Why Bitcoin Price Is Dropping Suddenly After Recovery to $102K?

Highlights

- Bitcoin price fell to $96K after US jobs data and ISM Services PMI.

- BTC price fell 5% within hours from an intraday high of $102,712.

- Traders remains bullish but the directions depend on macroeconomic and technical factors.

- Bitcoin to maintain its overall bullish sentiment ahead of Donald Trump's inauguration.

Bitcoin bulls lost bullish momentum in the crypto market again as BTC price fell below $97.5K, from an intraday high of $102,712. Traders anticipate an overall bullish outlook at the start of 2025 as the crypto-friendly Donald Trump administration takes control on January 20. However, the markets will brace temporarily for liquidity concerns and volatility risks amid jobs data and upcoming FOMC minutes release.

Bitcoin Loses Earlier Gains After Jobs Data

The JOLTS jobs openings increased by 259,000 to 8.1 million for November 2024, according to the U.S. Bureau of Labor Statistics. This indicates the labor market remains strong and the Fed rate cuts may be limited in 2025. JOLTS jobs data has increased for two consecutive months now. The job openings have increased in professional and business services, finance and insurance, and private educational services.

Meanwhile, ISM Services PMI shows the US economy remains strong. The resilience of the US ahead of Trump’s inauguration day fueled concerns about market conditions. In fact, US stocks declined on Tuesday, ending a two-day rally, as fresh economic data fueled speculation that the Federal Reserve may keep rates steady this month despite rising inflation.

This caused the US dollar index (DXY) to rebound sharply over 108.50, after a two-day low move that caused a recovery in Bitcoin price. Also, the 10-year Treasury yield increased to a 35-week high of 4.68%.

BTC Price Falls 5% Within An Hour

BTC price fell 5% in the past 24 hours, with the price currently trading at $96,500. The 24-hour low and high are $96,132 and $102,712, respectively. Furthermore, the trading volume has increased by 27% in the last 24 hours, indicating a decline in interest among traders. If weak sentiment continues, the price could fall to 50-EMA at $94,500 and in the worst case to $92,700.

Bitcoin price has skyrocketed over 10% in a week and may break above the previous ATH on bullish macroeconomic and technical factors. The upside move is supported by inflows into the spot Bitcoin ETFs, indicating institutional interest returning.

According to K33 Research, Bitcoin and crypto prices jumped after the strongest 2-day flow to ETFs since mid-November. Moreover, BTC open interest inches higher, recording a solid 7-day streak of positive daily returns.

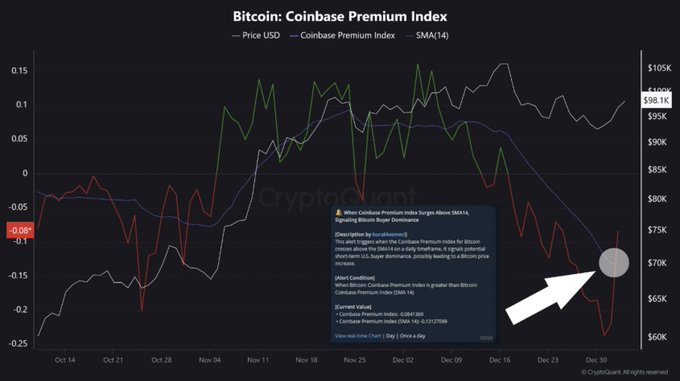

The price of Bitcoin has jumped back to the $100,000 mark, a sign that shows the Coinbase Premium Index is back to positive.

Bitcoin Price Hits Over $102K On Donald Trump’s Inauguration

Bitcoin’s recent drop reflects a seasonal lull during the Christmas holiday period. These trends are now reversing to create a bullish momentum in the global markets, according to Matrixport.

Moreover, investors expect the upside momentum to sustain as Donald Trump enters the White House on January 20. His pro-crypto administration works on providing crypto regulatory clarity in the country, creating a framework that other countries may adopt. Trump’s strategic Bitcoin reserve plans saw massive adoption from other countries and states.

Meanwhile, BitMEX co-founder Arthur Hayes has predicted a severe correction in Bitcoin and the crypto market in mid-March. His prediction came based on declining US dollar liquidity. While the Reverse Repo Facility (RRP) and the US Treasury’s General Account (TGA) will maintain bullish momentum, it may not continue further after March.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

Buy $GGs

Buy $GGs