US Shutdown Beyond 40 Days To Delay Crypto ETF Approval, But Demand Spikes

Highlights

- US shutdown could be the longest in the history so far, which could delay pending crypto ETF approvals.

- Despite the shutdown, ETF issuers continue to file new applications, including proposals for XRP, staked Ethereum (stETH), and leveraged HYPE ETFs.

- Charles Schwab clients now holding 20% of all US crypto ETFs showing strong investor demand.

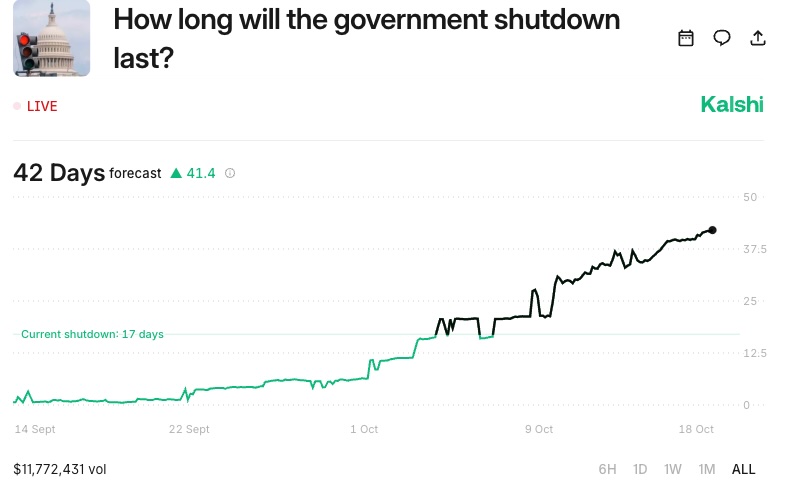

The US government shutdown is likely to extend further above 40 days, making it the longest shutdown in history. As per the latest Kalshi data, the US shutdown can last 42 days, which could further delay the crypto ETF approval.

Despite this shutdown, new applications have flooded the Satoshi Street last week, as market demand rises. A total of six XRP ETFs are waiting for approval between October 18-25.

US Shutdown to Extend Beyond 40 Days, Largest in History

The United States government is on course to remain shut down for more than 40 days. This would mark the longest federal shutdown in history. If the government office closure continues as projected, this US shutdown would last five times longer than the historical average for U.S. government shutdowns. As per the Kalshi data, there’s a 53% chance that the shutdown could extend beyond 40 days.

As a result of this, several crypto ETFs waiting in the queue for approval, starting today, October 18, could face further delays. However, this hasn’t stopped the issuers from submitting new applications for XRP ETF, HYPE ETF, and staked Ethereum ETFs.

This shows that the issuers are confident that once the US Securities and Exchange Commission (SEC) resumes normal office, a flood of approvals may happen.

Crypto ETF Demand Remains Strong

Charles Schwab CEO Rick Wurster said cryptocurrency remains a “topic of high engagement” among the firm’s clients. Schwab customers now hold 20% of all crypto ETFs in the United States, said Wurster in his recent interview with CNBC.

Visits to Schwab’s crypto website have jumped 90% over the past year, signaling strong retail and institutional interest. On the other hand, more than five new cryptocurrency ETF applications were filed with the US Securities and Exchange Commission (SEC) this week, even as the US shutdown continues.

VanEck submitted a filing for a Lido Staked Ethereum ETF (stETH), while 21Shares applied for a 2x leveraged ETF on HYPE. Other filings included proposals for XRP and several additional leveraged crypto ETFs.

Analysts suggest that once the shutdown ends, altcoin ETF approvals could accelerate, potentially sparking a major rebound across alternative digital assets.

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise