WAVES Price Tumbles 18% Amid Market Manipulation FUD

WAVES, the native token on the eponymous blockchain, slumped as much as 18% overnight amid growing allegations of market manipulation. A new governance proposal to prevent short selling of the token was also lambasted by the crypto community.

WAVES sank 18% to $44.09, retreating from some of its recent gains. The token had surged exponentially in late-March and doubling its value and largely outpacing the broader market.

But this rally had spurred allegations of price pumps by the project, through its defi lending platform Vires. While founder Sasha Ivanov denied the allegations, Vires began experiencing mass liquidations after the news. Total value locked in the platform plummeted by about $300 million in two days, standing at $972 million on Monday, according to Defi llama.

The sharp drop in liquidity also dented the blockchain’s dollar-pegged stablecoin, Neutrino (USDN). The token was now at $0.91, a record low.

WAVES FUD heats up

In a series of tweets, Ivanov accused crypto trading house Almeda Research of operating a smear campaign to make a short position profitable. Almeda, which was founded by FTX CEO Sam Bankman-Fried, denied the allegations, while users, including Fried, chided Ivanov for spreading “conspiracy theories.”

But the main source of controversy over WAVES was a new governance proposal by Ivanov, which seeks to prevent WAVES and USDN borrowing on Vires, as well as cap interest rates for deposits on the platform.

The proposal was widely criticized, given that it benefits only certain traders with large USD coin (USDC) loans on the platform. And given that Ivanov was recently accused of borrowing USDC from his own platform to pump WAVES prices, the proposal was treated with suspicion. The results of the vote on the token were still unclear.

Vires liquidity crunch

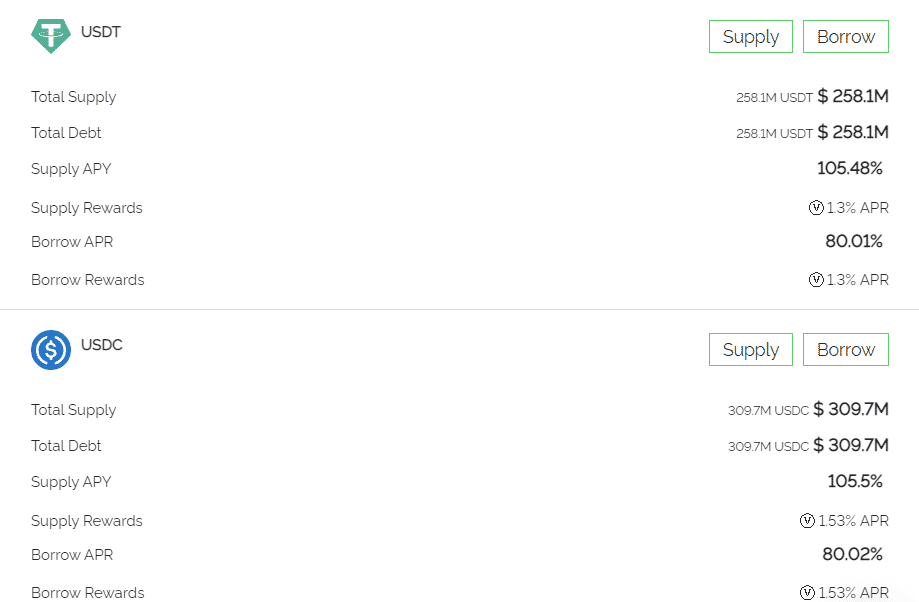

In the wake of the mass liquidations, Vires appeared to have exhausted its supply of stablecoins USDC and Tether (USDT). Users of the platform were already complaining that they could not withdraw their USDC/USDT deposits.

USDC and USDT were also allegedly used by the platform in its WAVES price pumps, further indication that early accusations of market manipulation may hold water. The platform is currently incentivising stablecoin deposits with high return rates, but given the liquidity crunch, such an investment may be risky.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

Buy $GGs

Buy $GGs