Why Bitcoin (BTC) Valuations Might Never Go Under $1 Trillion Again

Bitcoin (BTC), the world’s largest cryptocurrency has shown some volatility in the last two weeks slipping below $54,000 levels twice. However, it has bounced back strongly and is looking forward to breaking past its all-time high of $61,600. At press time, Bitcoin (BTC) is trading at $57,687 with a market cap of $1.076 trillion.

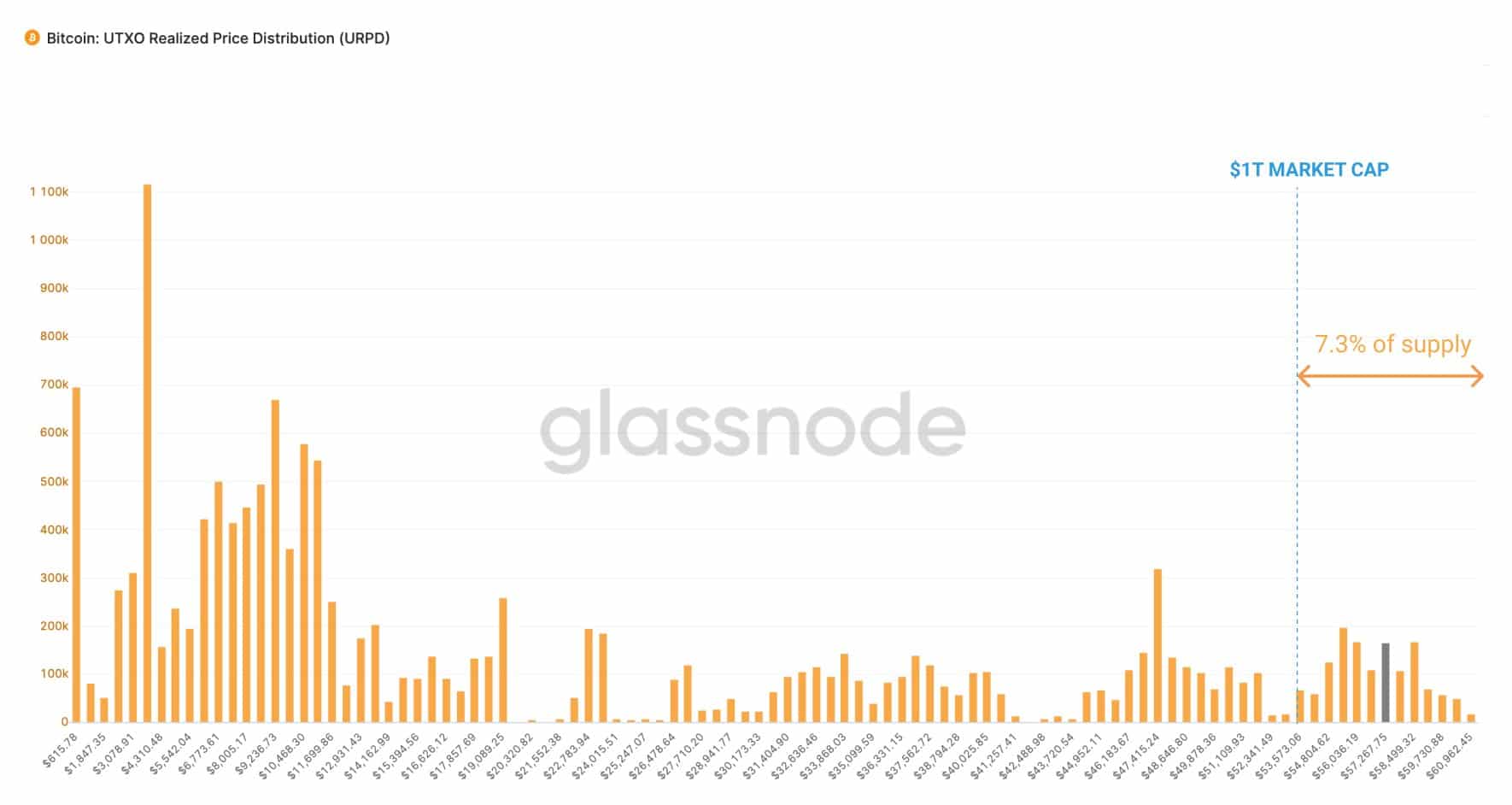

More importantly, despite the recent price volatility, the BTC valuations have never dipped under $1 trillion, and probably it might never as well go under in the future. Citing data from on-chain data provider Glassnode, popular market analyst Willy Woo notes that nearly 7.3% of the total Bitcoin supply has moved since the Bitcoin valuations surged past $1 trillion.

“This is pretty solid price validation; $1T is already strongly supported by investors. I’d say there’s a fair chance we’ll never see Bitcoin below $1T again,” he adds.

Willy Woo further states that it has been nearly three months since the Bitcoin (BTC) price has moved past its previous all-time high of $19.7K. Above these levels, 28.7% of Bitcoins in circulation have already moved. The URPD indicator offers investors an insight into price discovery while assuming that the BTC coins were bought by investors.

However, Woo asks investors to maintain caution stating “coin movements are not always from purchases. For example exchanges and users regularly move coins internally”.

Another data from Glassnode shows that during the previous bull runs, 50% of Bitcoin supply was younger than 6 months. Currently, it is just at 36%, which means there’s the scope of further price expansion.

In bull markets old coins tend to move more. This increases the relative supply of younger coins in the network.

At previous $BTC tops, around 50% of the #Bitcoin supply was younger than 6 months.

We are currently significantly below this level (36%).https://t.co/D40RJ5FlAA pic.twitter.com/OIOnnChpk0

— glassnode (@glassnode) March 21, 2021

The Race for the Bitcoin ETF Heats Up

There’s a lot of excitement currently around Bitcoin derivative products like exchange-traded funds (ETFs). North America’s first Bitcoin ETF from Canadian financial giant Purpose is a big hit. In one month of launch, the Purpose Bitcoin ETF has clocked over $1 billion CAD in assets under management.

The Purpose Bitcoin ETF has been on a strong accumulation spree during the recent correction. So far, it has accumulated over 14,100 Bitcoins in the physically-backed cold storage. However, all eyes are currently on when the United States gets its first Bitcoin ETF.

The U.S. financial institutions and corporates have recently shown huge interest in Bitcoin. Thus, a Bitcoin ETF in such a case would explode the institutional activity further. In the latest development, Anthony Scaramucci’s Skybridge Capital recently submitted an S1-registration form to the U.S. SEC for launching its own Bitcoin ETF.

Now there are 5 Bitcoin ETF applications waiting for approval from WisdomTree, VanEck, NYDIG Asset Management, Valkyrie Digital Assets, Skybridge and First Trust. A possible decision on it could arrive by the next 45 days.

If the Bitcoin ETF goes live in the U.S, we might see Bitcoin price surging very fast to $100K and above.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

Buy $GGs

Buy $GGs