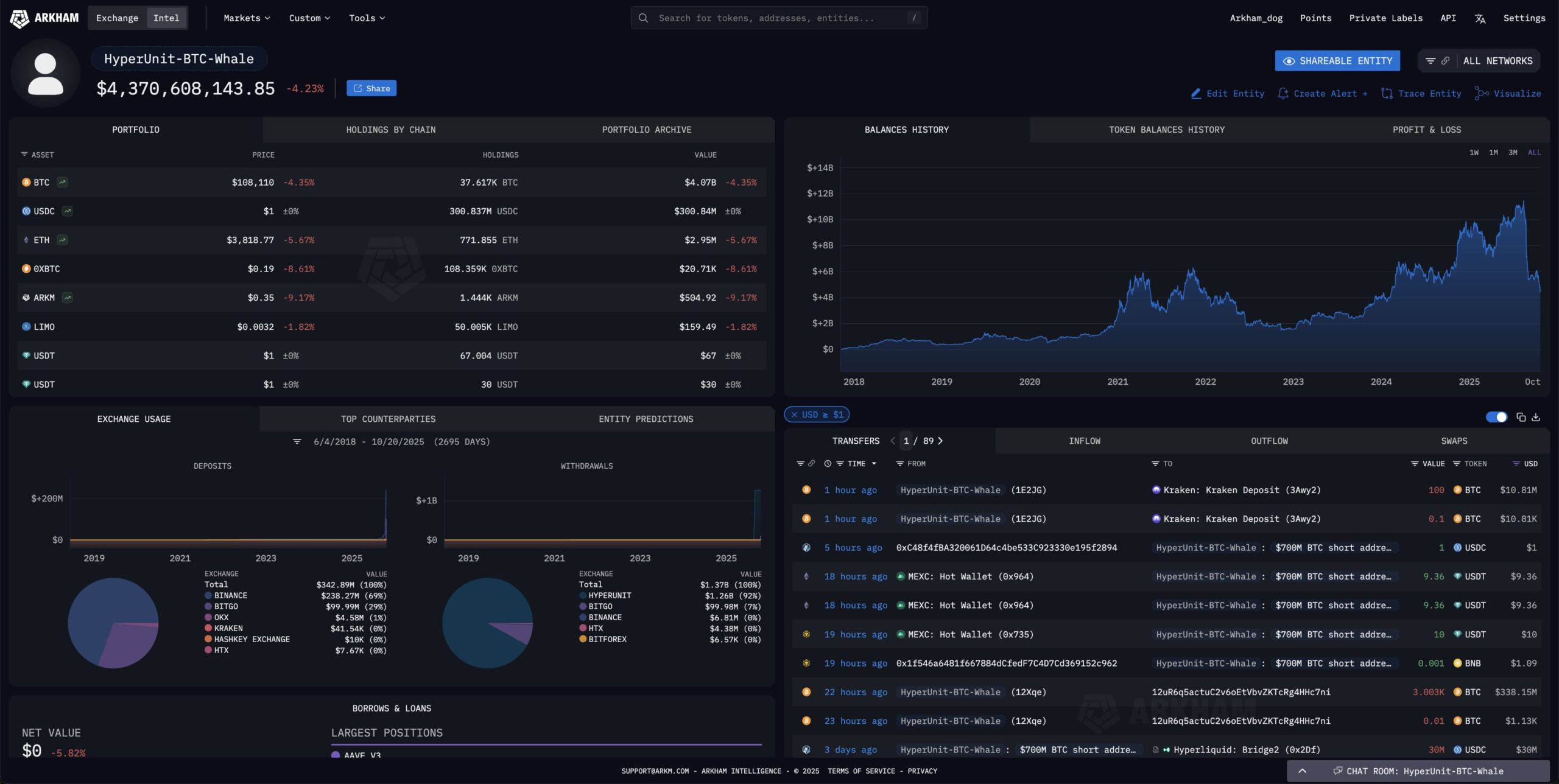

According to Arkham Intelligence, the whale known for correctly shorting the market ahead of the Trump tariff crash has begun reducing exposure. The trader recently closed $86.6 million in Bitcoin shorts, securing a $2.38 million profit.

The whale still holds an additional $140 million in open positions, currently in profit by about $4.3 million.

This entity previously made nearly $200 million during the last major market correction linked to the Trump tariff tensions between the two countries. The timing of the whale’s move coincides with the U.S. President’s public comments suggesting a major breakthrough could be on the horizon in U.S.-China relations.

POTUS: "I’ll be meeting with President Xi of China. We have a pretty long meeting scheduled. We can work out a lot of our questions and our doubts, and our tremendous asset together. So we look forward to that." pic.twitter.com/qXtRNucjSl

— Trump War Room (@TrumpWarRoom) October 22, 2025

The US president had previously confirmed that he would meet with President Xi Jinping on October 31 during the APEC summit.

“I’ll be meeting with President Xi,” Trump said. “We can work out a lot of our questions and our doubts, and our tremendous assets together. So we look forward to that.”

However, the president’s unpredictable stance has left traders cautious. Just days earlier, Trump hinted that the meeting might not happen, though he reiterated his intention to strike what he called “a very good deal with China.”

Trump Tariff Tensions and Policy Shifts

The developments come as the trade war continues to cast a shadow over both global and digital asset markets. Reports from Reuters suggest that Washington is considering additional restrictions on software exports to China.

The action comes after Beijing decided to restrict rare earth mineral exports, which sparked concerns about supply chain disruption. In response, the US president has floated the possibility of 100% tariffs on select Chinese goods starting November 1, unless a deal is reached.

Furthermore, Trump met with Australia to reduce reliance on China through new partnerships. The two leaders signed a $1 billion minerals agreement. This signals Washington’s broader strategy of diversifying critical resource supply lines.

Although the U.S. President projected confidence, saying, “I have a good relationship with President Xi, and I expect to make a good deal with him.” His list of negotiation priorities includes rare earths, fentanyl control, and agricultural exports like soybeans.

During the recent Trump tariff threats, the Bitcoin price briefly plunged to $104,000. Since then, sentiment has stabilized due to optimism surrounding the impending Trump-Xi meeting. As the market recovers, the token is currently trading between $109,000 and $110,000.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Ripple Bets On AI Boom With Strategic Investment In AI Agent Infrastructure Startup

- Prediction Market News: Kalshi Fines MrBeast Associate Over Insider Trading Amid State Crackdown

- CLARITY Act: Banks, Crypto Yet To Agree On New Crypto Bill Draft As March 1 Deadline Looms

- Michael Saylor Predicts $50T From Bonds Could Flow Into Bitcoin Ecosystem as Digital Credit Evolves

- Bitcoin Treasury Firm GD Culture Authorizes Sale of 7,500 BTC as Expert Warns Of More ‘Pain’

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

- COIN Stock Price Prediction as Wall Street Pros Forecast a 62% Surge

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

Buy Presale

Buy Presale