Bitcoin Price Notes Sharp Decline Today, Here’s Why

Highlights

- U.S. PMI spike drives BTC below $68,000 amid strong dollar.

- SEC’s pending ETH ETF decision stirs market volatility.

- Symbolic Capital's 6,968 ETH sale intensifies sell-off.

Bitcoin price has experienced a significant drop today, falling below the $67,000 mark, a stark contrast to its earlier price of around $70,000. Notably, this recent slump in Bitcoin’s value could be attributed to a flurry of factors that have impacted the broader cryptocurrency market trends.

Source: CoinMarketCap

Factors Influencing Bitcoin’s Price Drop

Today’s pullback in the Bitcoin price can primarily be attributed to the S&P Global Purchasing Managers’ Index (PMI) report suggesting a hot US economy. This has led to a surge in the dollar which has in turn put pressure on risk assets such as cryptocurrencies.

In the PMI report, the economy was reported to be growing at its fastest pace in two years, which caused traders to shift their expectations of interest rate cuts, thus exerting more pressure on Bitcoin and other digital currencies.

At the same time, there is expectation about the decision of the U. S. Securities and Exchange Commission (SEC) on spot ether (ETH) exchange-traded funds (ETFs). This could be due to the fact that market participants are on the lookout for decisions that may affect the market significantly. Crypto analyst Kaleo said that the market reaction could be drastic depending on the decision that has been made. He said

“If the ETH ETF could be denied today, I wouldn’t be surprised to see prices nuke as violently as they ripped the other day.”

Crypto Market Sentiment and Regulatory Landscape

The cryptocurrency market is also influenced by regulatory news and general market sentiment. The SEC has been fairly conservative in its response to the crypto bill that has recently been approved by the House of Representatives.

SEC Chair Gary Gensler pointed out that the agency is ready for dialogue but will continue to enforce the law to ensure that token operators provide disclosures that are helpful to investors and legally required.

ETH’s brief and sudden dip below $3800 was likely driven by MEV trading firm Symbolic Capital Partners. The institution sold 6,968 ETH in one minute, worth $27.38 million, with an average selling price of $3,930, according to @ai_9684xtpa. One of the transactions sold 3,497 ETH…

— Wu Blockchain (@WuBlockchain) May 23, 2024

Apart from the regulatory issues, other factors that have been seen to have led to the drop include large selling orders in the market. For instance, trading firm Symbolic Capital Partner sold 6,968 ETH worth $27 million in a single minute, which has led to increased selling pressure in the market.

ETH Price Performance and Market Speculation

The anticipation surrounding the SEC’s decision is also seen in the context of the “buy the rumor, sell the news” phenomenon observed in financial markets. This behavior, where prices increase in anticipation of an event and drop after the event occurs, is prevalent in the crypto market.

Concurrently, this week, the Ethereum market has been quite high volatile, and ETH prices increased more than 22% in expectation of an ETF approval. This was marked by a short squeeze and intense buying which was instrumental in causing large price swings in the market.

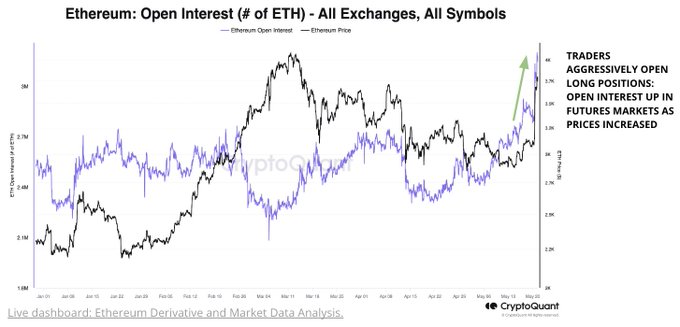

Source: CryptoQuant

CryptoQuant also reports that the ETH futures market has been quite active with total open interest reaching 3.2 million ETH- valued at $11 billion, the highest since January 2023. This rise is mainly due to the strong buy orders that push the price up which led to one of the biggest hourly liquidations of the year with 9.3K ETH.

Further, the ETH-BTC Open Interest ratio has also risen from 0.54 to 0.67 suggesting more investors are leaning towards Ethereum than Bitcoin. Moreover, the discount on the ETHE fund has further reduced to 17%, its lowest in two months, pointing to increased interest in Ethereum compared to Bitcoin among investors.

Read Also: XRP Price Prediction: Monumental Bull Run Likely As Coinbase Initiates XRP Trading In New York

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin Treasury Firm GD Culture Authorizes Sale of 7,500 BTC as Expert Warns Of More ‘Pain’

- USDT And USAT Get Adoption Boost as Tether Invests in Whop for Faster Settlements

- BTC Price Rises as U.S. Plans to Hold Trump Tariffs on China Steady

- Crypto Market Soars on Rumors of Trump’s 0% Tax Policy for Digital Assets

- Hong Kong Set to Launch Tokenized Bond Platform and Issue First Stablecoin Licenses

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

- COIN Stock Price Prediction as Wall Street Pros Forecast a 62% Surge

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

- Sui Price Eyes Recovery as Third Spot SUI ETF Debuts on Nasdaq

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

Buy Presale

Buy Presale