VanEck Pushes for Staked Hyperliquid ETF in US, Expects HYPE Coinbase Listing Soon

Highlights

- VanEck is prioritizing Hyperliquid ETF as part of its liquid fund strategy.

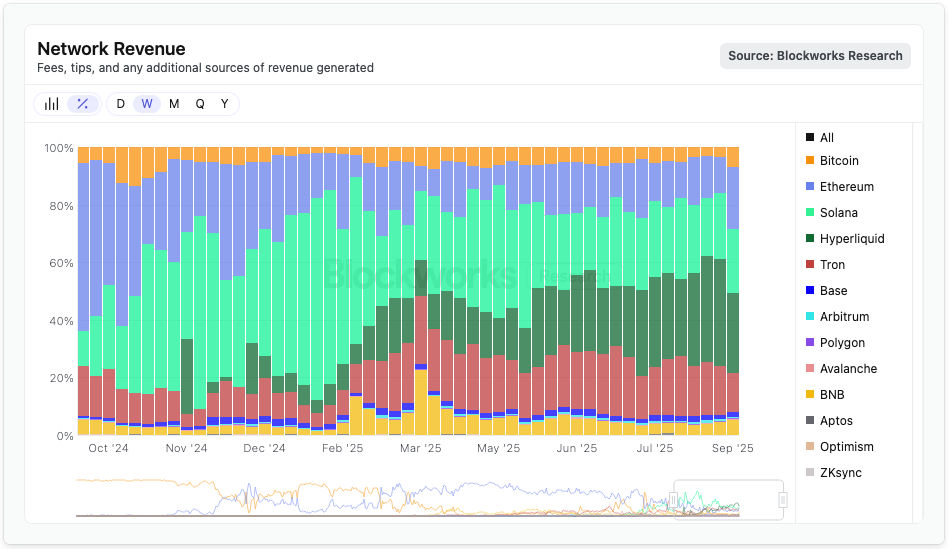

- Hyperliquid has outperformed several other blockchains in network revenue, over past few weeks.

- HYPE price has rallied 23% in the past week, reaching $56, and eyes a spot in top ten crypto list.

Sources familiar with the matter said that digital asset manager VanEck is reportedly filing for a spot staking Hyperliquid ETF in the US. The asset manager will also launch an equivalent HYPE exchange-traded product (ETP) in Europe. VanEck executives believe that an ETF launch could lead to the Coinbase listing of native cryptocurrency HYPE. The HYPE price has been on a strong rally with 23% weekly gains, and currently trades at $56.

VanEck to Pursue Hyperliquid ETF With Staking Facility

Crypto asset manager VanEck is looking to pursue a Hyperliquid ETF with a staking yield facility. The asset manager is betting big on Hyperliquid’s growth as the decentralized exchange proceeds to bring its native stablecoin USDH, into the market.

Matt Maximo, the VanEck senior digital assets investment analyst, said that Hyperliquid remains a key focus this year for the firm’s liquid fund. Kyle Dacruz, director of digital assets products at VanEck, noted that the firm is weighing the option of allocating a portion of its investment products’ net profits toward HYPE buybacks. Currently, Hyperliquid conducts buybacks equal to nearly all of its platform revenue.

The entire executive team at VanEck has been putting greater focus Hyperliquid, as the decentralized exchange has been challenging giants like Binance, in crypto derivatives trade. VanEck CEO Jan van Eck recently praised the DEX’s technology and decentralized governance.

Hyperliquid has swiftly executed billions of dollars’ worth of trades, with minimal to no hiccups, thereby winning the trust of investors. As per the data by Blockworks Research, Hyperliquid leads all other blockchains in terms of network revenue for nearly four consecutive weeks.

HYPE Could See A Coinbase Listing Soon

VanEck executive Kyle Dacruz added that his firm finds Hyperliquid ETF essential amid “plenty of demand.” He noted that a HYPE staking ETF could improve U.S. investor access to the token, and potentially push the listing of token on top crypto exchanges like Coinbase.

Note that the launch of the staked HYPE ETF will rely on the regulatory approval of the U.S. Securities and Exchange Commission (SEC). So far, the SEC has yet to give staking approval for an Ethereum ETF, sought by top asset managers like BlackRock and others. On the other hand, asset manager 21Shares has already introduced a European Hyperliquid ETP last month, in August.

Furthermore, the HYPE price rally continues to make fresh all-time highs, surging another 3% today to $56. During its 23% rally over the past month, HYPE has already overtaken players like Chainlink (LINK), Sui (SUI), and eyes a spot in the top-10 crypto list.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Vitalik Buterin Exceeds Planned Ethereum Sales as Total Liquidations Hit $35M

- Circle Stock Jumps 35% on Stablecoin Boom, USDC Supply Soars 72%

- Democrats Convene US Senate Crypto Bill Meeting as a16z Briefs Republicans on CLARITY Act & AI

- After 820% Gains: Privacy Coins Evolve into Payment Rails

- Bitcoin Price Rebounds as Jane Street “10 am Dump” Pattern Stops Amid Lawsuit

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

- COIN Stock Price Prediction as Wall Street Pros Forecast a 62% Surge

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

Buy Presale

Buy Presale