Wall Street Peeks at Bitcoin ETFs on Strong Pre-Market Gains, BTC Price to Hit $60K?

Highlights

- Spot Bitcoin ETFs and crypto stocks are trading higher in pre-market hours on Tuesday

- BlackRock iShares Bitcoin ETF (IBIT) and Grayscale's GBTC are trading at 3.73% and 3.80% higher in pre-market hours

- Bitcoin price to continue rally as it has only major resistance level at $68K

Despite amassing $520 million inflow at the close of trading on Monday, spot Bitcoin Exchange-Traded Funds (ETF) are now trading higher in Tuesday’s Pre-market hours. With the market outlook, the question now remains whether a robust Bitcoin ETF performance today will lead to BTC price hitting another high of $60,000.

Bitcoin ETF Strong Performance Shows Resilience

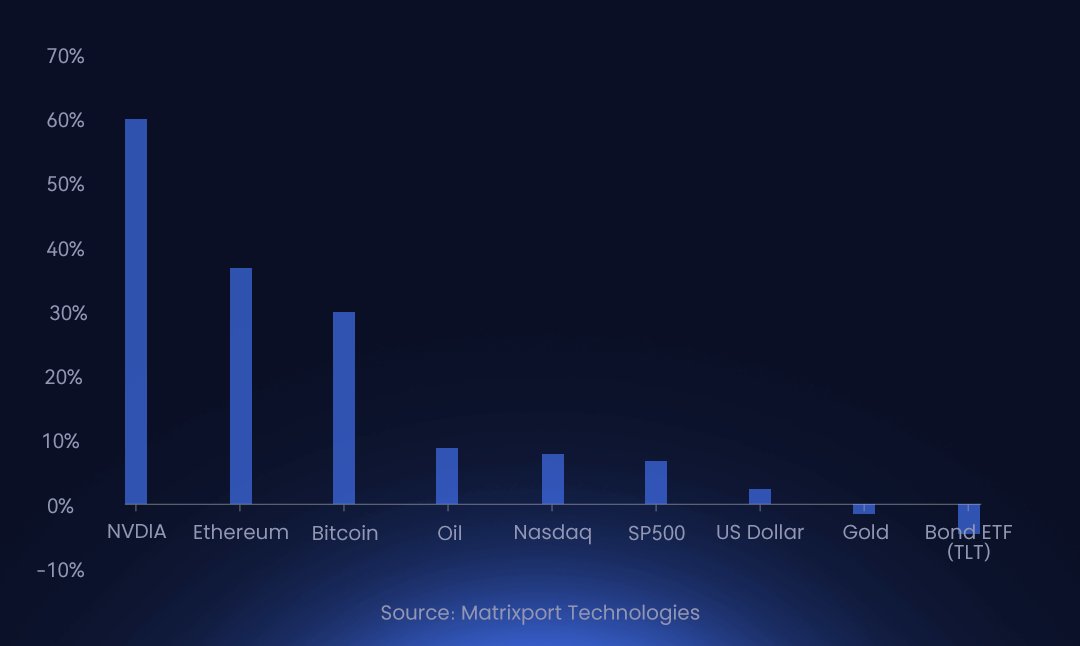

The surge in spot Bitcoin ETF volumes and inflow underscores the growing interest in Bitcoin ETF and indicates a notable shift in investor sentiment toward the crypto market. Bitcoin and Ethereum, the two largest cryptocurrencies, have recorded 30-36% gains year-to-date (YTD).

Matrixport predicts crypto returns will drive FOMO among Wall Street investors, as BTC and ETH perform better than oil, Nasdaq, S&P 500, gold, and bond ETF, clearly leading the wider asset groups. Nvidia is leading with over 64% ROI YTD.

Also Read: BTC Price Shoots to $57,000 As Nine Bitcoin ETFs Set New Records

BlackRock iShares Bitcoin ETF (IBIT) and Grayscale’s GBTC are trading at 3.73% and 3.80% higher in pre-market hours on Tuesday. Wall Street investors pouring money into GBTC will help

Other major Bitcoin ETFs, Fidelity Wise Origin Bitcoin Fund (FBTC), Ark 21Shares Bitcoin ETF (ARKB), and Bitwise Bitcoin ETF (BITB) trade at 4.11%, 4.07%, and 3.63%, respectively. Fidelity was the higher gainer on Monday with a $243.3 million inflow. Experts predict ETFs will continue to hit new volume records this year, with halving as a trigger button.

Also Read: Ethereum’s Vitalik Buterin Asks Elon Musk to “Join Us

BTC Price to $60K?

Along with spot Bitcoin ETF, crypto stocks such as MicroStrategy, Coinbase, and Robinhood are also trading higher in pre-market hours. MSTR price jumped 6.09% to $845 after they purchased 3000 more bitcoins and increased holdings to 193,000 BTCs. COIN price hit a new 52-week high of $203.63 in pre-market hours.

Crypto mining stocks including CleanSpark, Riot Platforms and Marathon Digital also continue to trade higher in 5-10% after a more than 20% jump when Bitcoin price surpassed $57,000.

According to CryptoQuant, Bitcoin upside is likely as it breaks above 2-3 year long term holder resistance price. BTC price has rallied significantly, rising to $57K, the only price that may act as resistance going forward is the last cycle high of $68K.

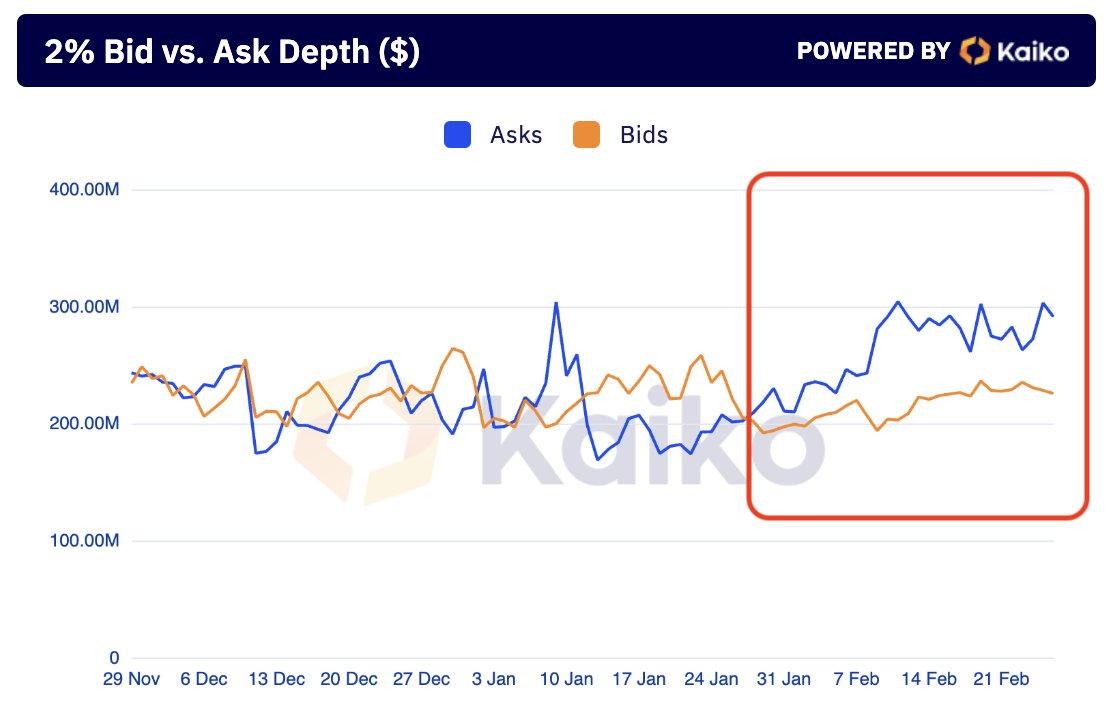

Bitcoin could face resistance to the upside amid other factors such as funding rates and PCE inflation. Crypto research firm Kaiko said “Order books are heavily imbalanced towards the ask side, a switch which first emerged early February.”

BTC price jumped over 11% in the last 24 hours, with the price currently trading at $56,784. The trading volume has increased by more than 200%, indicating traders are bullish for further upside.

Also Read: Binance Competitor OKX Launches OKX TR For Turkish Users

- Robert Kiyosaki Reveals Why He Bought Bitcoin at $67K?

- XRP News: Ripple Partner SBI Reveals On-Chain Bonds That Pay Investors in XRP

- BitMine Ethereum Purchase: Tom Lee Doubles Down on ETH With $34.7M Fresh Buy

- BlackRock Buys $65M in Bitcoin as U.S. Crypto Bill Odds Passage Surge

- Bitcoin Sell-Off Ahead? Garett Jin Moves $760M BTC to Binance Amid Trump’s New Tariffs

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?