Webus Files with SEC To Create $300 Million XRP Treasury Reserve

Highlights

- Webus International Limited files a Form 6-K with the US SEC.

- The move comes as part of Webus' collaboration with Samara Alpha Management LLC for $300M XRP management.

- The partnership aims to establish a strategic framework for potential future digital asset treasury operations.

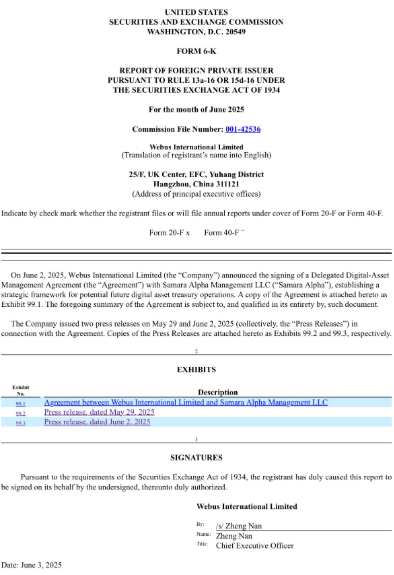

Webus International Limited, a China-based Nasdaq-listed AI-driven mobility solutions provider, filed a Form 6-K with the US SEC, as part of its strategic collaboration with Samara Alpha Management LLC to manage up to $300 million in XRP.

Webus Files Form 6-K with SEC Filing for Treasury Operations

Webus filed a Form 6-K with the SEC for its $300 million XRP-focused treasury. The company alluded to its agreement with Samara Alpha Management towards establishing a strategic framework for potential future digital asset operations, which will focus on XRP.

In his latest X post, XRP lawyer Bill Morgan also commented on Webus’s Form 6-K filing concerning its Delegated Digital-Asset Management Agreement with the SEC-registered investment adviser. Morgan noted,

Webus has filed its form 6-K with the SEC after signing the previous day a Delegated Digital-Asset Management Agreement with a delegated manager to establish a strategic framework for potential future digital asset treasury operations, which it asserts are focused on XRP management and an authorised mandate cap of up to $300M.

On May 30, CoinGape reported Webus’ plans to raise $300 million through multiple non-equity financing sources to establish an XRP reserve. The platform is building a blockchain infrastructure on the XRP network to reduce delays and fees in international transactions.

Webus Partners with Samara Alpha Management

On June 2, Webus announced its collaboration with Samara Alpha Management, a leading SEC-registered investment adviser. The joint venture aims to set a strategic framework for future digital asset treasury operations. Under the Agreement, Samara Alpha will serve as Webus’s exclusive digital asset manager, with a mandate cap of up to $300 million.

Commenting on the platform’s vision, Nan Zheng, Chief Executive Officer of Webus, stated,

This Agreement defines a clear structure for trusted digital asset management in the future. As we continue to evaluate innovative approaches to treasury management, establishing this framework with a regulated, institutional-grade partner provides us with strategic optionality while maintaining prudent controls.

Webus isn’t the only company exploring XRP for corporate use. Another Nasdaq-listed company VivoPower has launched an XRP-focused treasury strategy with a $121 million raise to build an XRP reserve.

Driven by these significant developments, the XRP price has seen a notable uptick of 3.3% over the past day. Currently trading at $2.25, the token has witnessed increasing traders’ sentiment, evidenced by the 23% surge in the trading volume.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

Buy $GGs

Buy $GGs