VanEck Submits Preliminary Prospectus for Lido Staked Ethereum ETF with US SEC

Highlights

- VanEck files for a Lido Staked Ethereum ETF with the US SEC.

- The ETF will offer staking rewards along with exposure exposure to Ethereum.

- Lido Staked ETH price fell more than 3%.

VanEck has submitted a preliminary application for a Lido Staked Ethereum ETF with the U.S. Securities and Exchange Commission (SEC). The issuer becomes the first to file an exchange-traded fund for Lido staked Ethereum as the Generic Listing Standards take effect earlier this month.

VanEck Files Application for Lido Staked ETF with US SEC

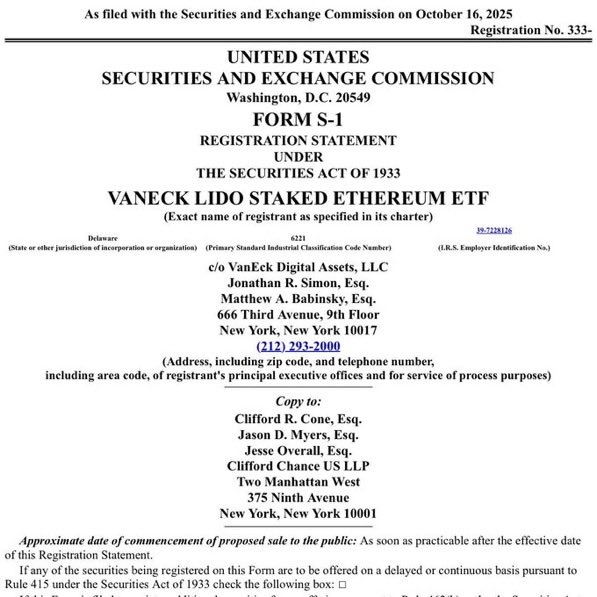

$133 billion AuM issuer VanEck has filed an S-1 form for a Lido Staked Ethereum ETF, according to a US SEC filing dated October 16. This comes following a statutory trust registration by VanEck for Lido Staked Ethereum ETF in Delaware last week, with CSC Delaware Trust Company as its registered agent.

If approved, it would give investors regulated exposure not only to Ethereum (ETH) but also to staking rewards earned through liquid staking protocol Lido. The ETF will track spot stETH prices based on MarketVector’s Lido Staked Ethereum Benchmark Rate index.

The DeFi staking protocol allows users to stake ETH without running validator nodes, issuing Lido Staked ETH (stETH) liquid staking token that represents deposited ETH and staking yield. As per DeFiLlama data, 8.49 million ETH worth over $33.37 billion is staked on Lido, representing 59.88% market share.

The SEC will decide on the first Lido Staked Ethereum ETF under the Generic Listing Standards. This reduces the crypto ETF approval timeline from 240 days to 75 days under the Securities Act of 1933.

Lido Staked ETH (stETH) Price Action

Traders didn’t respond immediately to the VanEck Lido Staked Ethereum ETF announcement amid uncertainty due to the crypto market crash. Lido Staked ETH price fell more than 3% in the past 24 hours, with the price currently trading at $3,867.53.

The 24-hour low and high are $3,835.96 and $4,066.89, respectively. Furthermore, the trading volume has increased by 40% in the last 24 hours, indicating cautious trading by traders.

The crypto community still awaits the SEC’s decision on permitting staking on spot Ethereum ETFs, currently delayed due to the U.S. government shutdown. Notably, Grayscale enabled staking in its Ethereum Trust ETF (ETHE) and Ethereum Mini Trust ETF (ETH), becoming the first U.S. spot crypto ETPs to offer staking.

However, despite the launch of staking facility, Grayscale ETHE and ETH didn’t see much inflows. In fact, these two ETFs saw the least inflows in comparison to other US ETF issuers.

- FOMC Minutes Drop Tomorrow: Will Crypto Market Rally or Face Fed Shock?

- BlackRock Amends Filing For Staked Ethereum ETF, Eyes 18% of Staking Rewards From ETH Fund

- Arizona Advances Bitcoin, XRP Reserve Bill Using Seized Crypto Assets

- Bitcoin ETF Update: BlackRock Signals BTC Sell-Off as Kevin O’Leary Warns of Decline In Institutional Demand

- Breaking: Tom Lee’s BitMine Buys 45,759 ETH as CryptoQuant Flags Potential Bottom For Ethereum

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k