Wall Street’s CPI Forecast: Expert Examines if Bitcoin Price Can Sustain Triangle Breakout?

Highlights

- US CPI is expected to come in at 0.3%, make headline CPI inflation rise to 2.9%.

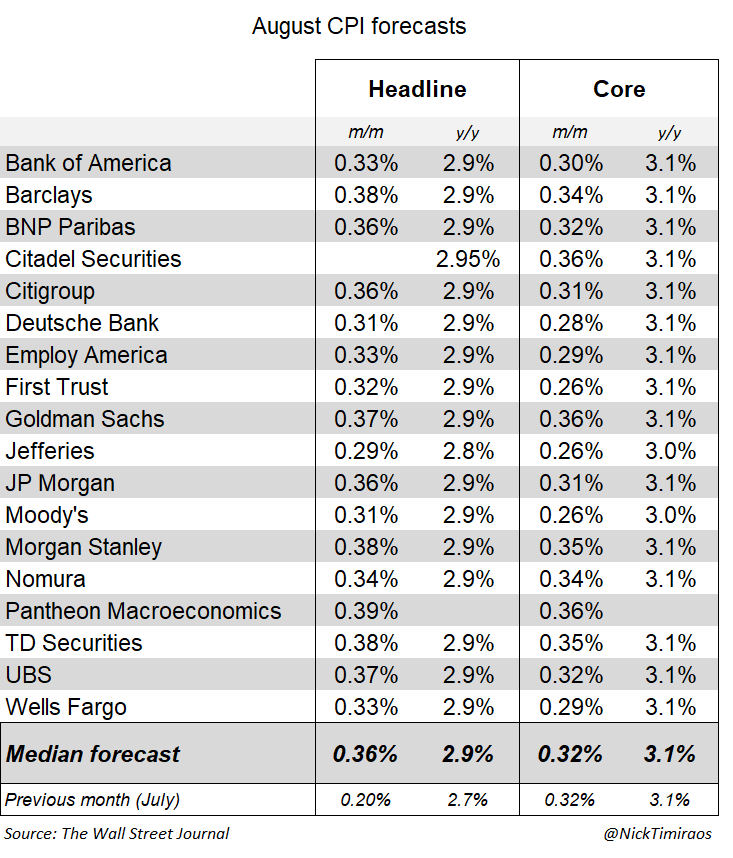

- 18 Wall Street giants such as JPMorgan and Goldman Sachs expect core CPI rising 0.32%, holding annual core CPI at 3.1%.

- Bitcoin triangle pattern breakout and inflows into spot Bitcoin ETFs signal shift in trends, but will it sustain?

The U.S. Bureau of Labor Statistics (BLS) is slated to release the Consumer Price Index (CPI) data for August, one of the most widely followed inflation gauges for the U.S. Federal Reserve. While traders actively await the release of the CPI print, the broader crypto market has already recovered with Bitcoin price holding above the $114K level.

US CPI Estimates by Wall Street Giants

After Wednesday’s PPI data showed inflation cooled to 2.6%, the crypto market now awaits the key Consumer Price Index data later today for further cues on direction as uncertainty and volatility rise.

Economists expect the monthly CPI to come in at 0.3%, slightly above July’s 0.2% print. The slight increase would make headline CPI inflation rise to 2.9%, after 2.7% in both June and July. Economists based their reasoning on the higher import tariffs, along with rising gasoline and supermarket costs.

Meanwhile, the core CPI is projected to rise 0.3% month-on-month, the same as in the previous month. The market is projecting the annual core CPI to remain steady at 3.1%.

The Wall Street Journal’s Nick Timiraos said the median of 18 Wall Street giants’ expectations showed the consumer price index rising 0.32%, holding the 12-month rate steady at 3.1%. The highest estimate of 0.36% was from Goldman Sachs, Citadel Securities, and Pantheon Macroeconomics.

Besides, the median estimate for headline CPI is 0.36%, corresponding to 2.9% YoY. Bank of America, Barclays, BNP Paribas, Citigroup, Deutsche Bank, Employ America, First Trust, Goldman Sachs, JPMorgan, Moody’s, Morgan Stanley, Nomura, TD Securities, UBS, and Wells Fargo expect the annual CPI to come in at 2.9%.

Expert Weighs on Bitcoin Price Holding Triangle Breakout

Most traders appeared overly focused on downside risk in Bitcoin this month due to historical seasonality. The sentiment is reflected in investment trends across derivatives markets. The double top pattern around $123K gained strength after the hottest 0.9% rise in US PPI last month, which caused Bitcoin price to tumble below $108K.

10x Research analyst and CEO Markus Thielen said market shifts are emerging and BTC will see a major move upwards if these trends persist. Rising inflows into spot Bitcoin ETFs clearly show the shift in trend.

Thielen added that the latest Bitcoin triangle pattern breakout signals a decisive shift from the mid-August correction. Notably, Bitcoin price will continue its upside move above $117K, if CPI inflation comes in lower than expectations.

BTC price is trading above $114,144, with a 24-hour low and high of $112,134 and $114,471, respectively. Furthermore, a 7% increase in trading volume over the last 24 hours indicates huge interest among traders.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs