Veteran Trader Peter Brandt Predicts New Bitcoin Price Target

Highlights

- Peter Brandt predicts Bitcoin price rally to $108K ahead, sparking market optimism.

- Brandt also warned that a potential correction to $70K looms for BTC.

- Matrixport has set a BTC price target of $160K in 2025.

Bitcoin price has noted a strong recovery this weekend after a sharp decline recently falling below the $91K mark. Amid this, veteran trader Peter Brandt has reiterated his bullish outlook on the flagship crypto, indicating that the crypto could continue its rally ahead. In addition, other on-chain metrics also indicate a positive momentum for BTC ahead.

Peter Brandt Predicts Bitcoin Price Rally Ahead

The Bitcoin price, alongside the top altcoins, has witnessed a strong rally over the past few days, sparking market confidence. However, the flagship crypto has recently witnessed a sharp decline amid a broader crypto market crash this week. Despite that, BTC has recovered from its weekly lows on Saturday, indicating investors are reentering the market.

Amid this, veteran trader and top market expert Peter Brandt maintained a bullish outlook for BTC. In a recent analysis, Brandt said that the crypto is likely to hit $108,358 in the coming days, sparking optimism. However, he also warned over a potential decline to $76,614 citing the technical charts.

Besides, he also said that “this is not a prediction”, indicating the risks associated with the market. He said that these analyses only reflect the “possibilities, not probabilities, not certainties.” Besides, he has recently set a BTC price target of $125K, which has also gained notable market attention.

However, the market optimism is soaring towards the crypto market after Donald Trump’s election win in November. Now, as Trump’s inauguration on January 20 is approaching, the market sentiment is further bolstered by anticipation over the pro-crypto regulatory environment in the US.

What’s Next For BTC?

The discussions over the US BTC Strategic Reserve have fueled market sentiment recently. On the other hand, the recent robust inflow into US Spot Bitcoin ETF has also signaled a growing institutional interest in the crypto. However, the recent outflux this week into BlackRock Spot Bitcoin ETF and others has fueled concerns.

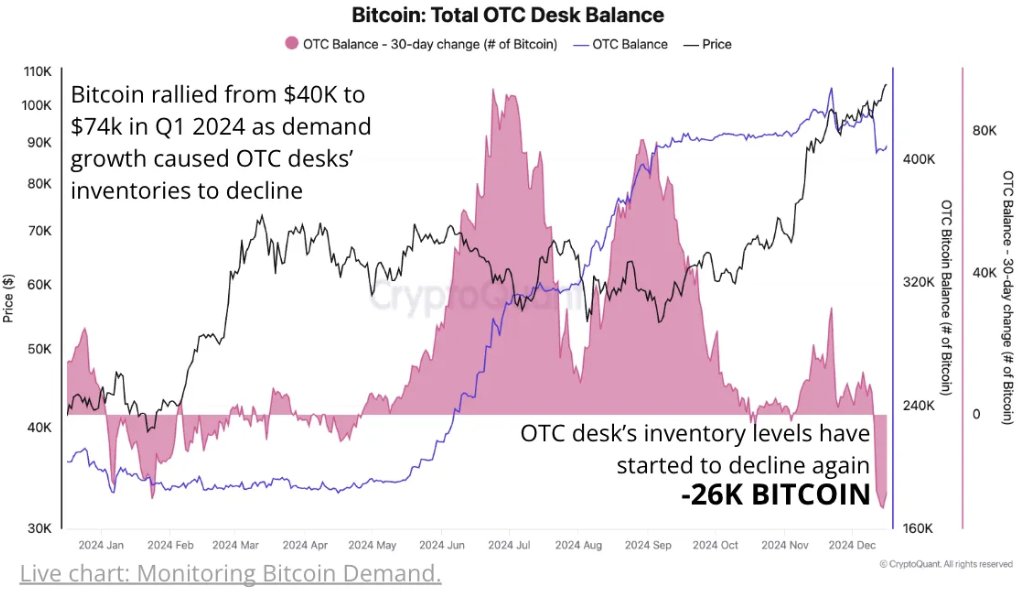

Despite that, the on-chain metrics indicate positive momentum ahead. For context, top analytics platform CryptoQuant said that “Bitcoin demand is surging.” CryptoQuant said that “OTC desks” are witnessing their largest monthly inventory decline this year, down 26K BTC. Considering that, the tightening market supply also indicates a bullish momentum ahead.

In addition, other market experts have also remained optimistic about the future trajectory of BTC. For context, Matrixport has cited key reasons recently that have sparked a rally in Bitcoin price and top altcoins like Solana, XRP, and DOGE. Besides, it also set a BTC price target of $160K for the crypto, boosting investors’ confidence.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Vitalik Buterin Maps Out Quantum Risks as Ethereum Foundation Unveils ‘Strawmap’

- BlackRock Adds $289M in BTC as Bitcoin ETFs Log 2-Week High Inflows Of $500M

- Glassnode Signals Bitcoin Still Faces Downside Risk Amid Massive Sell Pressure at $70K

- U.S House Introduces Bipartisan Crypto Bill To Protect Crypto Developers Amid DeFi Push Under CLARITY Act

- XRP News: Ripple Unveils Funding Hub To Support Innovation On XRPL

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs