US SEC Delays Spot Ethereum ETF Launch, Sends Back S-1 Forms

Highlights

- The SEC has delayed spot Ethereum ETF launch as it send back S-1 forms for revision.

- With refiling expected in the coming weeks, Ethereum ETF launch is likely to happen by July-end.

- ETH price risks falling as the market participants can sell ETH on this report.

The spot Ethereum ETFs that experts like Bloomberg ETF analysts Eric Balchunas and James Seyffart expected to launch next week have been further delayed by the U.S. Securities and Exchange Commission (SEC). The SEC issued a few comments on the S-1 form submitted by spot Ethereum ETF issuers, with refiling expected in the coming weeks.

SEC Comments Postpones Spot Ether ETF Launch

The U.S. SEC in the latest comments has asked the spot Ethereum ETF issuers to submit the S-1 forms by July 8, according to people familiar with the matter. This means the spot Ethereum ETFs launch is delayed to mid-July or July-end.

SEC Chair Gary Gensler recently confirmed that the approval process for spot Ethereum ETF is going smoothly after issuers including BlackRock, Fidelity, 21Shares, Grayscale, Franklin Templeton, VanEck, and Invesco. The Ether ETF issuers such as VanEck have also filed Form 8-A in preparation for listing on exchanges by July 8.

The delay puts Ethereum holders in limbo. ETFstore President Nate Geraci earlier noted that the last round of S-1 revisions was quite “light” and the regulator will likely clear issuers for trading within the next 14-21 days. While the exact timeline is unclear, the SEC hinted at a potential launch this summer.

Also Read: ETH/BTC Pair Eyes Major Breakout With Ethereum ETF on Horizon, What’s Next?

ETH Price to Drop Due to Delay?

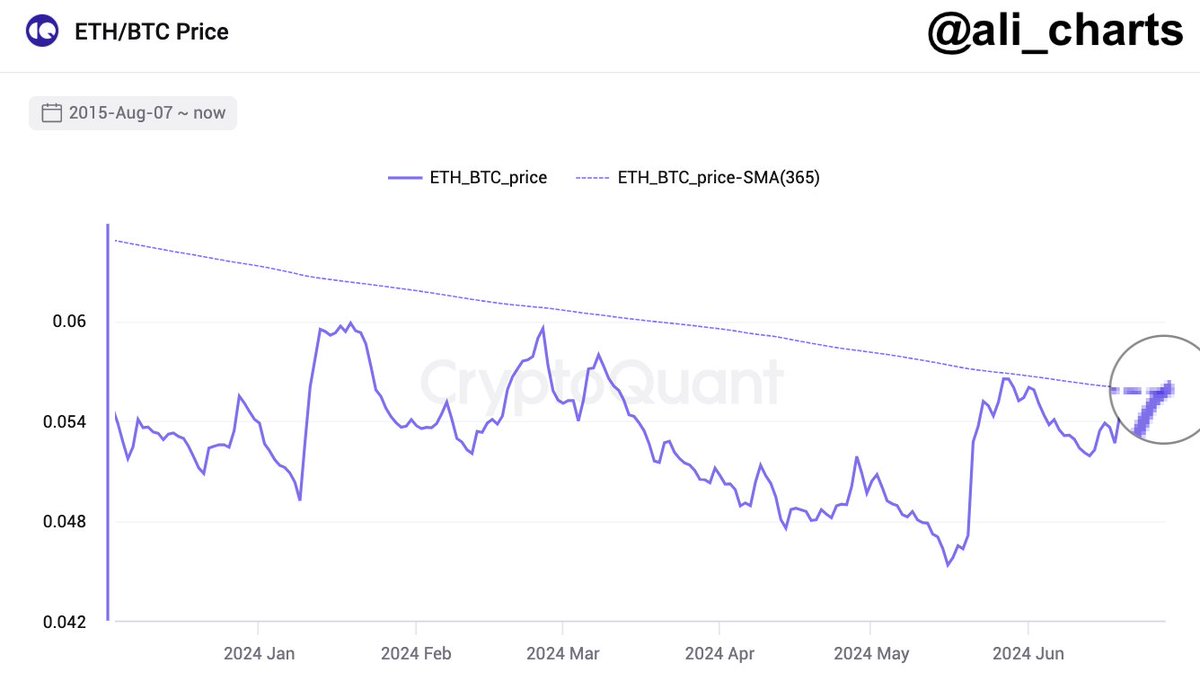

Market participants have criticized the move by the SEC as Ethereum and the broader crypto market are already trading under selloff pressure. The odds of Ethereum ETF launch next week ignited hopes of altseason as ETH/BTC price was finally moving above the 365 simple moving average.

ETH price rose 2% in the past 24 hours, with the price currently trading at $3,068. The 24-hour low and high are $2,826 and $3,090, respectively. Furthermore, the trading volume has increased further by 57% in the last 24 hours, indicating a rise in interest among traders.

Also Read: Ripple Vs SEC – Judge Torres Doctrine Stands, XRP Secondary Sales Are Not Securities

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Here’s Why Tether Gold (XAUt) Price Is Falling Even With Growing Gold Demand

- XRP News: Ripple Expands Payments Platform To Unify Fiat and Stablecoins Globally

- U.S.–Iran War: Bitcoin Price Extends Decline as Oil Prices Surge To Two-Year High

- Bitcoin Treasury Firm MARA Considers Selling BTC Reserves After Policy Update

- Cardano Founder Warns Over CLARITY Act, Cites Lack of Protection for DeFi, Stablecoins, Prediction Markets

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

Buy $GGs

Buy $GGs