Breaking: Wall Street Expects 75 Bps Rate Hike, Will Bitcoin (BTC) Price Correlate?

Wall Street expects a 75 bps rate hike by the U.S. Federal Reserve in the FOMC meeting today, September 21. Goldman Sachs, Wells Fargo, JPMorgan, Morgan Stanley, and others anticipate a 75 bps rate hike is most likely this month as the Fed pushes to control inflation. Meanwhile, the Bitcoin price continues to struggle under the $20,000 level amid macro fear.

Wall Street Predicts 75 bps Rate Hike by the Federal Reserve

Wall Street believes the Federal Reserve is mostly likely to go with a 75 bps rate hike in September as a 100 bps rate hike may push the economy into recession. The rate hike causes the federal funds rate to reach the highest level since 2008. The Fed benchmark borrowing rate will be between 3.0% to 3.25%, up from the current range of 2.25% to 2.5%.

Goldman Sachs earlier predicted that the Fed could raise interest rates by 75 bps in September. Thereafter, 50 bps rate hikes in November and December. JPMorgan and Morgan Stanley also assert the 100 bps rate hike will be risky for the economy.

Meanwhile, Wells Fargo’s managing director Michael Schumacher says the Fed should go with a straight 150 bps, rather risking panic on Wall Street. Billionaire and Carlyle Group co-founder David Rubenstein says the 100 bps Fed rate hike would depress markets.

However, ex-Treasury Secretary Larry Summers recommends the Federal Reserve to consider a 100 bps rate hike this month to tame inflation. Meanwhile, the U.S. dollar index has hit a 20-year-high of 110.87 today.

The U.S. equity market has opened in the “green” today, with Dow Jones, S&P 500, and Nasdaq Composite rising higher. According to the CME FedWatch Tool, the probability of a 75 bps rate hike is 82%.

Bitcoin (BTC) Price to Rally Amid Dovish Fed

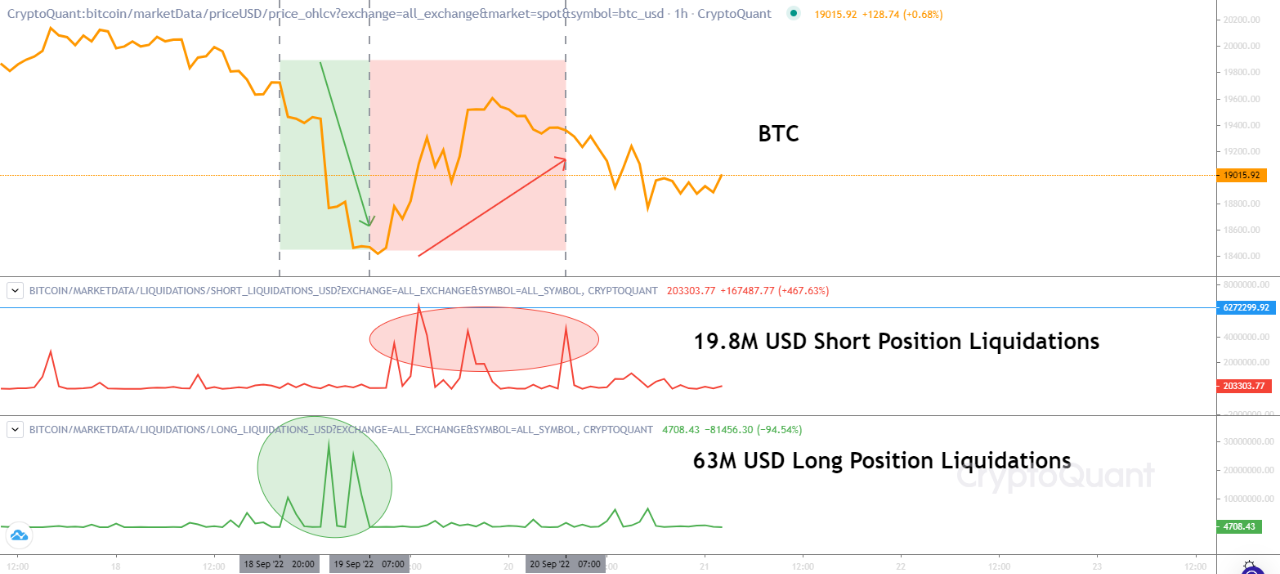

Bitcoin’s (BTC) price fell from $19.7K to $18.4K after the liquidation of long positions worth $63 million. Moreover, the BTC price rebounded to $19.6K again after the liquidation of short positions worth $19.8 million. It indicates that the price trend is maintained in the direction in which a long or short squeeze occurs.

Data indicates traders still hold more short positions than long positions despite the price rise, as long positions have been liquidated about three times more than the short positions.

Moreover, the market volatility is most likely to peak as the Fed announces rate hike. A liquidation of short position will move the Bitcoin (BTC) price upwards.

Meanwhile, Bitcoin evangelist Michael Saylor believes Bitcoin is getting stronger after the Ethereum Merge.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs